Under

- global default valuation settings, to define Xplain’s default valuation parameters

- inflation seasonality and convexity settings, to define inflation seasonality factors and interest rate future convexity adjustments

- discount currency definition and index tenor mapping rules, to enable the grouping of trades by discount curve ahead of valuation, when the Discount Currency is set to “Local Ccy”

Inflation Seasonality and Convexity Settings

Under

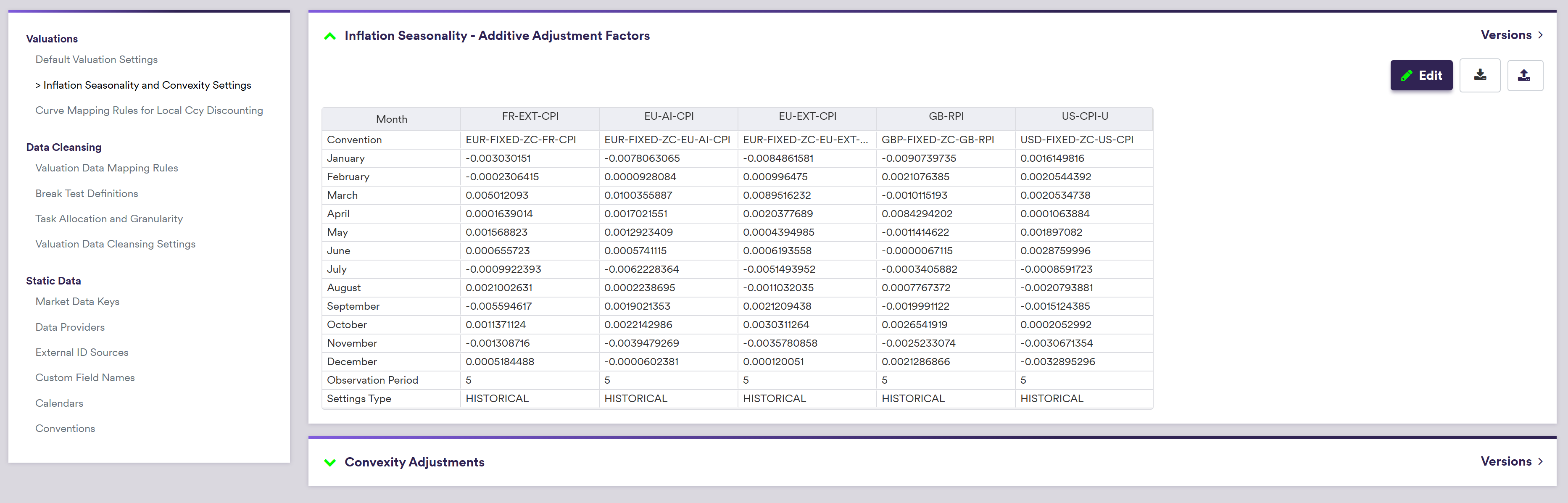

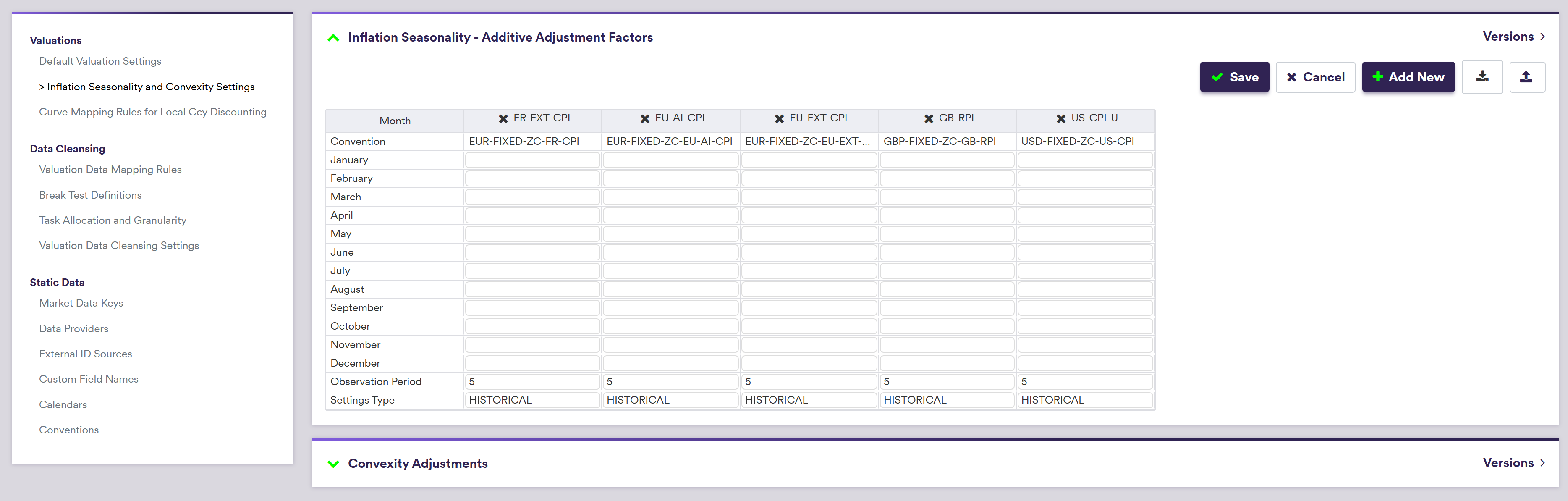

1. Inflation Seasonality Factors

You can (import) inflation seasonality additive adjustment factors or manually define them by first clicking

A description of the inflation seasonality factors’ attributes and corresponding permissible values are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Curve Name | The inflation curve name | Any permissible inflation index |

|

January … December | Seasonality adjustment to be added to the forward inflation rate for (December to) January, … (November to) December etc. | Numeric |

| Settings Type | Manual input or calculated based upon historical index values over a certain horizon | MANUAL | HISTORICAL |

| Observation Period |

The calculation horizon for historical factors, expressed in years Applicable only if Settings Type = 'HISTORICAL' | Numeric |

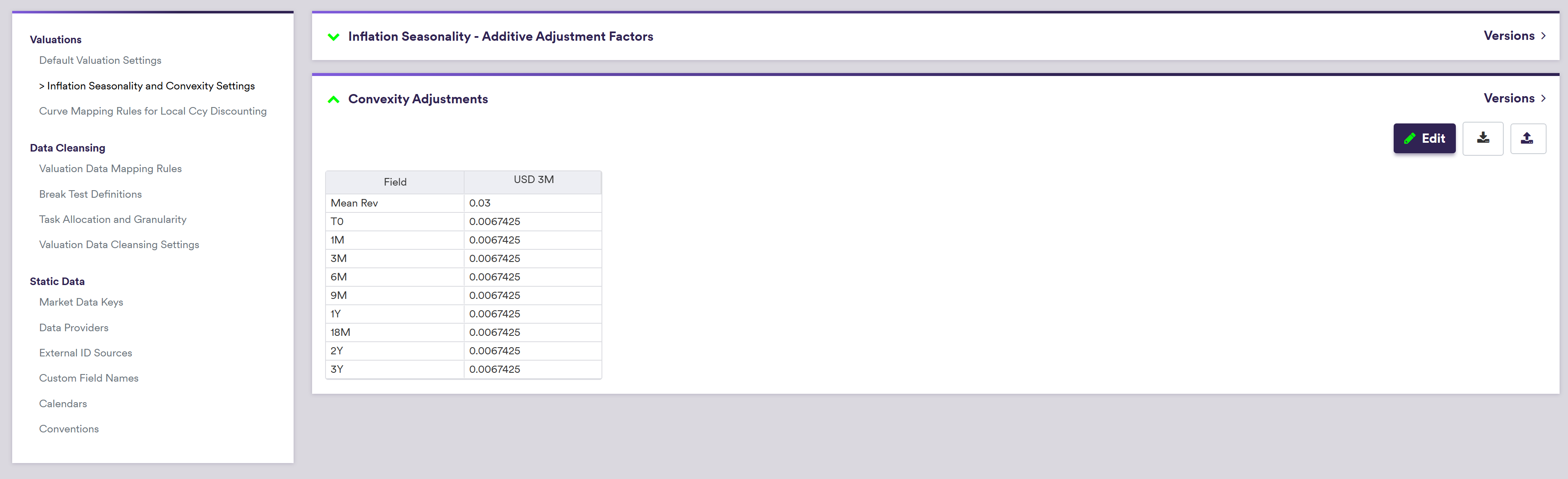

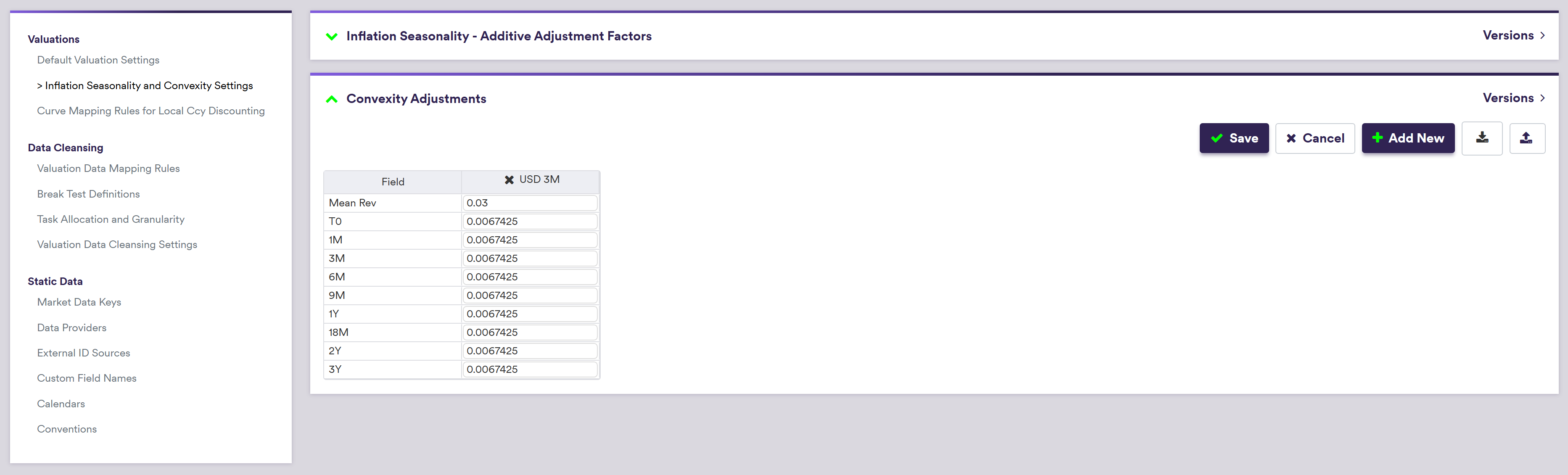

2. Future Convexity Adjustment

You can (import) future convexity adjustment factors or manually define them by clicking

A description of the future convexity adjustment factors’ attributes and corresponding permissible values are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Curve Name | The 3M curve name |

CAD 3M | CHF 3M | EUR 3M | GBP 3M NZD 3M SEK 3M | USD 3M |

| Mean Rev | Hull-White model’s mean reversion | Numeric (e.g. 0.03) |

| T0 | 1M | 3M | 6M | 9M | 1Y | 18M | 2Y | 3Y |

Hull-White model’s short rate volatility Required: T0 + another tenor | Numeric |