Under

- global default valuation settings, to define Xplain’s default valuation parameters

- inflation seasonality and convexity settings, to define inflation seasonality factors and interest rate future convexity adjustments

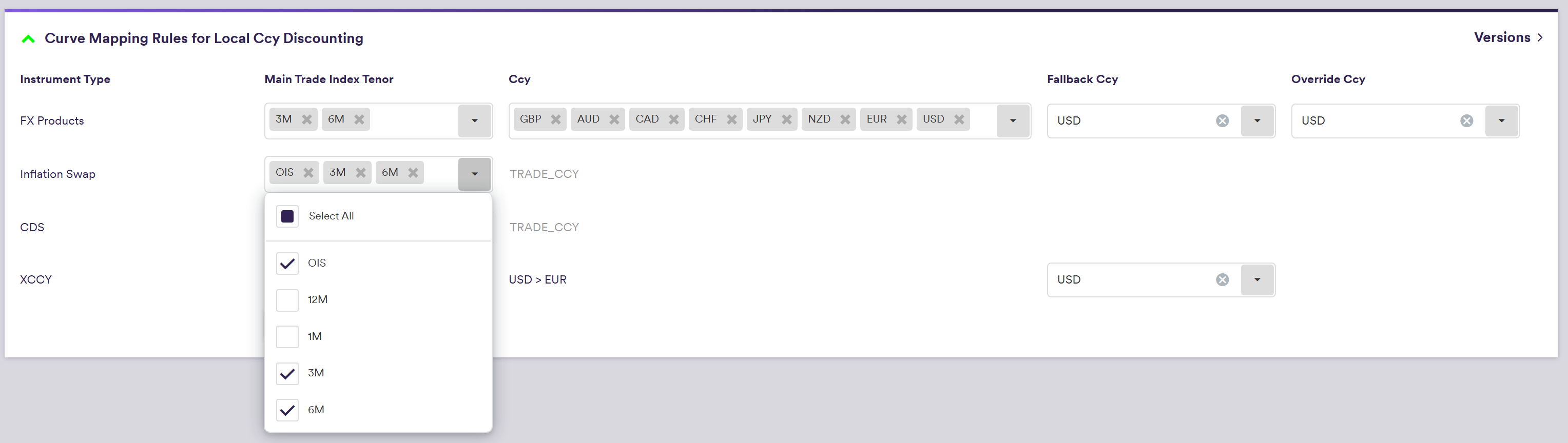

- discount currency definition and index tenor mapping rules, to enable the grouping of trades by discount curve ahead of valuation, when the Discount Currency is set to “Local Ccy”

Discount Currency and Index Tenor Mapping Rules

When performing a portfolio valuation with “Local Ccy” discounting, the portfolio split rules described in the curve calibration section is applied, as summarised below.

On an instrument type basis, you can specify:

- discount currency definition rules

- index tenor mapping rules (only applicable when there is no OIS curve for the discount currency)

The portfolio is first split into sub-portfolios according to each trade’s discount currency (as defined in the discount currency definition rules), then further split according to whether any one of the trade’s legs is not denominated in that currency.

In the case where there is no OIS curve for the discount currency, the portfolio will also be split according to the (mapped) tenor of the alternative underlying index (as defined in the index tenor mapping rules). The combination of the discount currency and the (mapped) index tenor will determine the applicable discount curve (which is the only time when the index tenor is relevant for discounting purposes).

Relevant sub-curve groups will be created in accordance with the portfolio split rules, and used to price trades in each sub-portfolio, in order to minimise the number of potential valuation failures.

Discount Currency Definition Rules per Instrument Type

For instruments such as IRS, inflation swaps and credit instruments, the discount currency will be the single currency of the trade.

Under

For FX instruments, unless an Override Ccy is defined, Xplain will lookup the currency of each trade leg, and use the user-defined currency priority order to determine the discount currency. If none of the leg currencies can be found in the priority order, the Fallback Ccy will apply. Permissible discount currencies can be found here.

For XCCY instruments, the discount currency will be i) USD if one of the legs in denominated in USD, ii) EUR if one of the legs is denominated in EUR or iii) otherwise, the Fallback Ccy will apply (USD or EUR).

Index Tenor Mapping Rules per Instrument Type

These mapping rules are only relevant when there is no OIS curve for a given discount currency, as an alternative discount curve needs to be defined.

If the trade is linked to an underlying index (e.g. a PLN 6M Wibor swap), the curve associated with such index will be used for discounting.

When the trade is not linked to an index, you will need to artificially associate such trade to an underlying index, by defining the desired priority for index tenor mapping. This will be applicable when multiple alternative index curves are available. The curve in the Discount Currency associated with the mapped index will be used for discounting.

Under

Select tenors in desired priority order for index mapping

A description of the instrument type parameters and corresponding permissible values are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Instrument Type | The instrument type that requires user-defined classification criteria (read-only) |

FX Forward and FX Option Inflation Swap Credit Instruments XCCY |

|

Main Trade Index Tenor |

User-defined tenor mapping, to be selected in the desired priority order Only relevant when the instrument type is not linked to an index | 1M | 3M | 6M | 1Y |

| Ccy (1) |

User-defined priority order for FX instruments USD -> EUR for XCCY swaps |

Any permissible discount currency for FX instruments; USD -> EUR for XCCY swaps |

| Fallback Ccy (2) | The fallback for the discount currency when it cannot be determined automatically (applicable for FX instruments using the user-defined priority order, or XCCY instruments without a USD or a EUR leg) |

Any permissible discount currency for FX instruments; EUR or USD for XCCY swaps |

| Override Ccy (3) | For FX instruments, the discount currency that will always prevail over the user-defined priority order and the Fallback Ccy | N/A | Any major currency for FX instruments |