Under

- global default valuation settings, to define Xplain’s default valuation parameters

- inflation seasonality and convexity settings, to define inflation seasonality factors and interest rate future convexity adjustments

- discount currency definition and index tenor mapping rules, to enable the grouping of trades by discount curve ahead of valuation, when the Discount Currency is set to “Local Ccy”

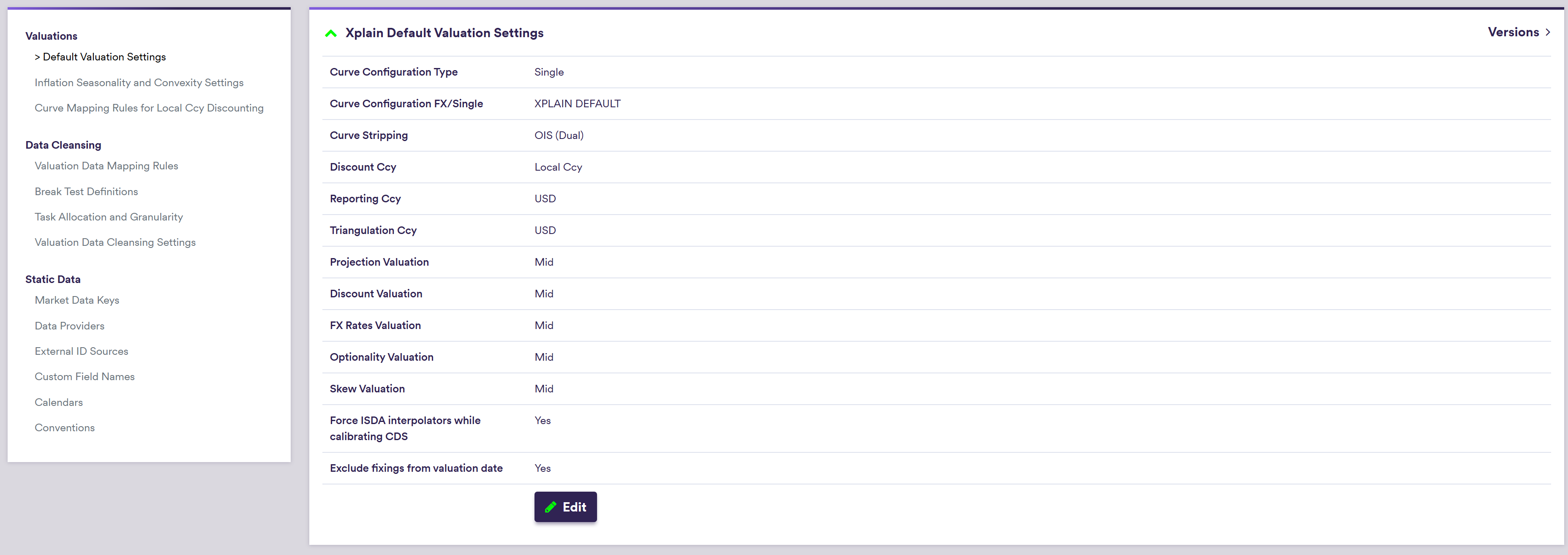

Xplain Default Valuation Settings

You can parameterise Xplain’s default valuation methodology by clicking on

| Field Name | Description | Permissible Values |

|---|---|---|

| Curve Configuration Type | If Curve Configuration Type = 'FX vs non-FX Instruments', a different curve configuration will apply for FX vs non-FX trades |

Single FX vs non-FX Instruments |

| Curve Configuration (Single, FX / Non-FX) | The applicable curve configuration(s) | See curve configuration |

| Curve Stripping |

Dual stripping (for the projection and discount curves) or Single curve stripping |

OIS (DUAL) SINGLE |

| Discount Ccy |

Applicable single currency for discounting purposes or If Discount Ccy = 'Local Ccy', the discount currency will be a function of the trade type and user parameterisation (see here) |

Any permissible discount currency Local Ccy |

| Reporting Ccy | The currency in which the calculation results are expressed | Any permissible currency |

| Triangulation Ccy | The triangulation currency used first when no direct base vs counter curve can be found for foreign cashflow discounting | Any permissible discount currency |

| Projection Valuation | Market data side for projection | Bid | Mid | Ask |

| Discount Valuation | Market data side for discounting | Bid | Mid | Ask |

| FX Rates Valuation | Market data side for FX rates | Bid | Mid | Ask |

| Optionality Valuation | Market data side for ATM swaption and FX volatilities | Bid | Mid | Ask |

| Skew Valuation | Market data side for Swaption and FX volatility skews | Bid | Mid | Ask |

| Force ISDA interpolators while calibrating CDS (*) | To allow a zero-coupon curve interpolation override that is compliant with the ISDA CDS Standard Model when pricing a CDS | Boolean |

| Exclude fixings from valuation date (*) | Whether to exclude fixings on the valuation date (fixings occuring after the valuation date will be ignored) | Boolean |