TRS Portfolio and Trade Definitions

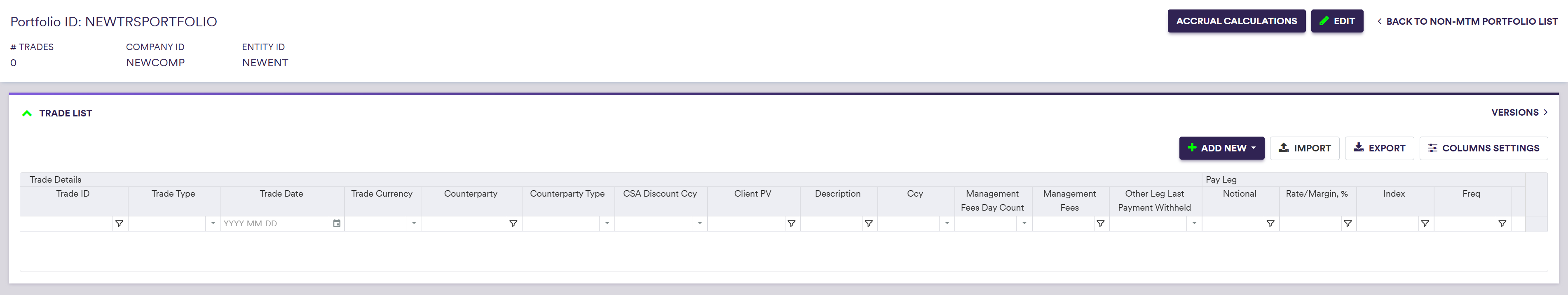

A TRS portfolio holds the trades whose details can be used for accrual calculations

Once a company and entity have been created, the two steps required to define a non-MTM portfolio of TRS trades are as follows:

You can then perform a system-wide search on any Trade ID.

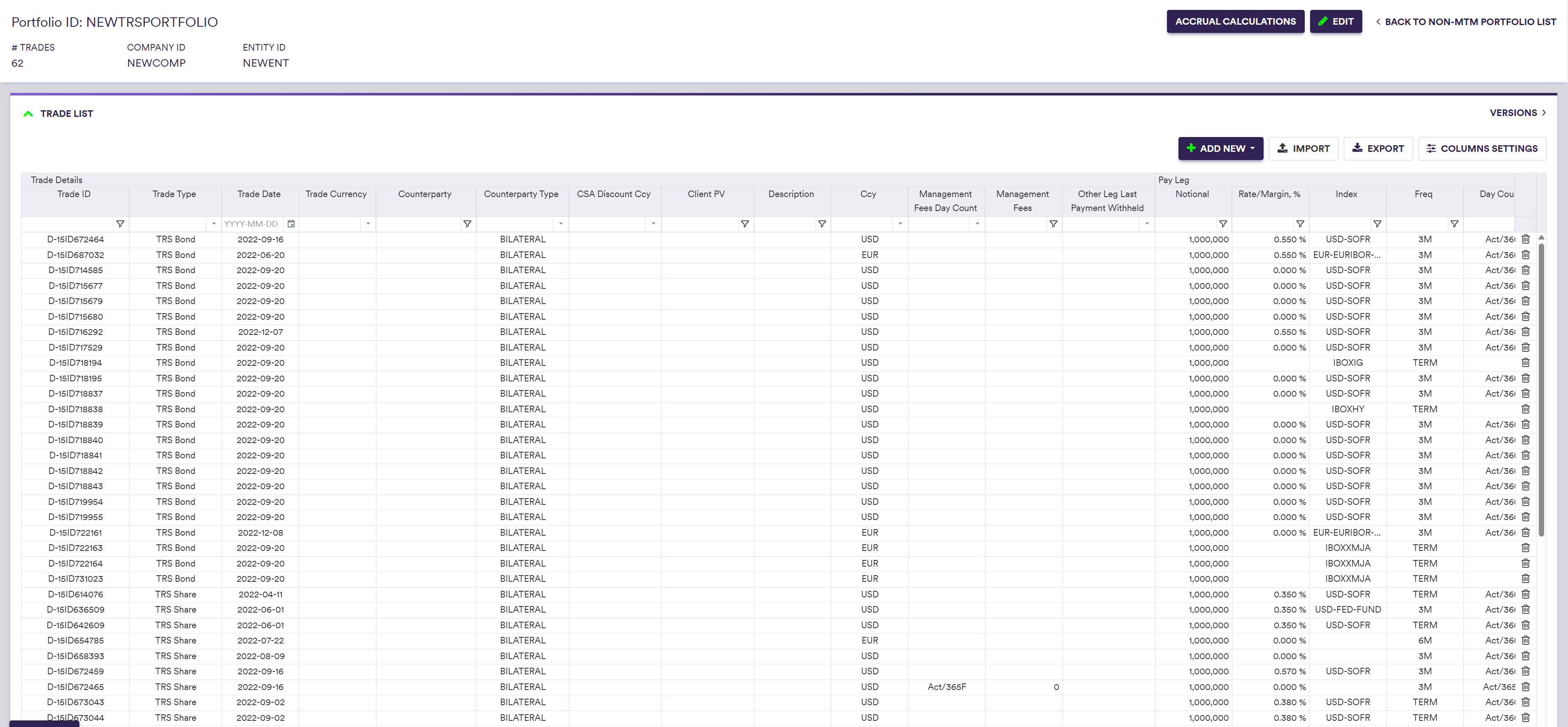

Portfolio Example

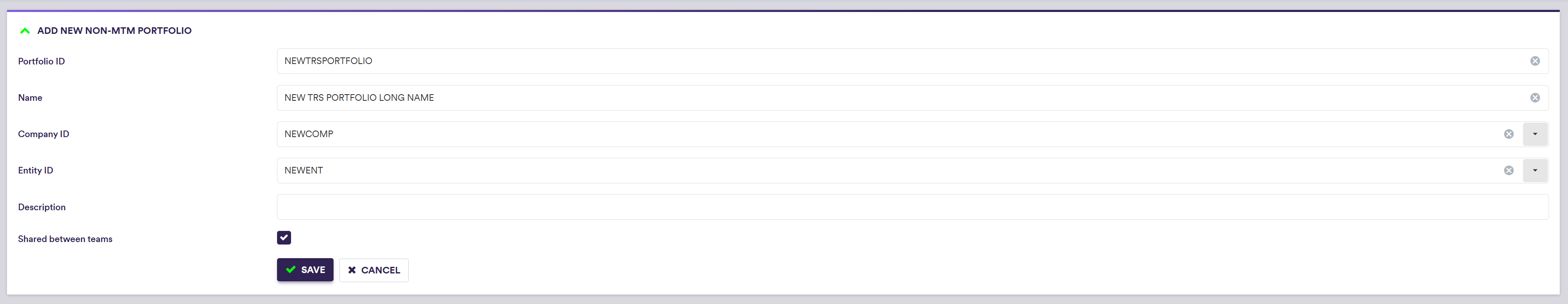

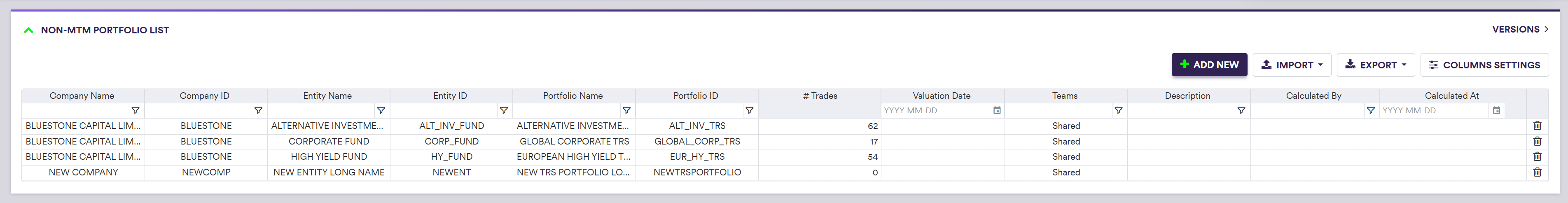

You can use the predefined ‘ALT_INV_FUND’ portfolio, or define your own independently. This page will guide you through the process using an example: manually creating a ‘NEWTRSPORTFOLIO’ that replicates ‘ALT_INV_FUND’ with its underlying trades. For trade definition, we will use two examples: manually defining a ‘USDOIS_10Y’ IRS trade, or importing all the trades. You can download the example .CSV data import file here.

1. Creating a Non-MTM Portfolio

Under

To import a portfolio (or a list of portfolios), click on (import) and select the relevant portfolio list definition .CSV file.

You can download the import file template here ![]() .

.

| Field Name | Description | Permissible Values |

|---|---|---|

| Portfolio ID | The ID for the portfolio (immutable) | Free text (no spaces) |

| Name | The name of the portfolio | Free text |

| Company ID | The Company ID |

Any existing company See company configuration |

| Entity ID | The Entity ID |

Any existing entity See entity configuration |

| Description | Portfolio description | Free text |

| Shared Between Teams | Whether the portfolio will be accessible across all teams | Boolean |

| Teams |

The team(s) that will have access to the portfolios Applicable only if Shared between Teams = FALSE |

Any existing team(s) See creating a team |

2. Adding TRS trades

Under

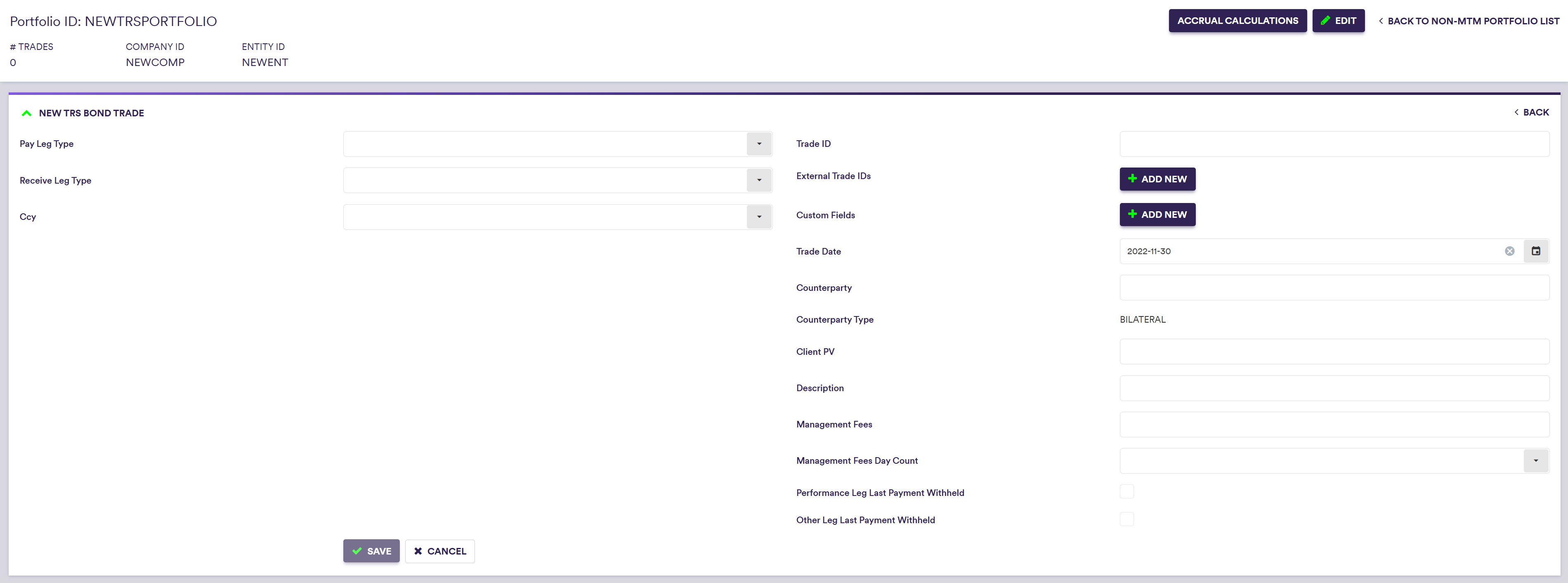

To manually create a trade, click on

There are two types of TRS trades in Xplain: ‘TRS Bond’ (where the underlying index is a bond) and ‘TRS Share’ (where the underlying index is an equity index or a share).

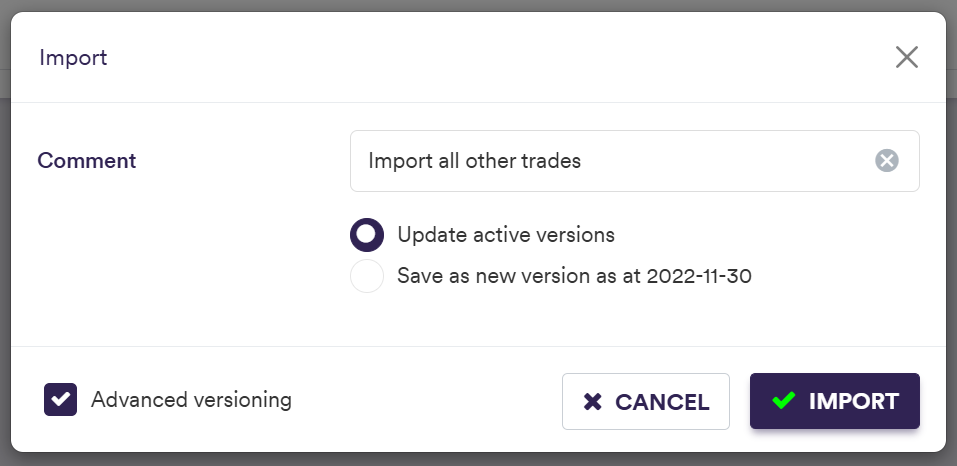

To import a trade, click on (import) and select the relevant TRS trade list definition .CSV file.

You can download the import file template here ![]() .

.

A trade field will either be mandatory (M), optional (O), conditional (C) (i.e. mandatory upon a certain condition), optional with a default value (D) or hardcoded in Xplain (H).

In addition to the generic fields that set out information about the trade, a TRS will have:

- Specific trade fields

- A funding leg (Overnight, Fixed or Ibor)

- A Performance Leg

A description of the funding leg’s attributes and corresponding permissible values are set out in the Portfolios and Trades Permissible Values section.

Permissible trade’s attributes will either be mandatory (M), optional (O), conditional (C) (i.e. mandatory upon a certain condition), optional with a default value (D) or hardcoded in Xplain (H).

| Field Name | Description | Permissible Values | TYPE |

|---|---|---|---|

| Pay Leg Type | Pay Leg Type | Ibor | Overnight | Fixed | Performance | M |

| Receive Leg Type | Recieve Leg Type | Dependent on trade type and other leg | M |

| Ccy | Trade 3-letter ISO 4217 currency code | See Permissible Currencies | M |

| Management Fees | Management fees (with respect to the performance leg) | Numeric (+ve) | O |

| Management Fees Day Count | Management fees' day count | See Permissible Daycount Conventions | C |

| Performance Leg Last Payment Withheld | Performance leg last payment withheld? |

Boolean Default = FALSE | D |

| Funding Leg Last Payment Withheld | Funding leg last payment withheld? |

Boolean Default = FALSE | D |

Additionally to the fields applicable to trade legs defined in Portfolios and Trades Permissible Values, the following fields apply for the funding leg of a TRS.

| LEG TYPE | Field Name | Description | Permissible Values | TYPE |

|---|---|---|---|---|

| Ibor | Initial Coupon | The value for the initial fixing rate used in ibor funding leg valuation | Numeric | O |

| Ibor | Accrual Offset Days | Leg accrual date offset (in business days) |

Integer (+ve) Default = 0 | D |

| Ibor | Ibor Fixing Calendar | Fixing business day calendar(s), separated by '+' | Default = Leg Calendar | D |

| Overnight | Accrual Offset Days | Leg accrual date offset (in business days) |

Integer (+ve) Default = 0 | D |

| Fixed | Accrual Offset Days | Leg accrual date offset (in business days) |

Integer (+ve) Default = 0 | D |

| Overnight | Overnight Fixing Offset Days | Index fixing date offset (in business days) |

Integer Default = 0 | D |

| Field Name | Description | Permissible Values | TYPE |

|---|---|---|---|

| Notional | Leg notional | Numeric | M |

| Accrual Freq | Frequency of leg accrual dates | See Permissible Frequencies | M |

| Payment Freq | Frequency of leg payment dates | See Permissible Frequencies | M |

| Payment Offset Days | Leg payment date offset (in business days) |

Integer Default = 0 | D |

| Compounding Method | Leg compounding method |

See Permissible Compounding Methods Only applicable if AccrualFreq <> PaymentFreq Default = "None" | D |

| Accrual Offset Days | Leg accrual date offset (in business days) |

Integer (+ve) Default = 0 | D |

| TRS Index | TRS index | Any existing TRS index | M |

| TRS Index Type | TRS index type |

Hardcoded based on trade type BOND | SHARE | H |

| TRS Index Fixing Offset Days | Index fixing date offset (in business days) |

Negative Integer Default = 0 | D |

| TRS Index Fixing Calendar | Fixing business day calendar(s), separated by "+" | See Permissible Calendars | D |

| Initial Base Index | The value for the initial index used in performance leg valuation | Numeric | D |

| Dividend Payout | Dividend payable for share index |

Numeric (+ve) For Trade Type = ""TRS_SHARE"" Default = 0 | C |

| Identifier | Leg Identifier | Leg Identifier for individual legs, must be unique | O |

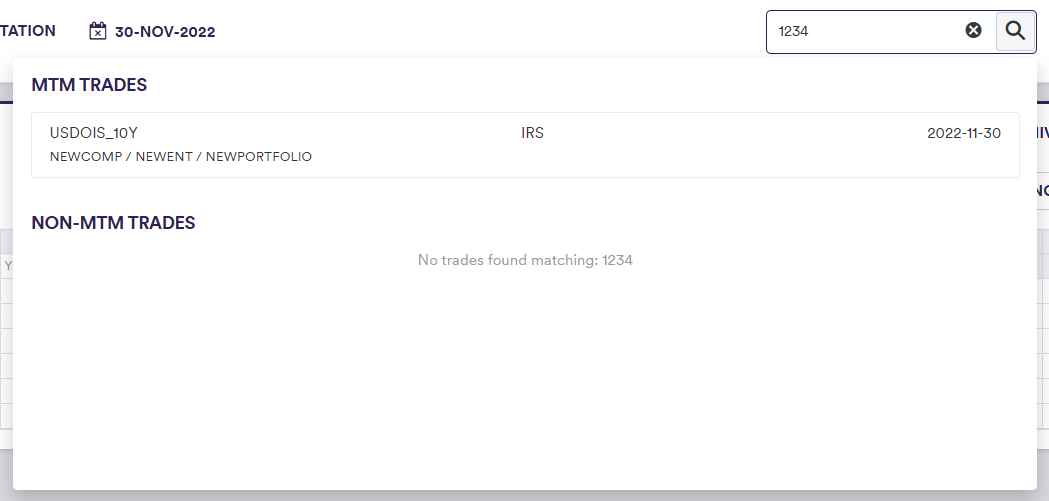

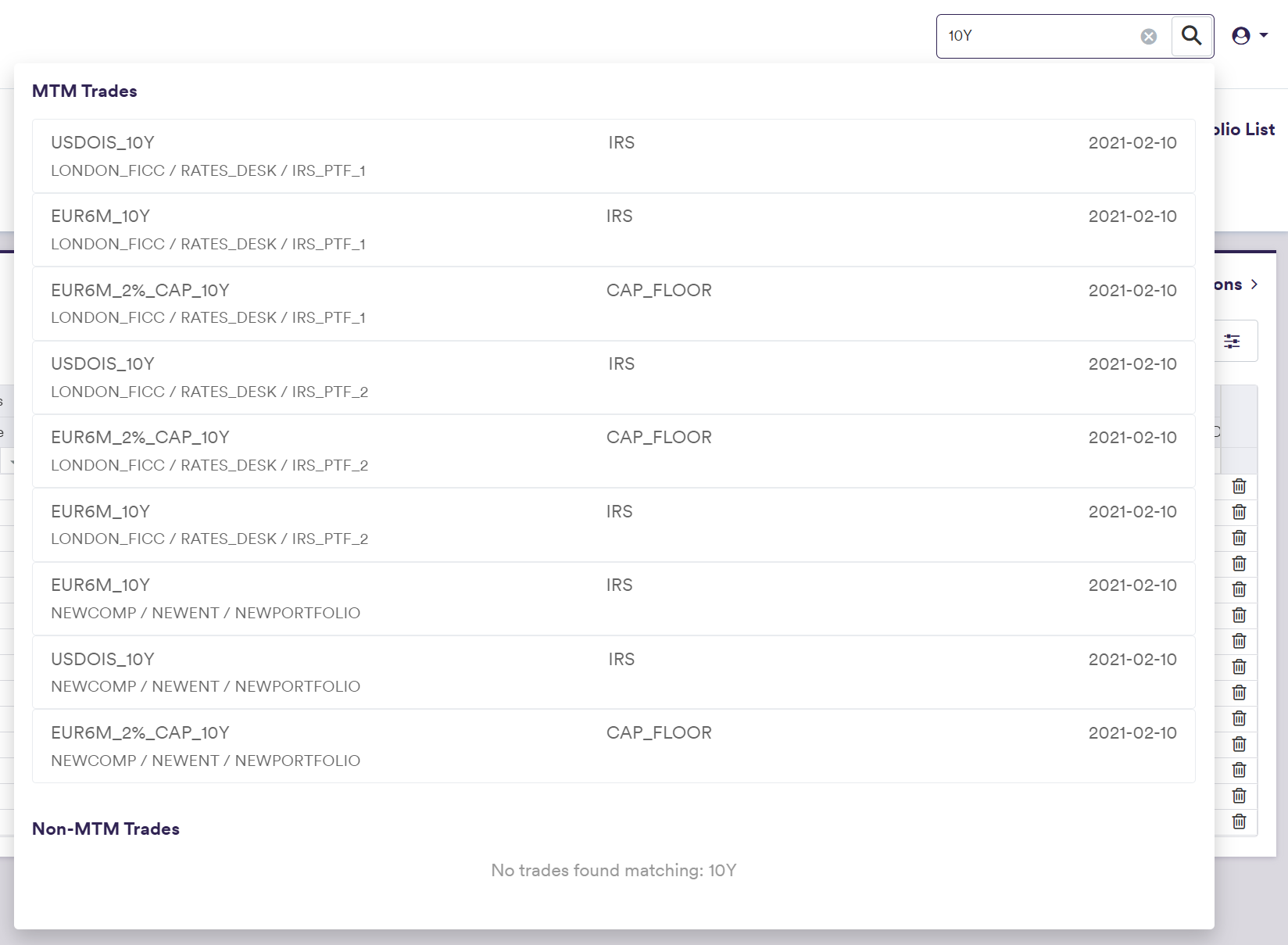

System-wide Search on Trade ID

You can perform a system-wide search on any Trade ID by entering part of the Trade ID in the search box in the top right corner and clicking on . You can click on any result to be redirected to the selected trade.