A company tree is defined by a company and its entities (and each entity’s trade portfolios). This can be used for instance to represent a client account and its funds, or a bank’s business unit and its trading desks.

At company level, you can define company’s default valuation settings and preferred valuation data providers. These can also be overridden at entity level.

Once the company tree has been defined, you can create portfolio(s) which will hold the trades whose details can be used for PV calculation, net currency exposure calculations and simulations, or valuation data anomaly detection.

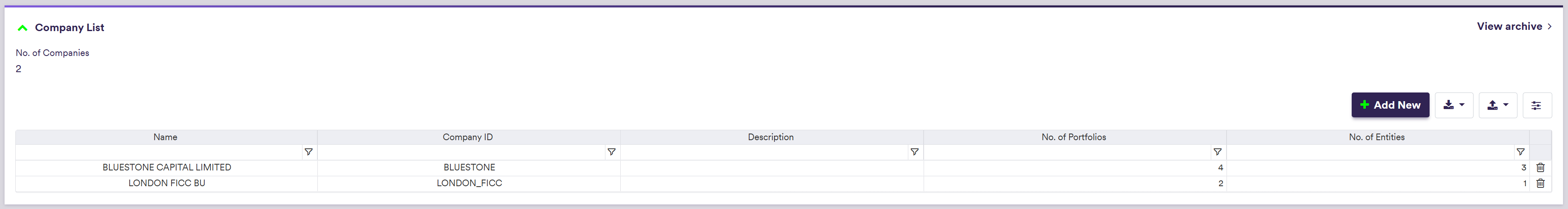

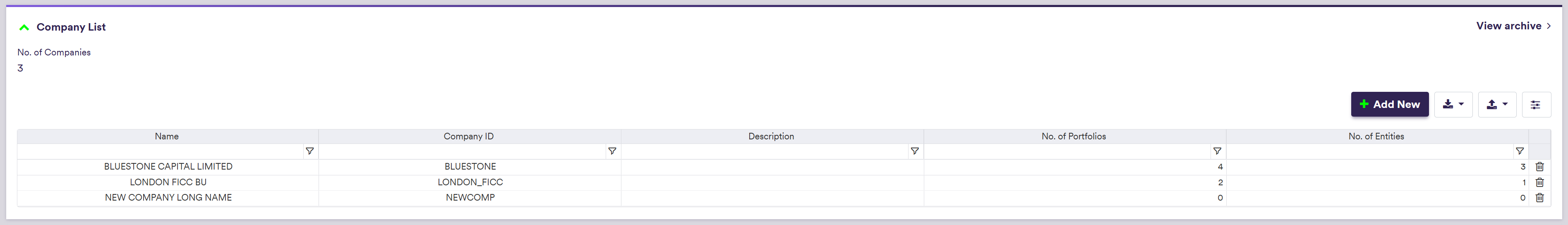

Xplain offers two pre-configured options - ‘BLUESTONE’ and ‘LONDON_FICC’ - which are available as off-the-shelf to use when performing your valuations or valuation data anomaly detection. For more details, please refer to our sandbox environment page.

Company Tree Example

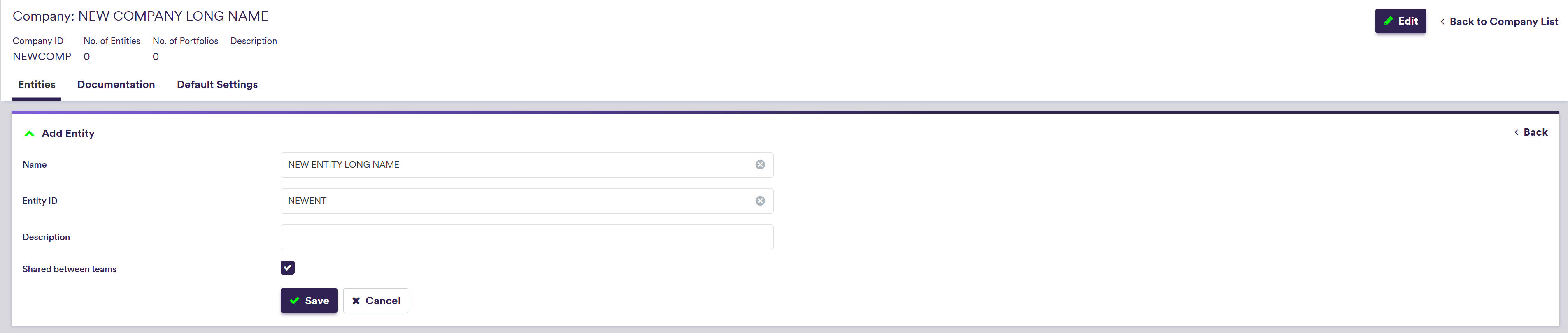

You can use the predefined ‘LONDON_FICC’ company (with its ‘RATES_DESK’ entity), or define your own independently. This page will guide you through the process using an example: defining a ‘NEWCOMP’ with a ‘NEWENT’ that replicates ‘LONDON_FICC/RATES_DESK/’. This will be used with the ‘NEWPORTFOLIO’ example.

You can download the example *.CSV data import files here ![]() .

.

On this page, we will discuss how to:

- define a company tree

- define company’s default settings for valuation and valuation data provider (*)

(*) Defining valuation data providers is only relevant for the purpose of valuation data anomaly detection.

Company Tree Definition

The three steps required to define a company tree are as follows:

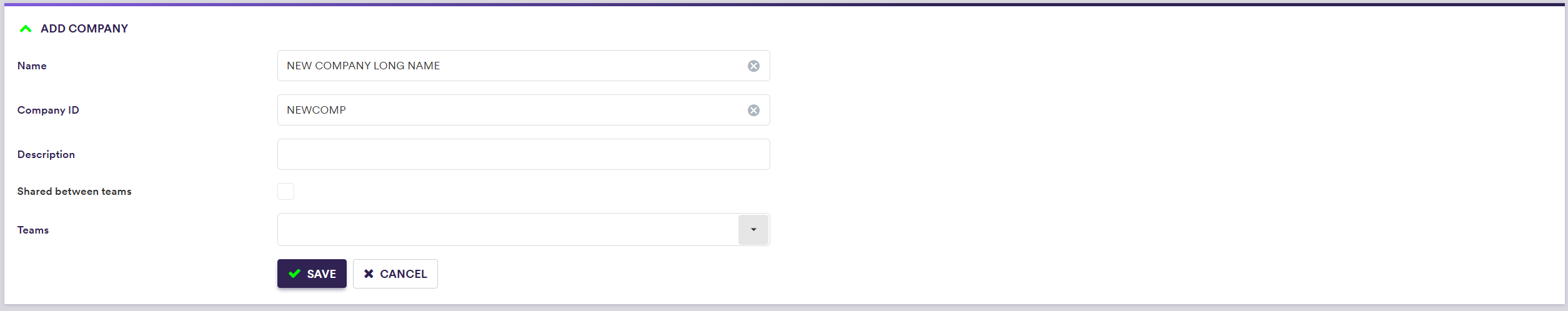

1. Creating a Company

Under

To manually create a company, click on

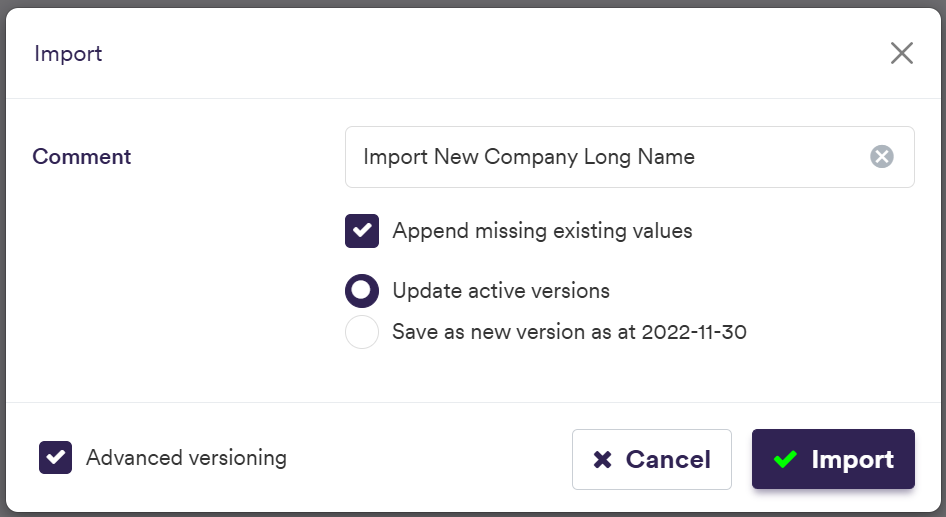

To import a company (or a list of companies), click on (import) and select the relevant company list definition .CSV import file.

You can download the import file template here ![]() .

.

A description of the company’s attributes and corresponding permissible values are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Name | The name of the company | Free text |

| Company ID | The ID for the company (immutable once saved) | Free text (no spaces) |

| Description | Comment field (optional) | Free Text |

| Shared between Teams | Whether the company’s details and portfolios will be accessible across all teams | Boolean |

| Teams |

The team(s) that will have access to the company’s details and portfolios Applicable only if Shared between Teams = FALSE |

Any existing team(s) See creating a team |

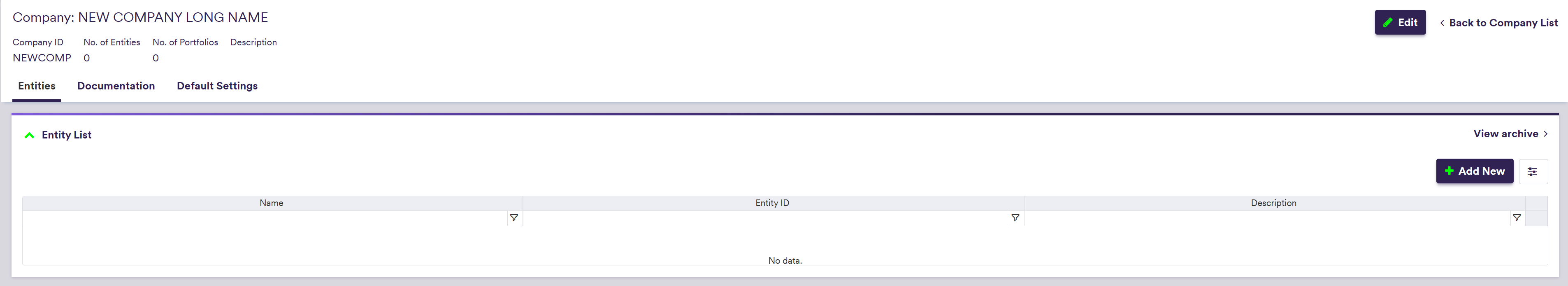

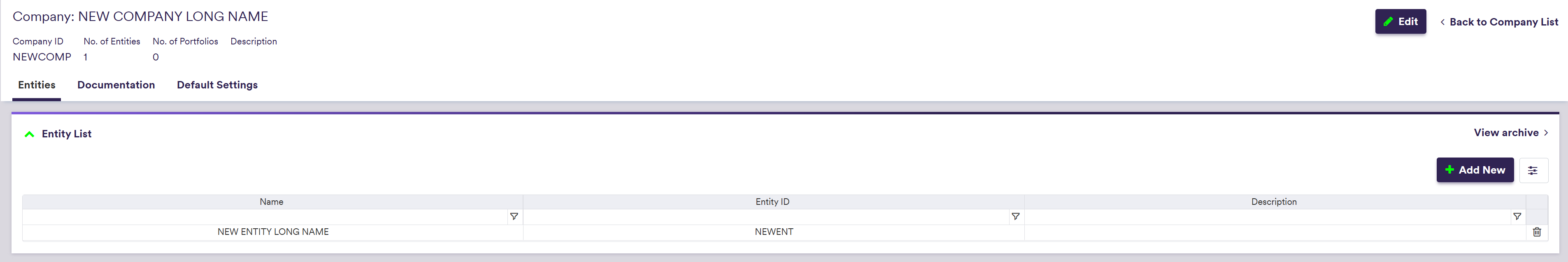

2. Adding an Entity

Under

Under

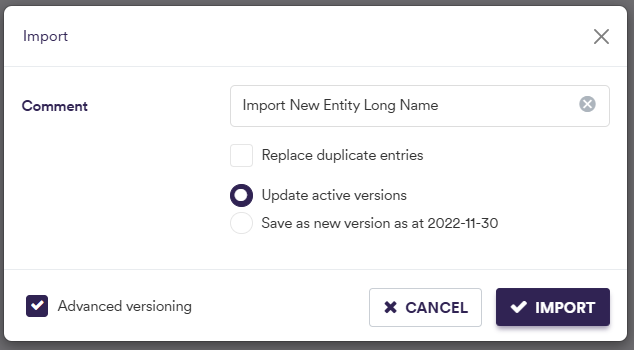

To import a company (or a list of companies), click on (import) and select the relevant company list definition .CSV file.

You can download the import file template here ![]() .

.

A description of an entity’s attributes and corresponding permissible values are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Name | The name of the entity | Free text |

| Entity ID | The ID for the entity (immutable once saved) | Free text (no spaces) |

| Description | Comment field (optional) | Free Text |

| Shared between Teams | Whether the entity's details and portfolios will be accessible across all teams | Boolean |

| Teams |

The team(s) that will have access to the entity's details and portfolios Applicable only if Shared between Teams = FALSE |

Any existing team(s) See creating a team |

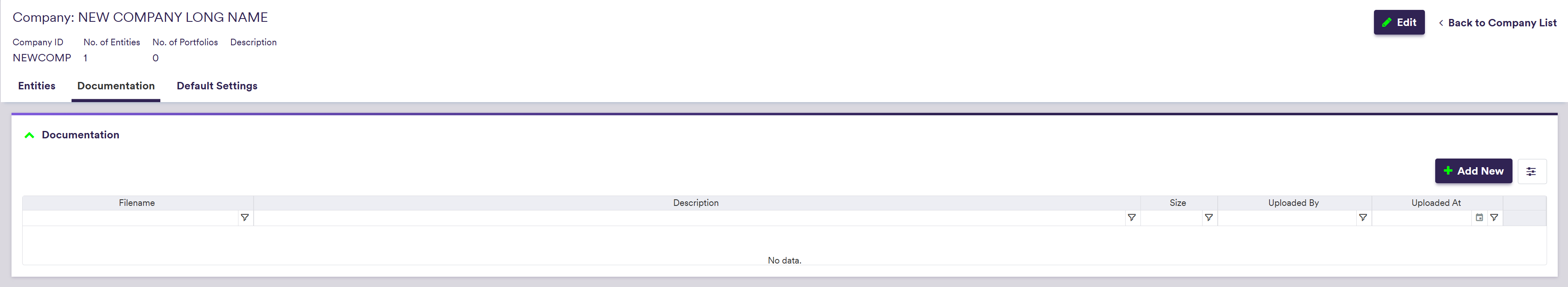

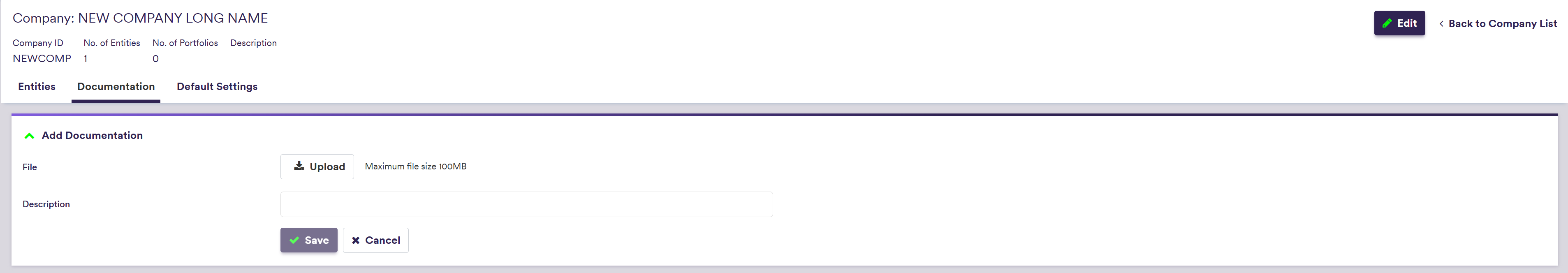

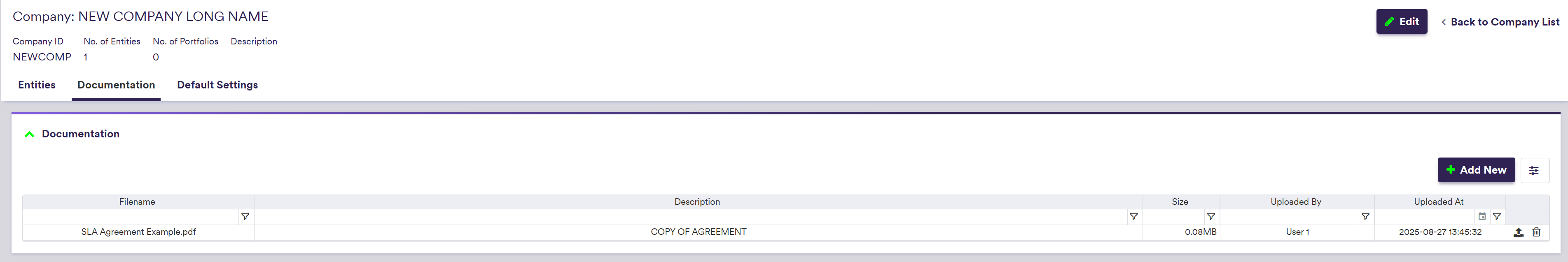

3. Uploading Documentation

Under

Company's Default Settings

There are two types of default settings that can be defined at company level:

- company’s default valuation settings

- company’s default valuation data provider settings

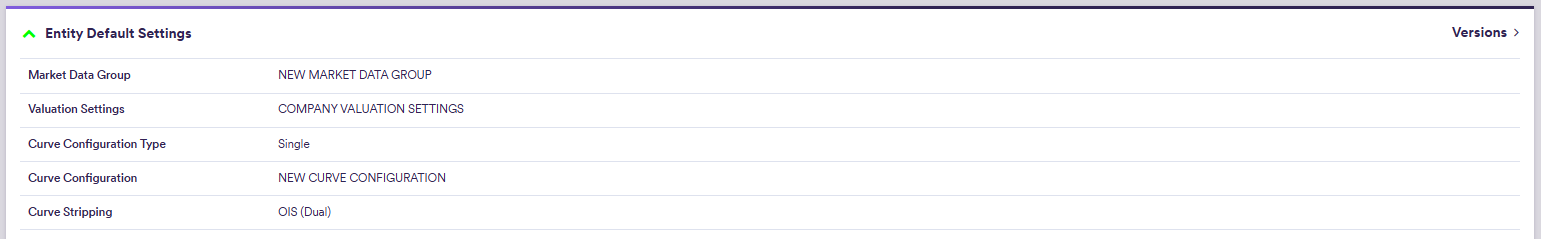

Default valuation settings includes preferred:

- curve configuration,

- market data group,

- discounting settings and

- market side valuation (bid, mid or offer).

They will automatically be applied when valuing trades prior to running a valuation data anomaly detection.

However, you can override them prior to running a manual PV calculation.

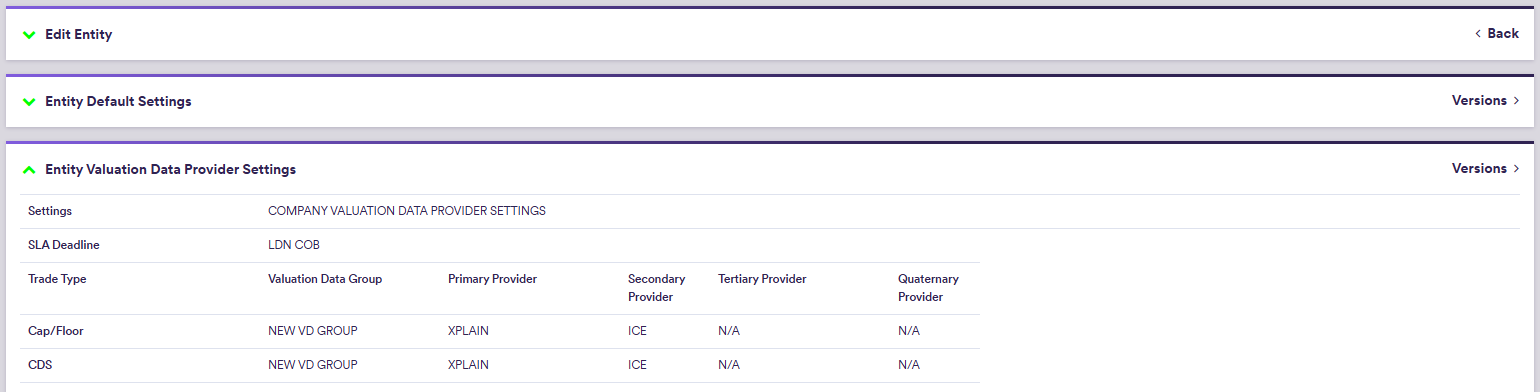

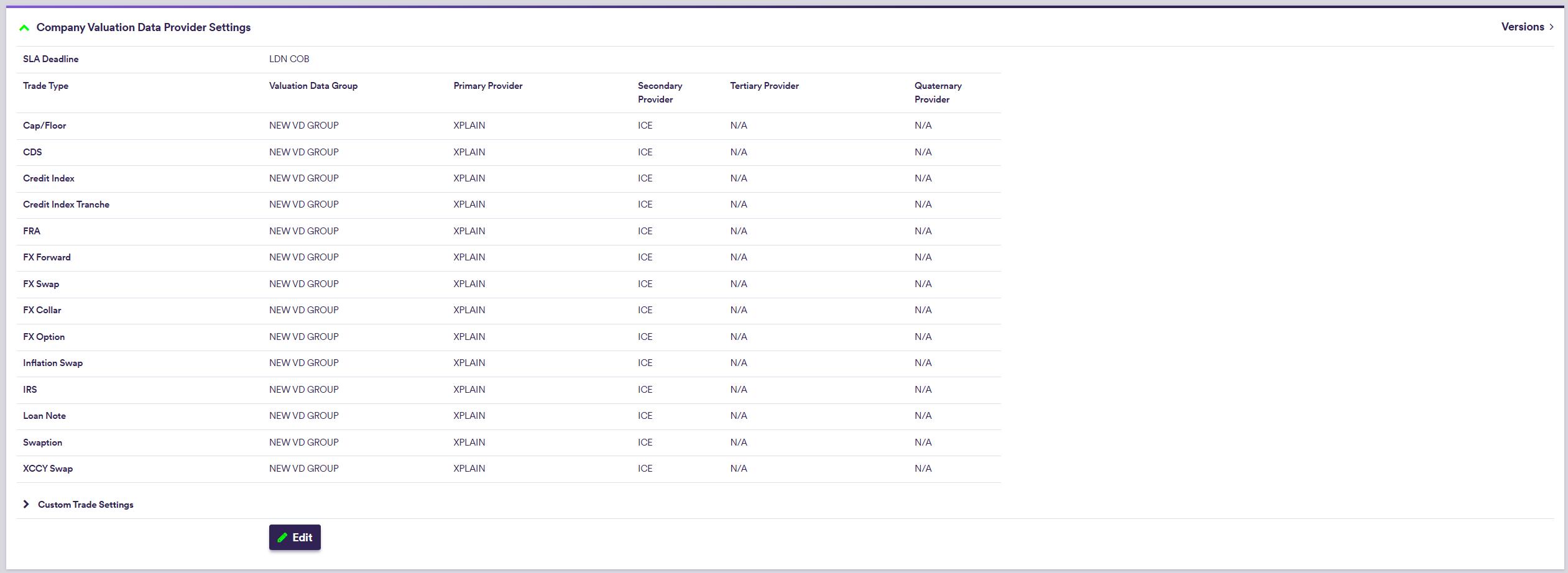

Default valuation data settings, which are only relevant for the purpose of valuation data anomaly detection, comprise SLA deadline time and, on a trade type basis, preferred valuation data group(s) and data providers (primary, secondary, tertiary and quaternary, as applicable).

Entity settings are inherited from the parent company, but they can be overridden at entity level.

Part of our ‘NEWCOMP’ example that replicates ‘LONDON_FICC’, this section will guide you through the process of defining default settings at company and entity level.

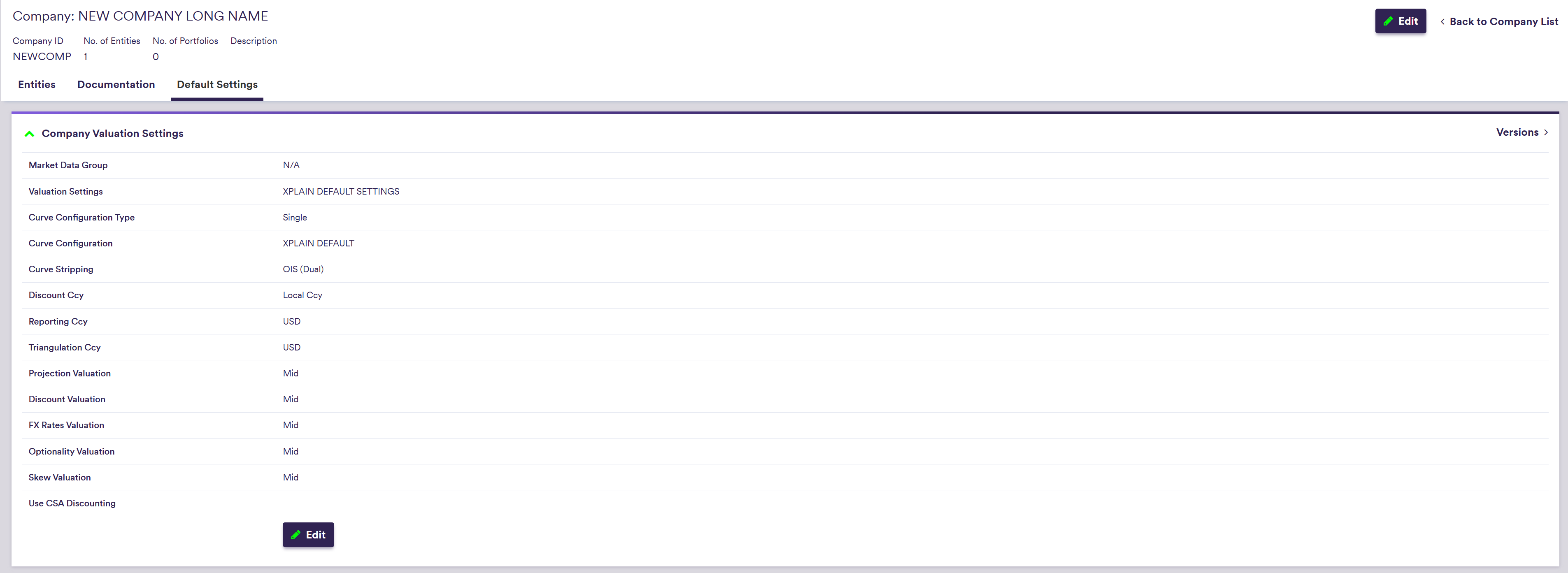

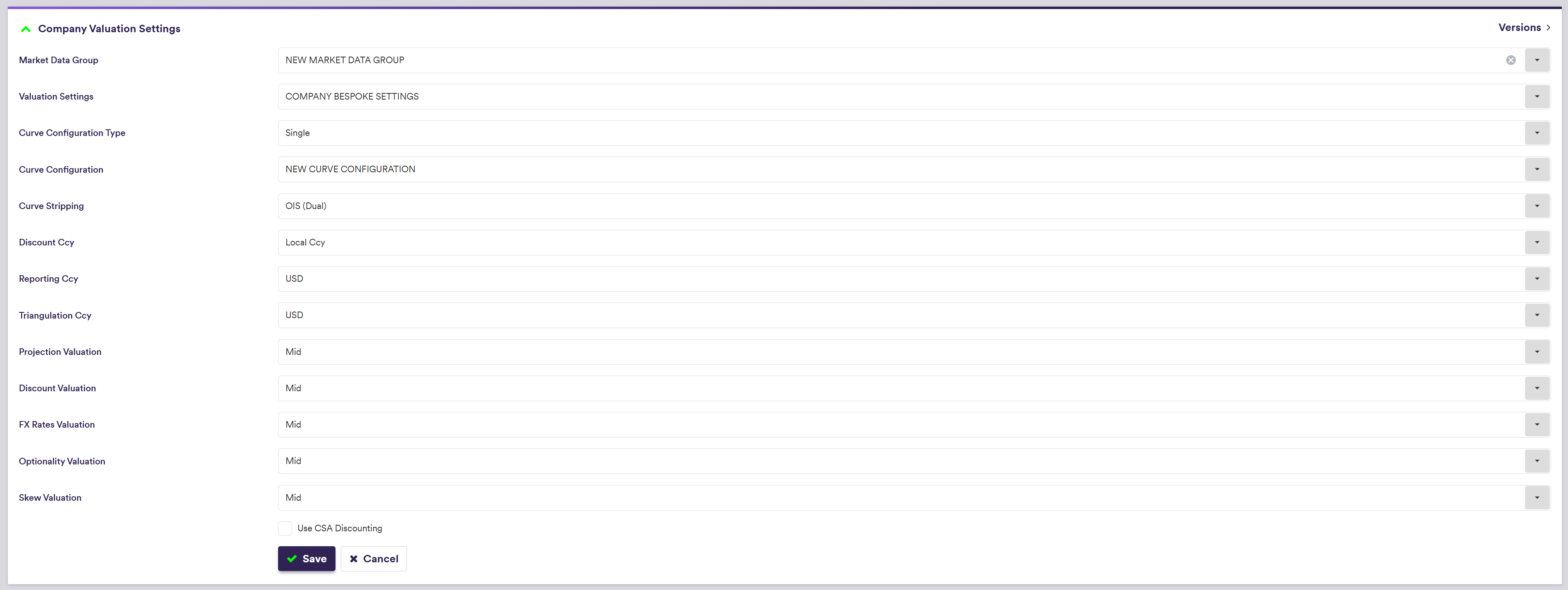

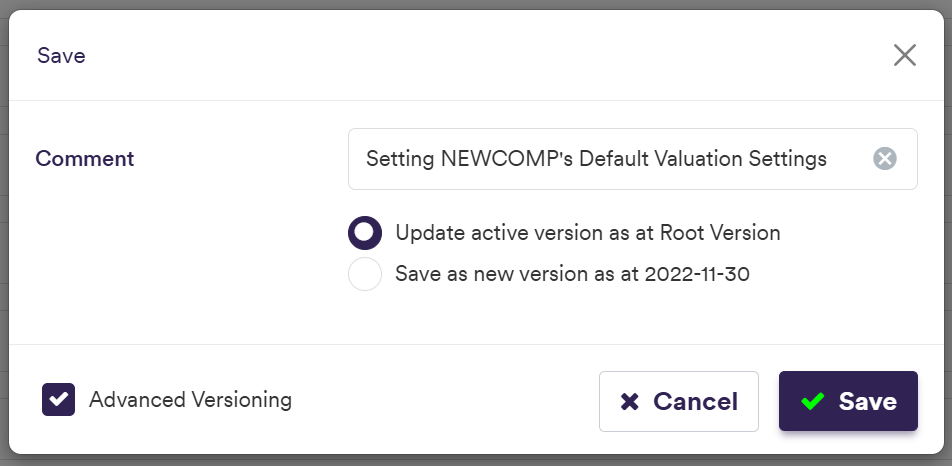

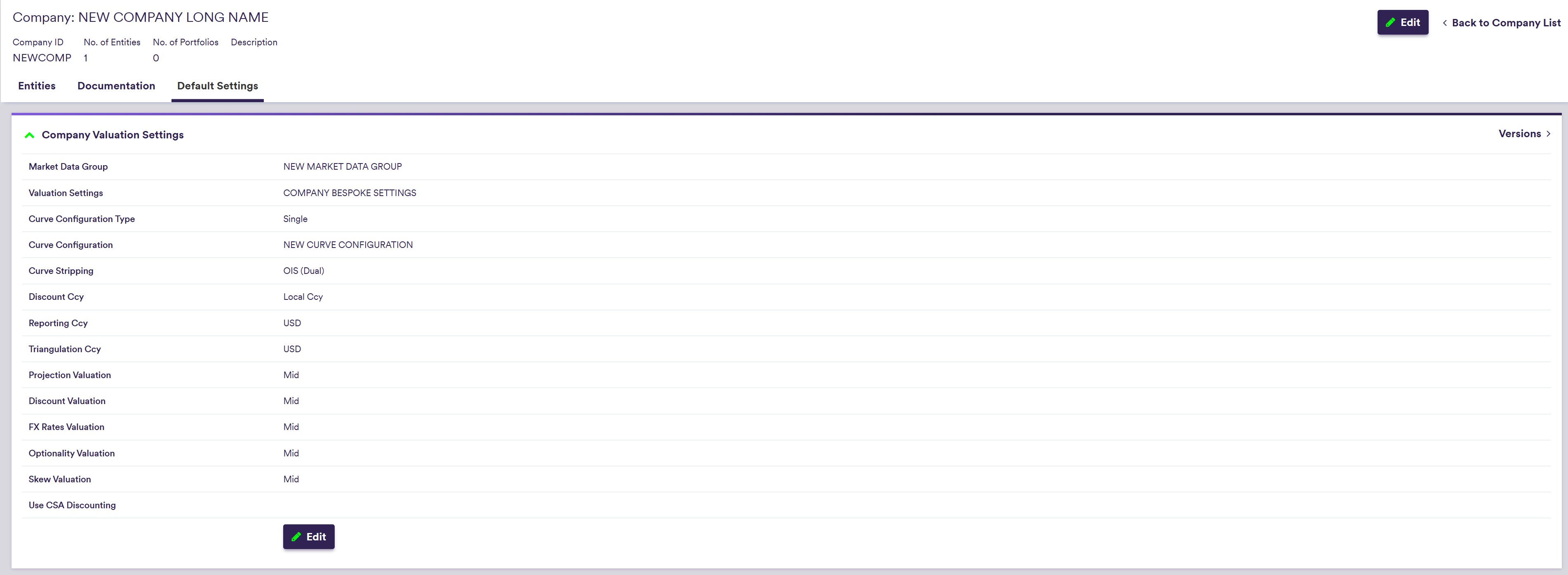

1. Company’s Default Valuation Settings

Under

Xplain’s global valuation settings, which are defined under

| Field Name | Description | Permissible Values |

|---|---|---|

| Market Data Group | The market data group that contains the raw market data | See market data |

| Valuation Settings | If Valuation Settings = 'COMPANY BESPOKE SETTINGS', you can define bespoke company valuation settings |

XPLAIN DEFAULT SETTINGS | COMPANY BESPOKE SETTINGS |

| Curve Configuration Type | If Curve Configuration Type = 'FX vs non-FX Instruments', a different curve configuration will apply for FX vs non-FX trades |

Single | FX vs non-FX Instruments |

| Curve Configuration | The applicable curve configuration(s) (depending on Curve Configuration Type) | Any existing curve configuration |

| Curve Stripping |

Dual stripping (for the projection and discount curves) or Libor curve stripping |

OIS (DUAL) | LIBOR |

| Discount Ccy |

Applicable single currency / CSA terms for discounting purposes If Discount Ccy = 'Local Ccy', the discount currency will be the currency of the trade |

Local Ccy; or Any major currency |

| Reporting Ccy | The currency in which the calculation results are expressed |

Any currency See FX rates |

| Triangulation Ccy | The triangulation currency used first when no direct base vs foreign XCCY curve can be found for foreign cashflow discounting | Any major currency for FX instruments |

| Projection Valuation | Market data side for projection | Bid | Mid | Ask |

| Discount Valuation | Market data side for discounting | Bid | Mid | Ask |

| FX Rates Valuation | Market data side for FX rates | Bid | Mid | Ask |

| Optionality Valuation | Market data side for ATM swaption and FX volatilities | Bid | Mid | Ask |

| Skew Valuation | Market data side for Swaption and FX volatility skews | Bid | Mid | Ask |

| Use CSA Discounting | Whether to apply a trade specific discounting currency when CSA Discount Currency is specified at trade level | Boolean |

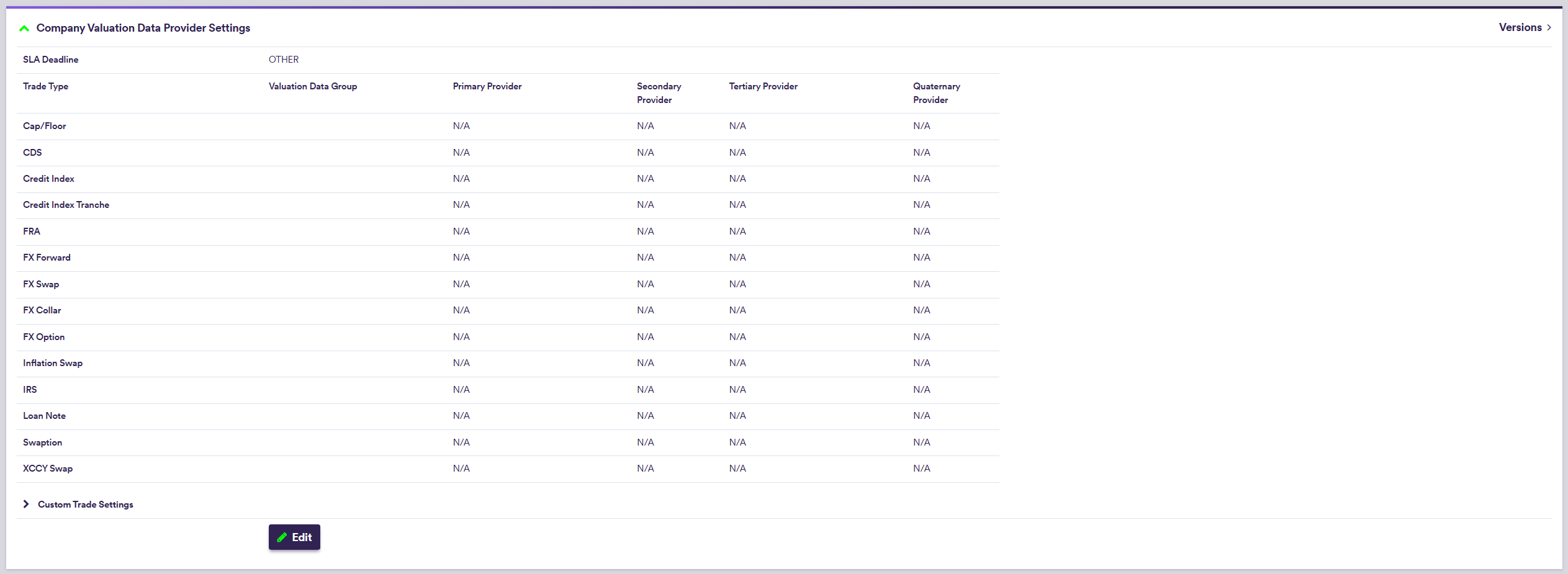

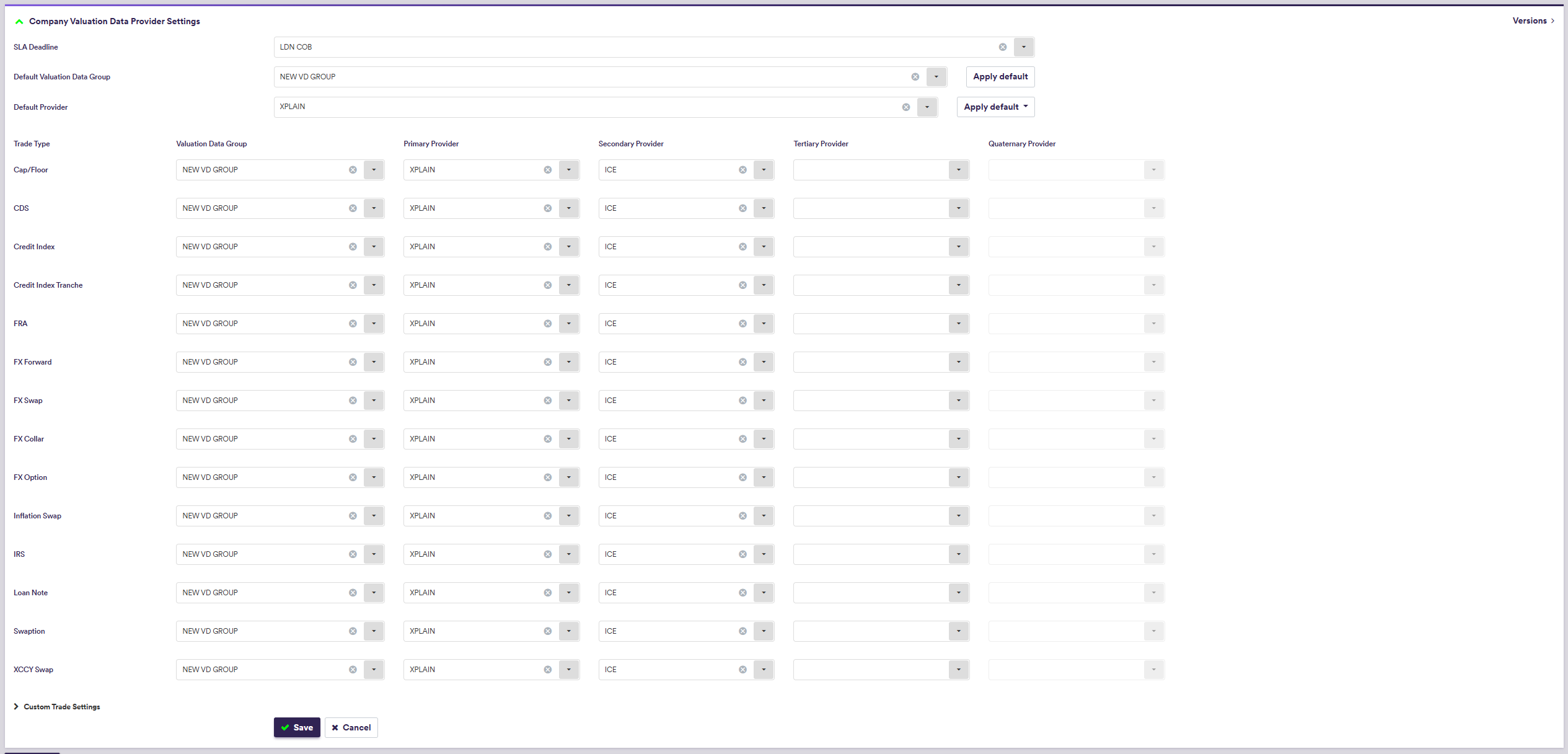

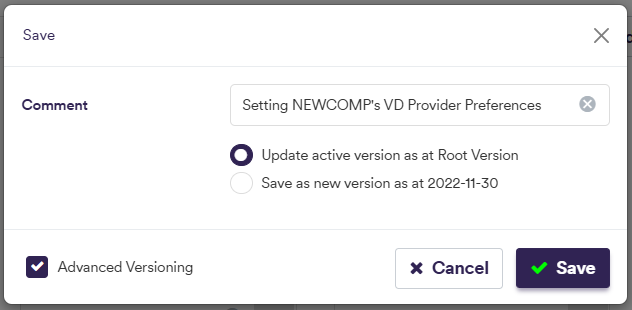

2. Company’s Default Valuation Data Provider Settings

For the purpose of valuation data anomaly detection, you need to specify the applicable SLA deadline time, and on a trade type basis, the applicable valuation data group(s) and preferred data providers (primary, secondary, tertiary and quaternary, as applicable).

In addition, under

Under

The ‘Default Provider’ selection can be used to populate primary to quaternary provider settings using the

| Field Name | Description | Permissible Values |

|---|---|---|

| SLA Deadline | The contractual SLA deadline associated with the company | See SLA deadline permissible values |

| Valuation Data Group | The valuation data group that contains the raw valuation data | See valuation data |

| Trade Type | The trade type |

Cap/Floor | CDS | Credit Index | Credit Index Tranche | FX Forward | FX Option | Inflation Swap | IRS | Loan Note | Swaption | XCCY Swap | Custom Rates 1 to 5 | Custom Fx 1 to 5 | Custom Equity 1 to 5 | Custom Commodity 1 to 5 | Custom Other 1 to 5 |

| Primary Provider | The default primary provider for valuation data for a given Trade Type (optional) | Any existing valuation data provider |

| Secondary Provider | The default secondary provider for valuation data for a given Trade Type (optional) | See data providers |

| Tertiary Provider | The default tertiary provider for valuation data for a given Trade Type (optional) | See data providers |

| Quaternary Provider | The default quaternary provider for valuation data for a given Trade Type (optional) | See data providers |

3. Entity's Default Settings

Entity’s settings are inherited by default from the parent company.

Under

- valuation settings by defining Valuation Settings as ‘Entity Bespoke Settings’ and

- valuation data provider settings by defining Settings as ‘Entity Valuation Data Provider Settings’ (instead of ‘Company Valuation Settings’ and ‘Company Valuation Data Provider Settings’).