To define a pricing environment ready to perform valuations in Xplain, you need to set up a curve configuration.

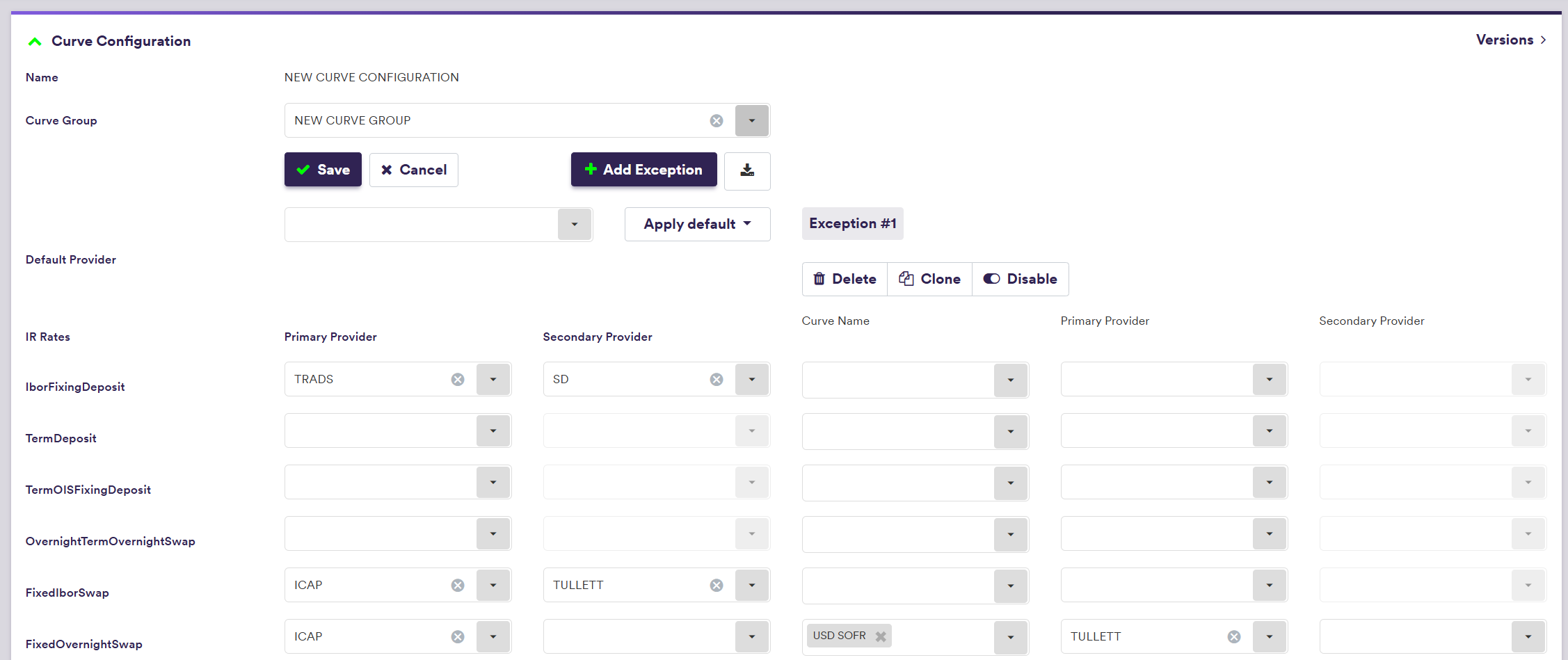

A curve configuration holds the mapping that links a curve group (which needs to be defined first) to preferred data providers (e.g. primary and secondary) on an instrument type basis.

On this page, we will discuss how to:

- set up a curve configuration, by selecting a curve group and specifying the mapping to market data providers (primary and secondary, if any) on an instrument type basis

- add provider mapping exceptions (if any)

Curve Configuration Example

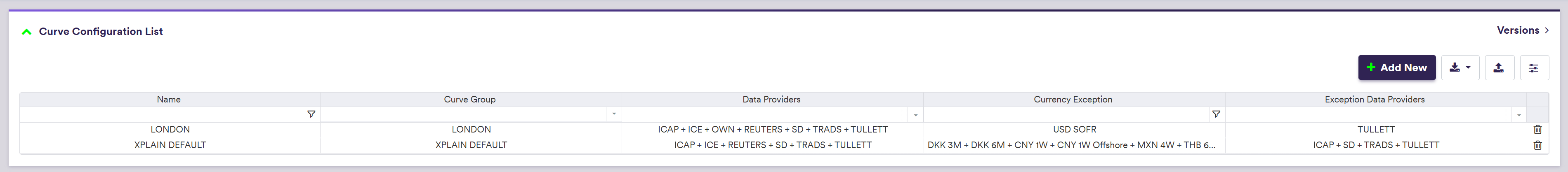

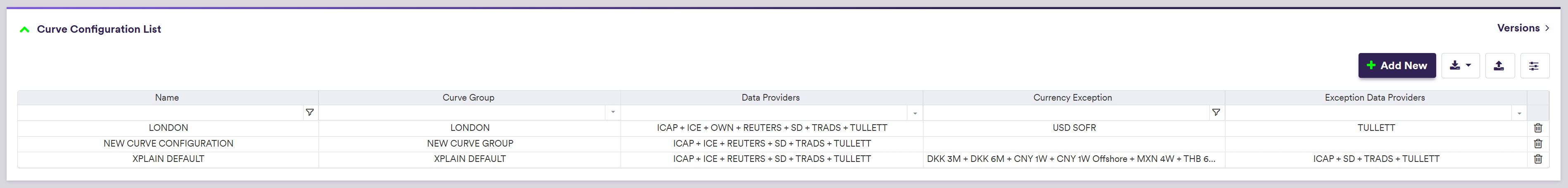

You can use the predefined ‘XPLAIN DEFAULT’ or ‘LONDON’ curve configurations, or define your own independently. This page will guide you through the process using an example: defining a ‘NEW CURVE CONFIGURATION’ that replicates ‘LONDON’, which will be used with our ‘NEW CURVE GROUP’ example.

Permissible values for curve configuration definitions can be found on the Curve Configuration Permissible Values page.

Curve Configuration Definition

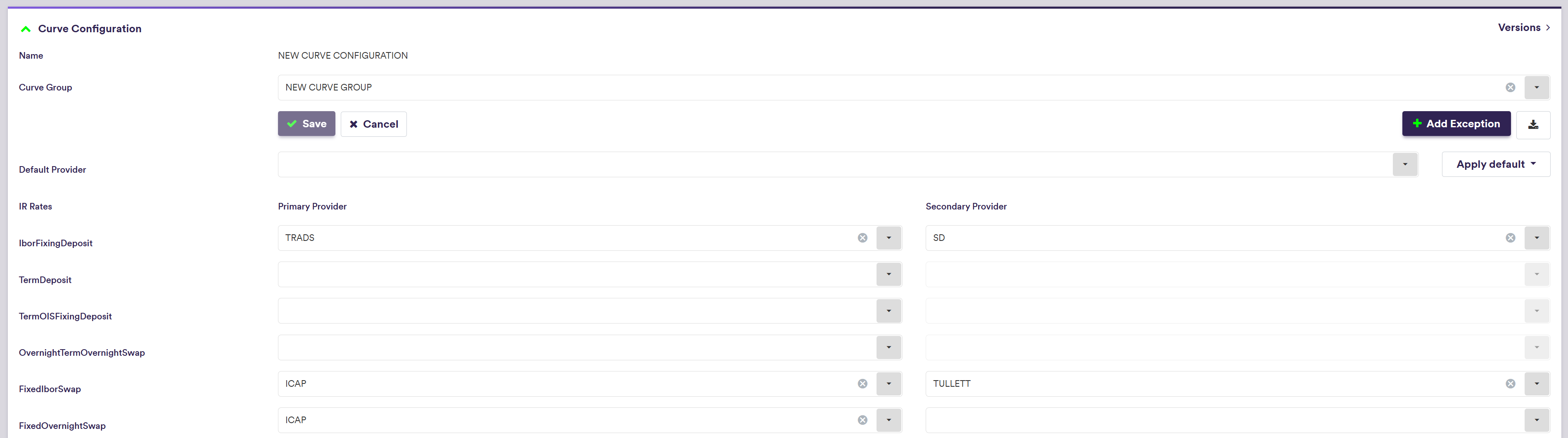

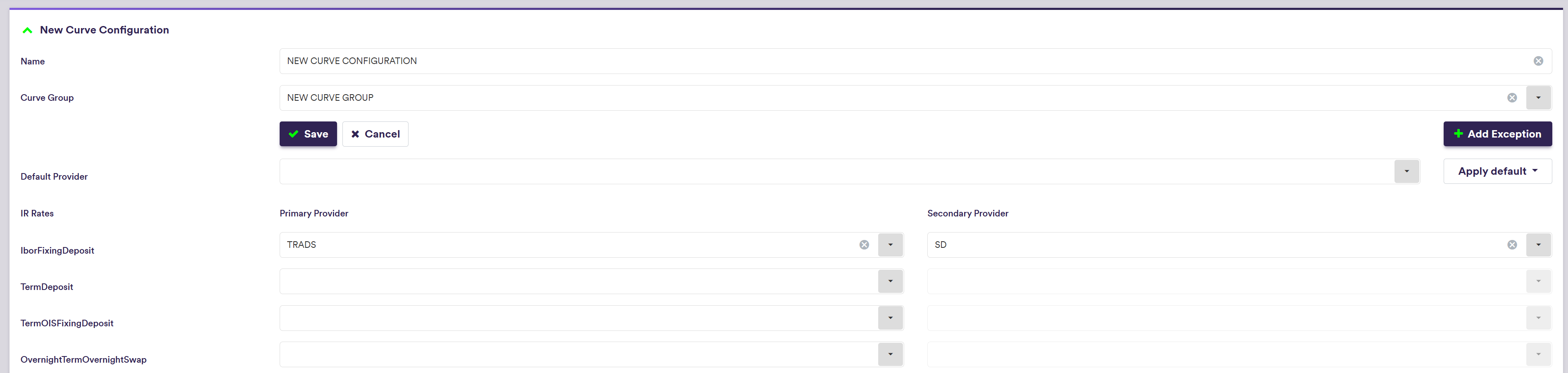

1. Setting Up a Curve Configuration

Under

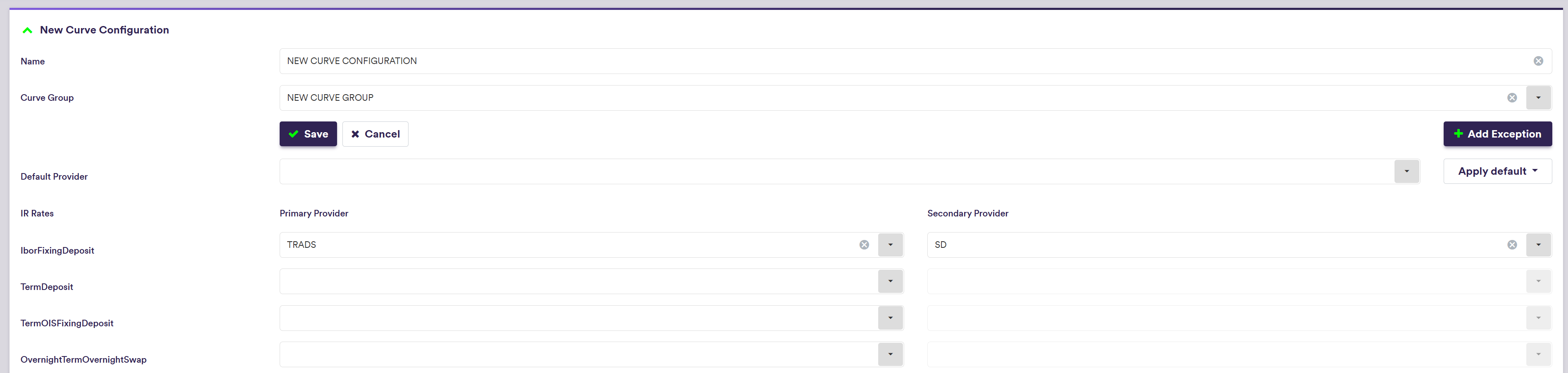

To manually set up a curve configuration, click on

setting Name = 'NEW CURVE CONFIGURATION' and Curve Group = 'NEW CURVE GROUP', and

mapping IborFixingDeposit to 'TRADS' as Primary Provider and 'SD' as Secondary Provider

Click on

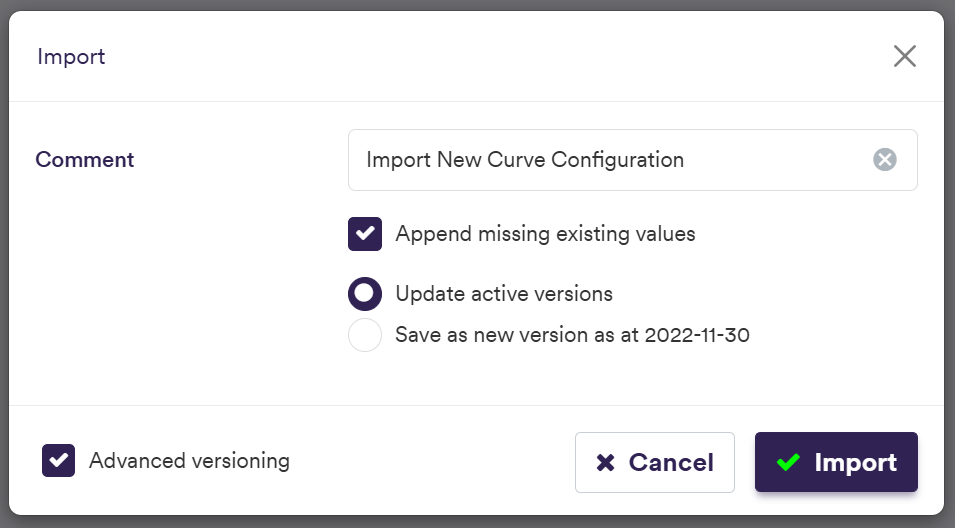

To import a curve configuration (or a list of curve configurations), click on (import) and select the relevant curve configuration definition .CSV import file.

You can download the import file template here ![]() .

.

At the curve configuration level (after double-clicking on the line item at the curve configuration list level), you can view the import results after clicking on

| Field Name | Description | Permissible Values |

|---|---|---|

| Name | The name of the curve configuration | Free text |

| Curve Group | The underlying curve group | Any existing curve group |

| Instrument Type | The instrument type | See Instrument Types |

| Primary Provider | The default primary provider for market data for a given Instrument Type (optional) | Any existing market data provider |

| Secondary Provider | The default secondary provider for market data for a given Instrument Type (optional) | See Data Providers |

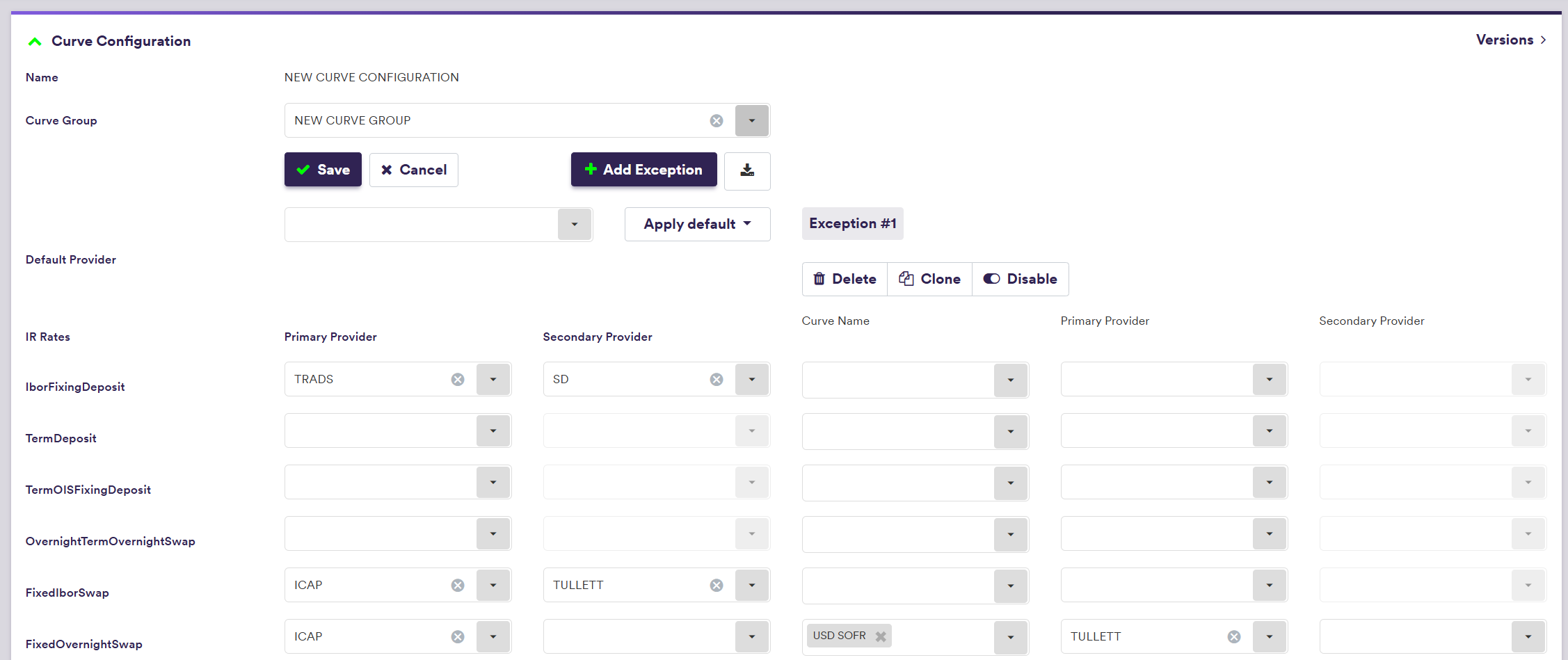

2. Adding a Provider Mapping Exception

By adding provider mapping exceptions, the default mapping between instrument types and preferred providers can be overridden on an instrument type basis.

Under

After clicking on

To manually add a provider mapping exception, click on

and mapping FixedOvernightSwap to 'TULLETT' as Primary Provider for USD SOFR

Click on

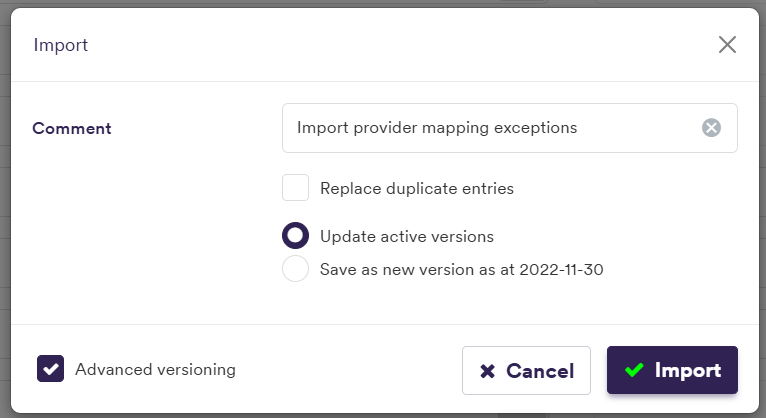

To import a mapping exception (or a list of mapping exceptions), click on (import) and select the relevant mapping exception definition .CSV import file.

You can download the import file template here ![]() .

.

| Field Name | Description | Permissible Values |

|---|---|---|

| Curve Name | A list of FX rates, curves / volatility surfaces or credit curves, which will be mapped to different providers for a given Instrument Type |

See list of permissible FX rates See list of permissible curve names See list of permissible credit sectors |

| Primary Provider | The exception Primary Provider for market data for a given Curve Name | Any existing market data provider. |

| Secondary Provider | The exception Secondary Provider for market data (optional) for a given Curve Name | See Data Providers |

The curve calibration applied at the start of a valuation process to derive cashflow discounting curves and index projection curves, can also be performed on a standalone basis at the curve configuration level.