XVA calculations will required additional credit curves and market data:

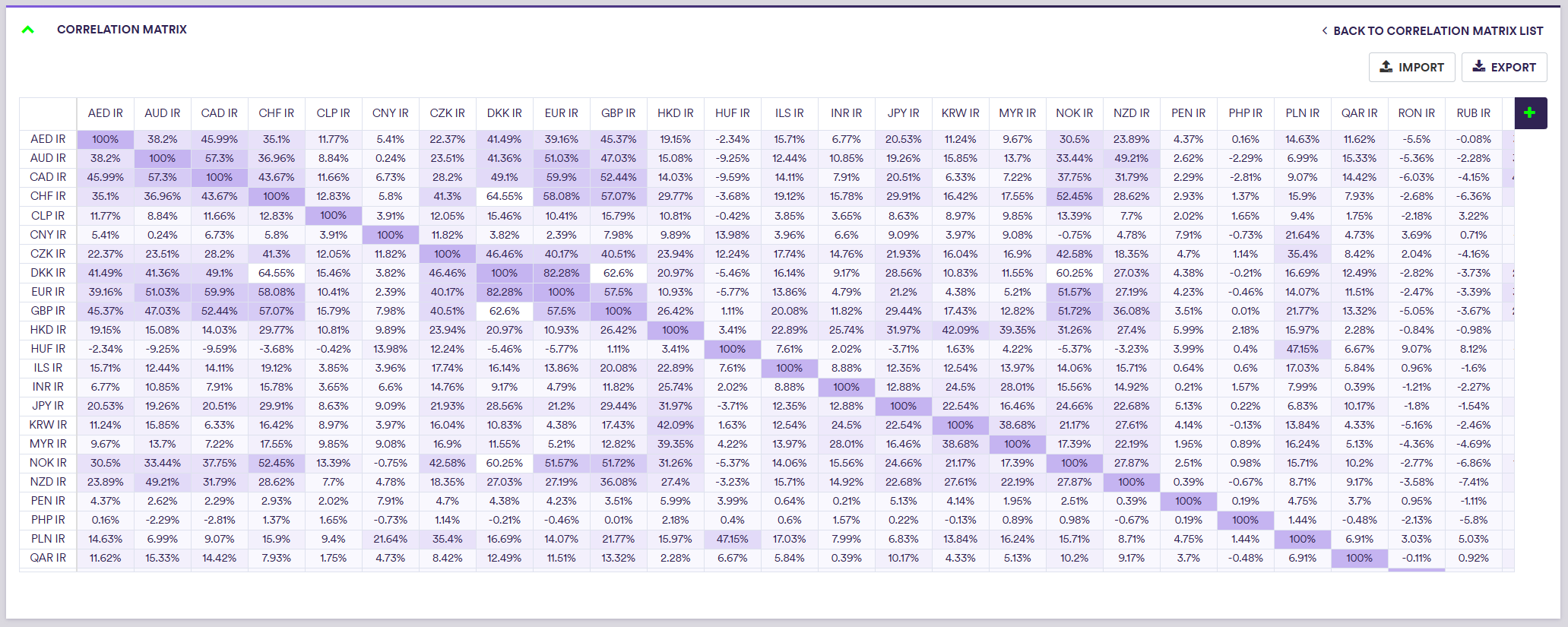

- a matrix of correlations between underlying IR rates and FX rates (base vs counter currency pairs)

- the volatility curves associated to those underlying IR rates and FX rates

- credit curves associated to counterparties (*) for CVA and FVA calculations

- a ‘SELF’ credit curve for DVA and FBA calculations

(*) The mapping between the Counterparty trade attribute and the relevant credit curve will be driven by the credit curve’s Ticker attribute.

For the purposes of FCA and FBA calculations, funding nodes will be required (with the relevant MDK mapping) and can only be defined for credit curves whose Seniority = ‘SNRFOR’.

On this page, we will discuss:

- how to create a rates vs FX correlation matrix

- how to add correlation points to such matrix

- how to define the XVA model parameters

Correlation Matrices

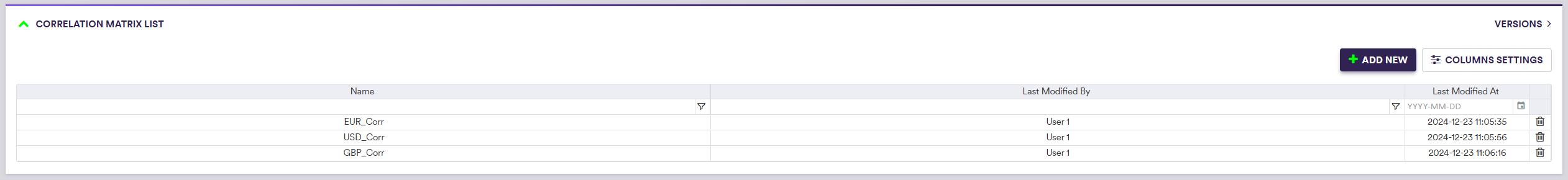

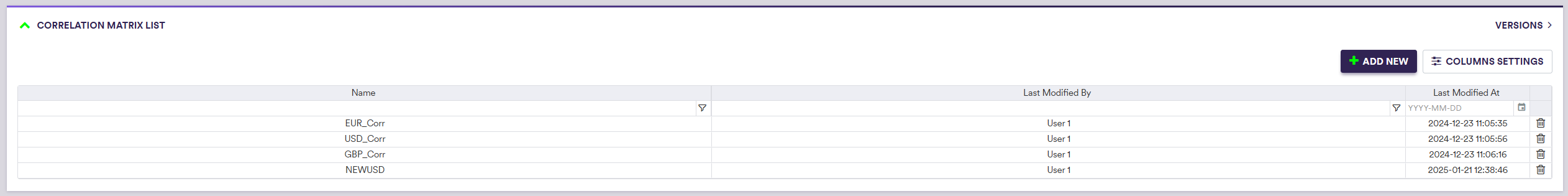

1. Creating a Correlation Matrix

Under

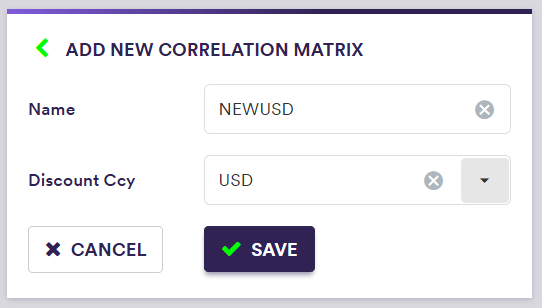

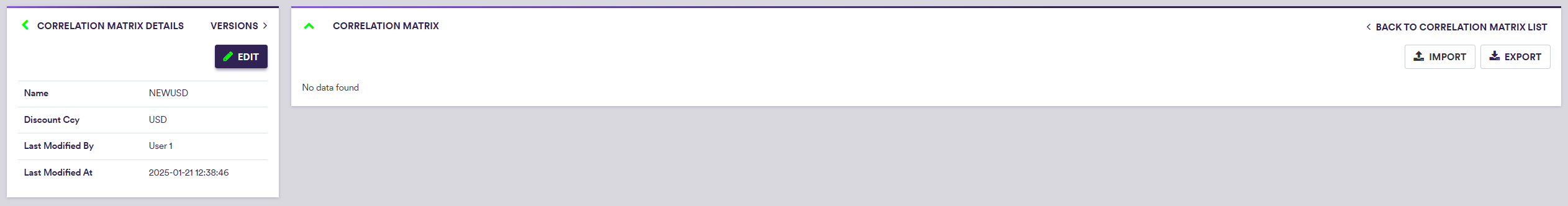

For the purpose of this example, you can manually create a new matrix to replicate the ‘USD_Corr’ matrix which can be used for XVA calculations for the ‘LONDON_FICC’ company setup (IRS_PTF_2 portfolio), with USD as discount currency.

A description of the correlation matrix’s attributes and corresponding permissible values are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Name | Correlation matrix name | Free text |

| Discount Ccy | Applicable single currency for discounting purposes | Any permissible discount currency |

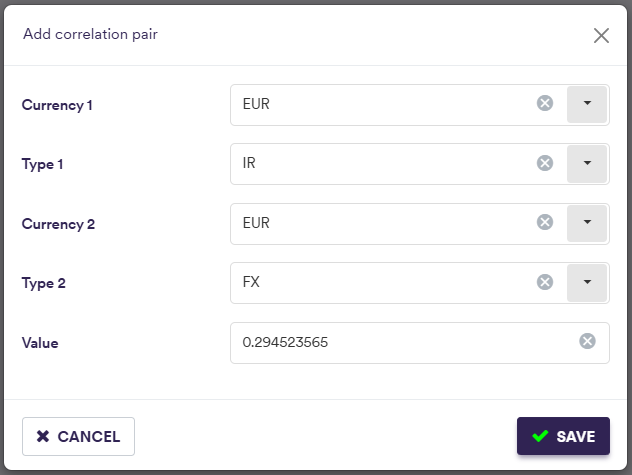

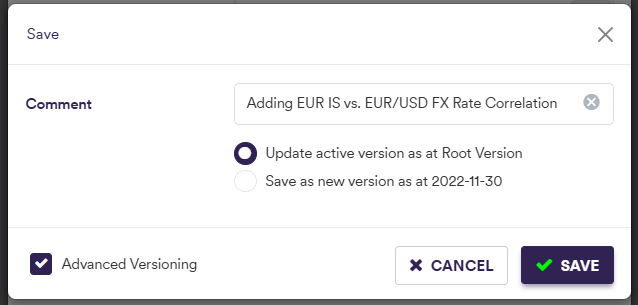

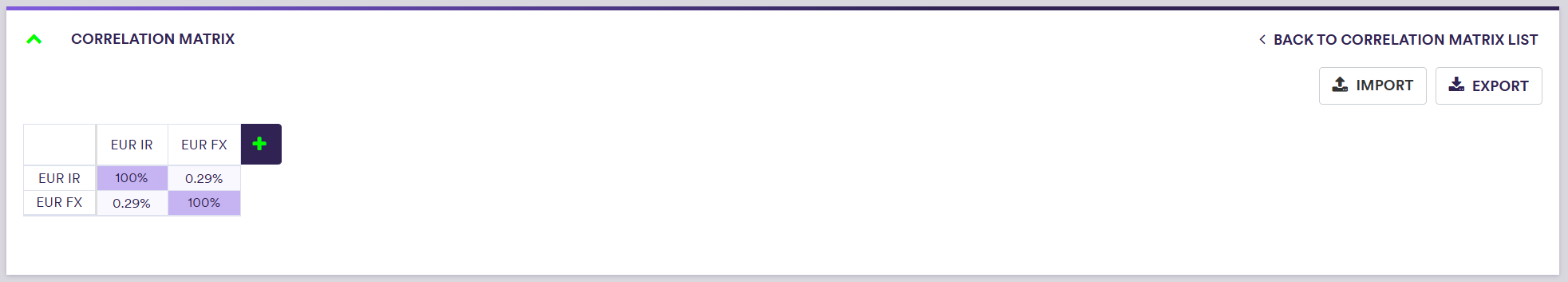

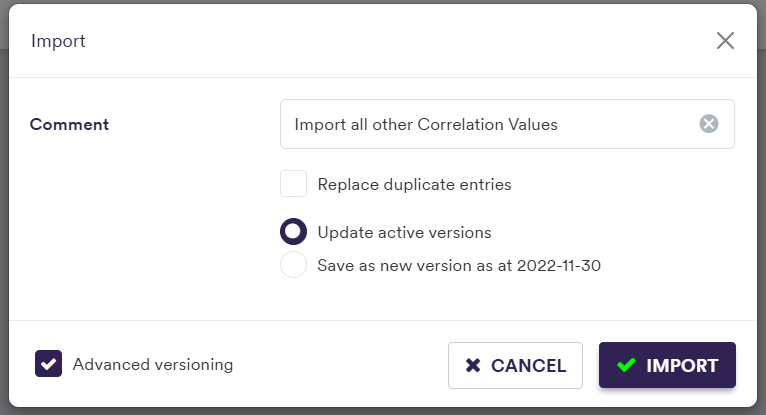

2. Adding Correlation Points

Under

A description of a correlation point’s attributes and corresponding permissible values are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Currency 1 |

If Type 1 = "IR": the underlying rates ccy If Type 1 = "FX": the counter ccy of the matrix's Discount Ccy 3-letter ISO 4217 ccy code |

Any ccy associated to a permissible IR curve See FX Rate Rule |

| Type 1 | Underlying asset type: rates or FX rate (counter currency) | IR | FX |

| Currency 2 |

If Type 2 = "IR": the underlying rates ccy If Type 2 = "FX": the counter ccy of the matrix's Discount Ccy 3-letter ISO 4217 ccy code |

Any ccy associated to a permissible IR curve See FX Rate Rule |

| Type 2 | Underlying asset type: rates or FX rate (counter currency) | IR | FX |

| Value | The pairwise correlation value | Numeric |

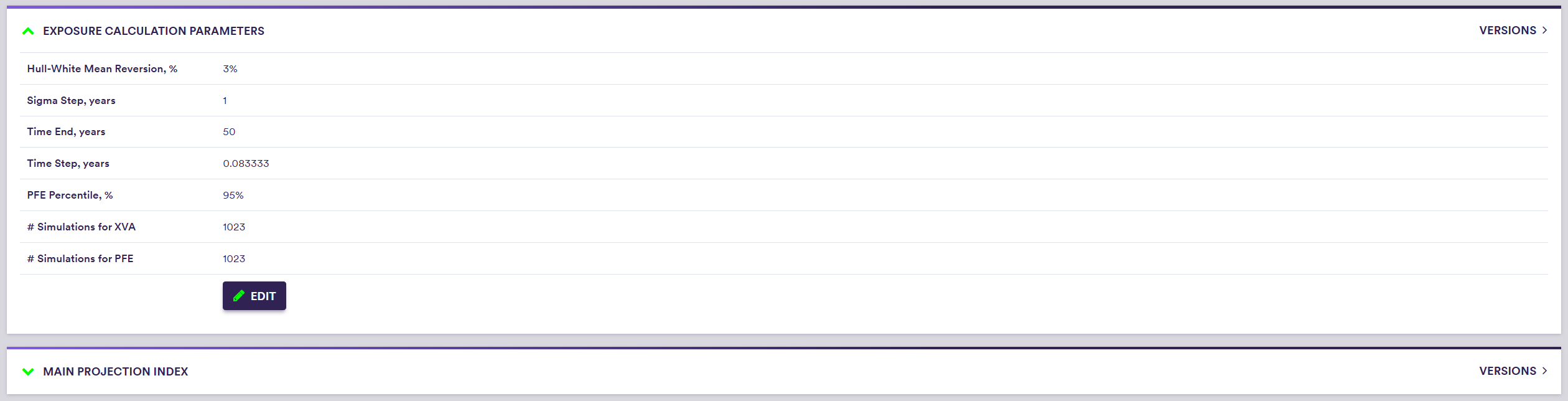

XVA Model Parameters and Assumptions

For XVA calculations, you will need to:

- parameterise the Hull-White model that is used for XVA calculations

- define the main projection index that will be used in the diffusion process on a currency basis

1. Hull-White Model Parameters

Under

| Field Name | Description | Permissible Values |

|---|---|---|

| Hull-White Mean Reversion | Hull-White model’s mean reversion | Numeric |

| Sigma Step, years | The time step-size for Hull-White model’s volatility vectors, expressed in years | Numeric |

| Time End, years | The final point of Hull-White model’s volatility vectors, expressed in years | Numeric |

| Time Step, years | Hull-White model’s grid discretisation, expressed in years | Numeric |

| PFE Percentile, % | The PFE percentile for exposure calculations | Numeric (e.g. 95 for 95%) |

| # Simulation for XVA | The number of Sobol sequences used in the integration algorithm for XVA calculations | 2^n, n = 2 to 14 |

| # Simulation for PFE | The number of Sobol sequences used in the integration algorithm for exposure calculations | 2^n, n = 2 to 14 |

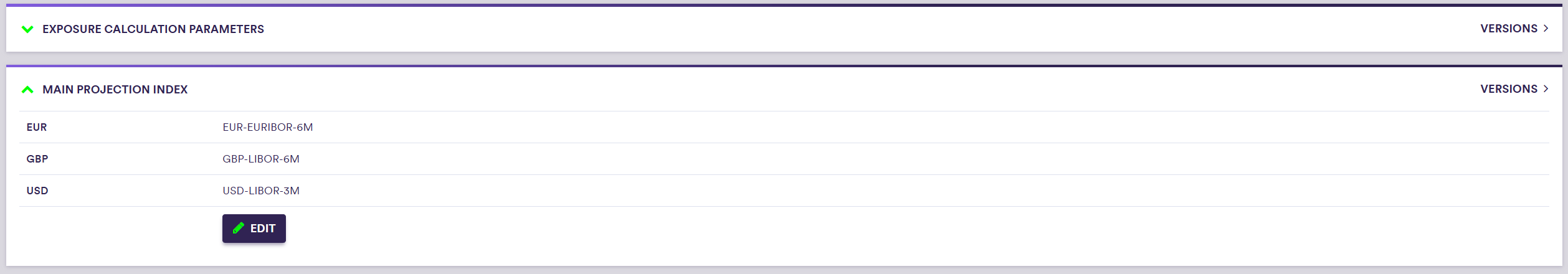

2. XVA Projection Index Definition

For each currency that has more than one associated projection indices, you will need to specify the main projection index that will be used for simulations in the Hull-White model. This is done under

A description of the XVA projection index definition and corresponding permissible values are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Currency | A currency that has more than one permissible projection indices (read-only) | See permissible IR projection curves |

| Main Projection Index | The projection index that will be used for simulations in the Hull-White model | See permissible IR projection indices |