Once you have a pricing environment ready, you can simulate portfolio valuations over a period of time, to pre-empt any potential future valuation issues.

Other pricing functionalities are listed here.

Running Valuation Simulation

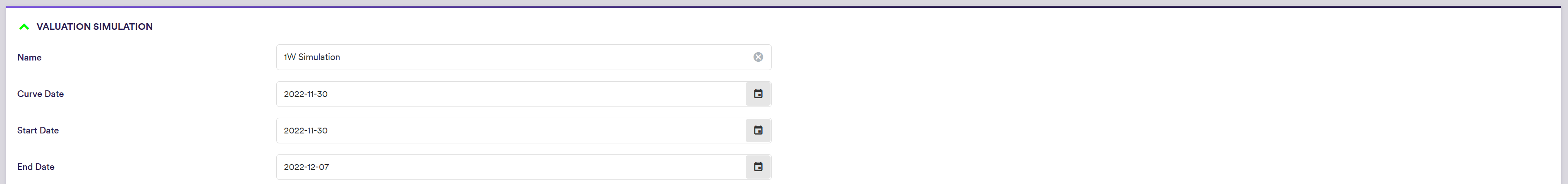

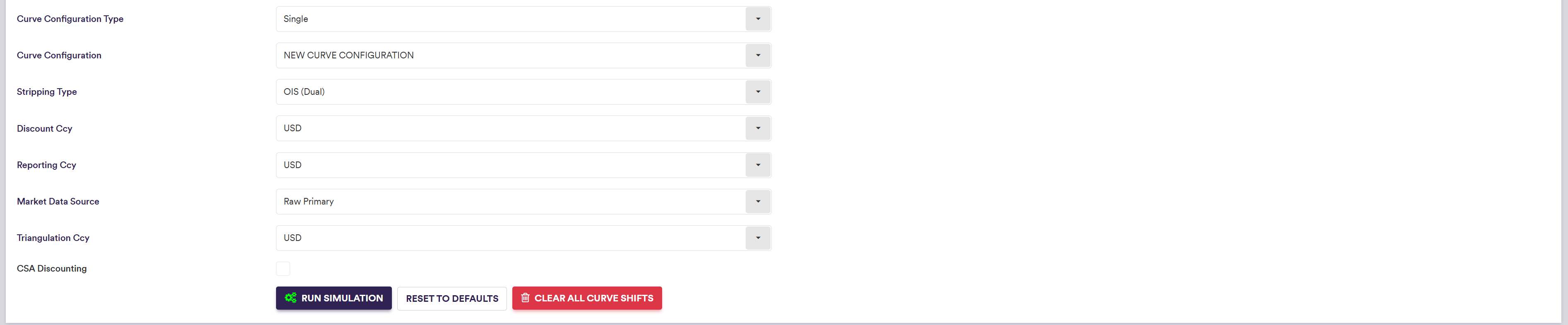

Under

The field changes in settings are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Name | The name of the simulation | Free text |

| Start Date (*) | The start date of the simulation period (default = Curve Date) | YYYY-MM-DD (ISO 8601) |

| End Date | The end date of the simulation period | YYYY-MM-DD (ISO 8601) |

The simulation period will be determined by Start Date and End Date. The market data used for the valuation simulation will be that of Curve Date. Fixings will be duplicated as of each day over the simulation period.

In the ‘Valuation Simulation’ window, click on

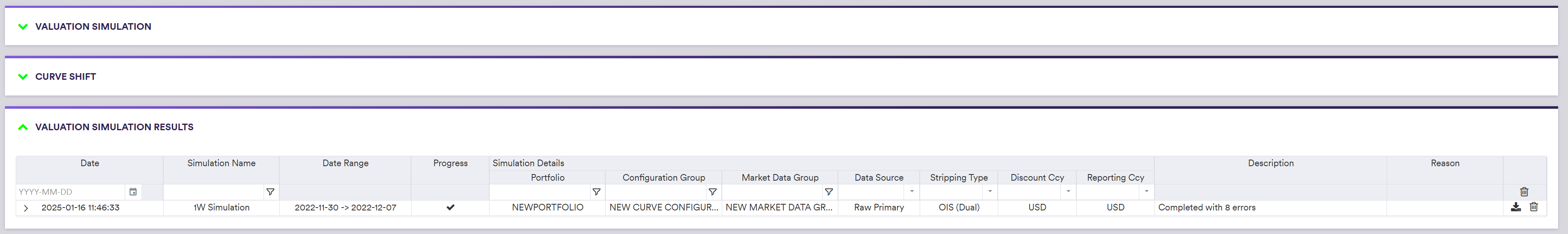

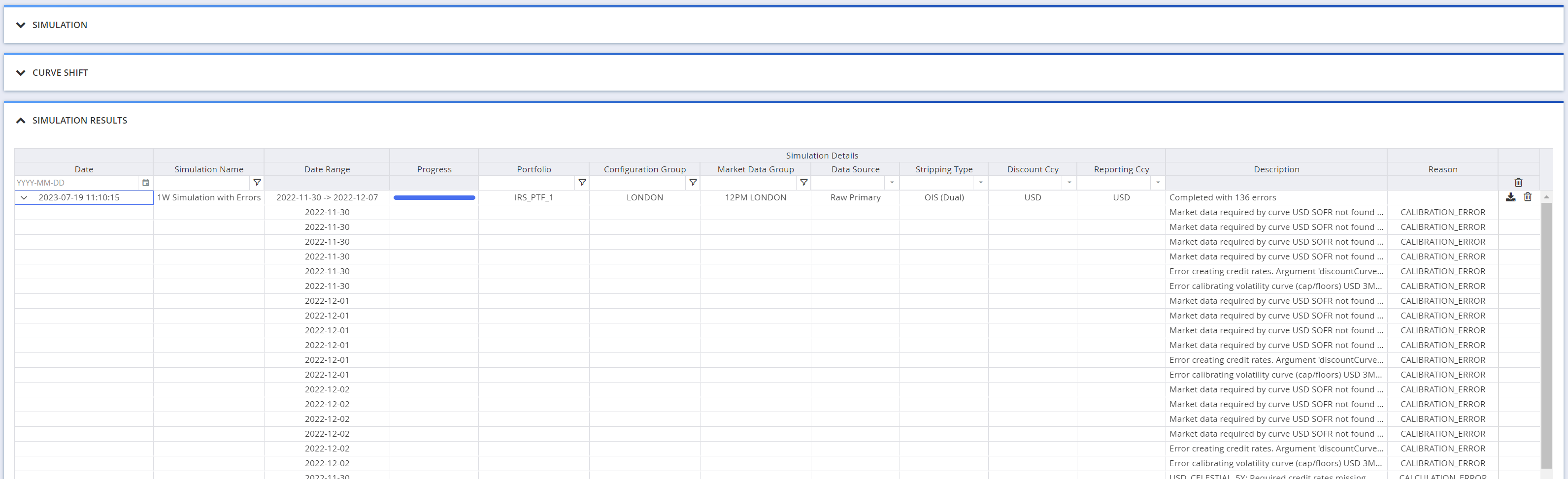

Valuation Simulation Results

Once the simulation process has been completed, in the ‘Simulation Results’ window, any error (type and corresponding description) will be set out for each calendar day in the simulation period.