Once you have a pricing environment ready, you can run PNL explain calculations between two dates for a given portfolio. This will allocate the change in valuation on a trade basis into first-order sensitivity components (i.e. DV01, BR01, CS01/INF01, Carry, Spot FX and Vega) and the remaining unexplained PNL component.

Other pricing functionalities are listed here.

Running PNL Explain Calculations

Under

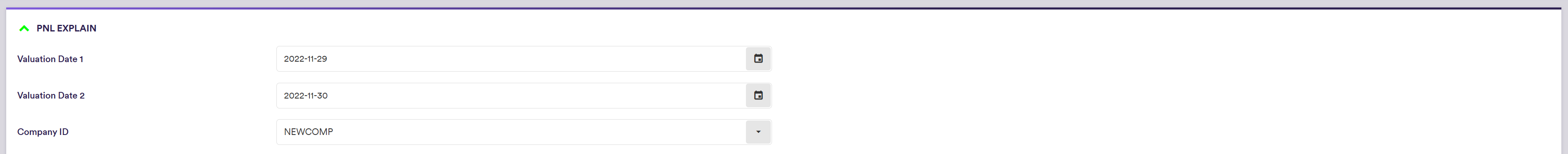

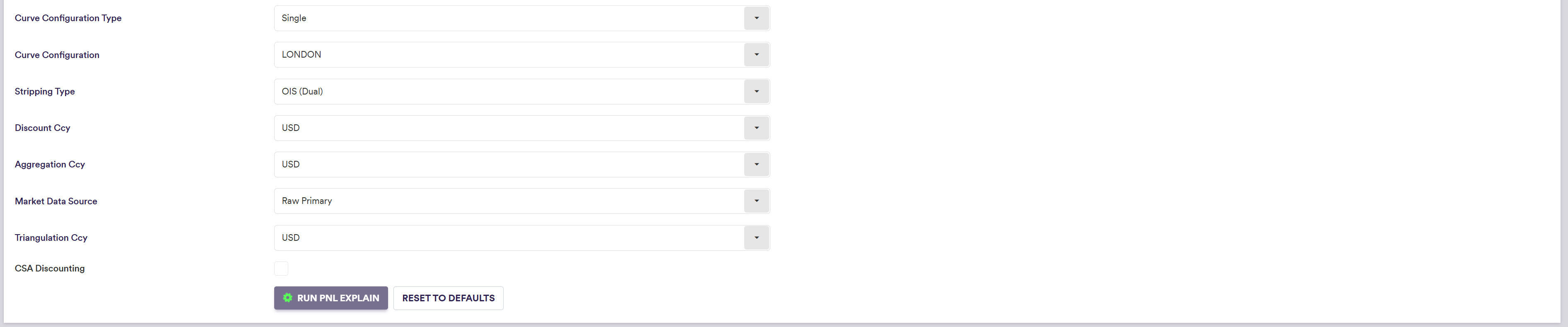

Prior to performing the portfolio valuation simulation, you will need to set the valuation parameters, as you would do in a standard PV calculation process.

The field changes in settings are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Valuation Date 1 (*) | The previous valuation date | YYYY-MM-DD (ISO 8601) |

| Valuation Date 2 (*) | The current valuation date (default = Anchor Date) | YYYY-MM-DD (ISO 8601) |

The market data used for the PNL explain calculations will be those of each Valuation Date.

In the ‘PNL Explain’ window, click on

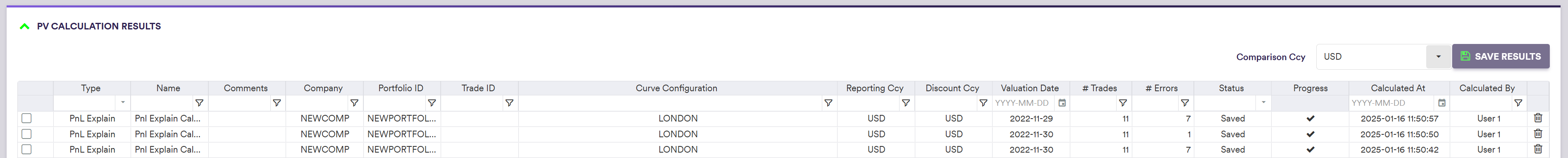

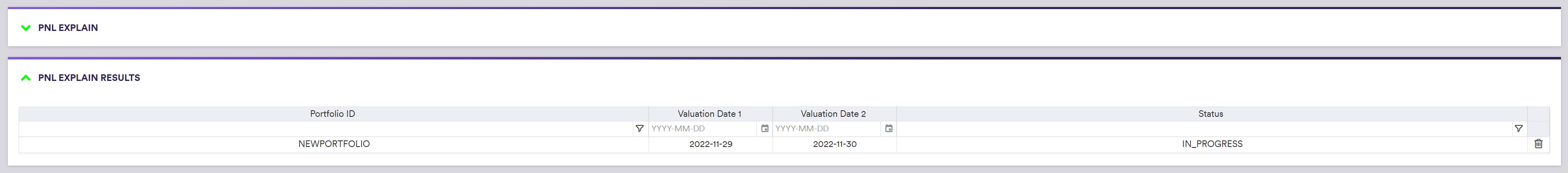

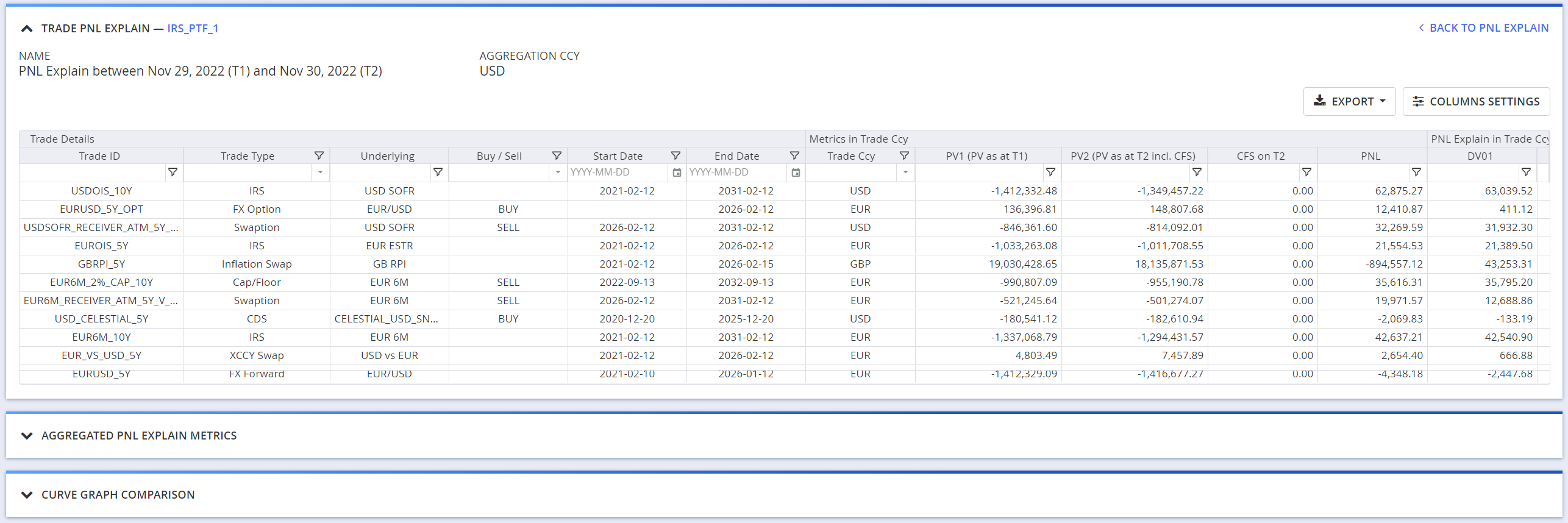

PNL Explain Calculation Results

Once the calculations have been completed, the corresponding result line item will appear in the ‘PNL Explain Results’ window.

After double-clicking on the line item, you can view, filter and sort the PNL explain calculations.

| CATEGORY | UI Field Name | Description / PERMISSIBLE VALUE |

|---|---|---|

| Trade Details | Trade ID | Unique trade identifier |

| Trade Details | Trade Type |

CAP_FLOOR | CDS | CREDIT_INDEX | CREDIT_INDEX_TRANCHE FXFWD | FXOPT | INFLATION | IRS | LOAN_NOTES SWAPTION | XCCY | any custom trade type |

| Trade Details | Underlying | The trade's underlying |

| Trade Details | Buy/Sell | Optionality or credit protection direction (where applicable) |

| Trade Details | Start Date | Start date |

| Trade Details | End Date | End date |

| Metrics in Trade Ccy | Trade Ccy | The currency in which the trade metrics are expressed |

| Metrics in Trade Ccy | PV1 (PV as at T1) | Dirty PV as at T1 |

| Metrics in Trade Ccy | PV2 (PV2 as at T2 incl. CFS) | Dirty PV as at T2 including CFS on T2 |

| Metrics in Trade Ccy | CFS on T2 | T2 net cashflows |

| Metrics in Trade Ccy | PNL | PV2 minus PV1 |

| PNL Explain in Trade Ccy | DV01 | PNL's DV01 component |

| PNL Explain in Trade Ccy | BR01 | PNL's BR01 component |

| PNL Explain in Trade Ccy | INF01 | PNL's CS01/INF01 component |

| PNL Explain in Trade Ccy | Carry | PNL's carry component |

| PNL Explain in Trade Ccy | FX | PNL's SPOT01 component |

| PNL Explain in Trade Ccy | Vega | PNL's Vega component |

| PNL Explain in Trade Ccy | Unexplained | PNL's unexplained component |

| Pay Leg / Rec Leg | Ccy | Leg currency |

| Pay Leg / Rec Leg | Notional | Leg notional |

| Pay Leg / Rec Leg | Rate/Margin, % | Leg fixed rate or margin, expressed in % |

| Pay Leg / Rec Leg | Index | Leg index |

| Pay Leg / Rec Leg | Freq | Leg frequency |

The underlying calculations used for PNL explain can be found under