Net currency exposure refers to the total amount of risk you may have in a particular currency. This is calculated by:

- aggregating currency exposure cashflows: Summing up all the cashflows (inflows and outflows) in a specific currency over a certain period.

- against hedge FX trades: Comparing these cashflows to the notional amounts of FX hedge trades that are meant to offset the currency risk.

So, net currency exposure is essentially the difference between the cashflows in a given currency and the hedging trades in that same currency over a specified time horizon.

On this page, we will discuss how to define the currency exposure and its cashflows. The hedge trades will be considered on a portfolio basis (or on selected trades), following the portfolio’s PV calculation.

Currency Exposure Definition

The two steps required to define a currency exposure are as follows:

1. Creating a Currency Exposure

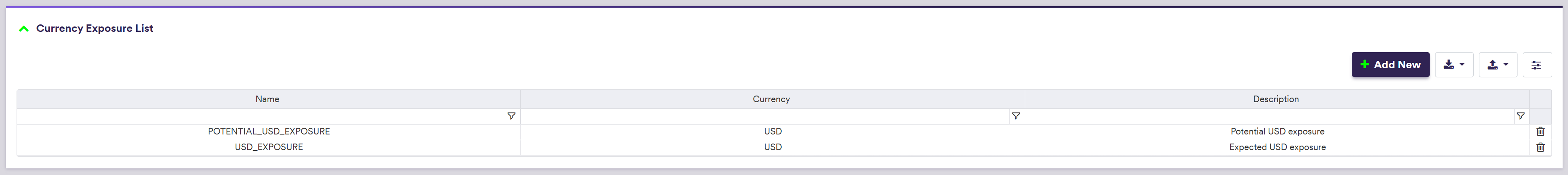

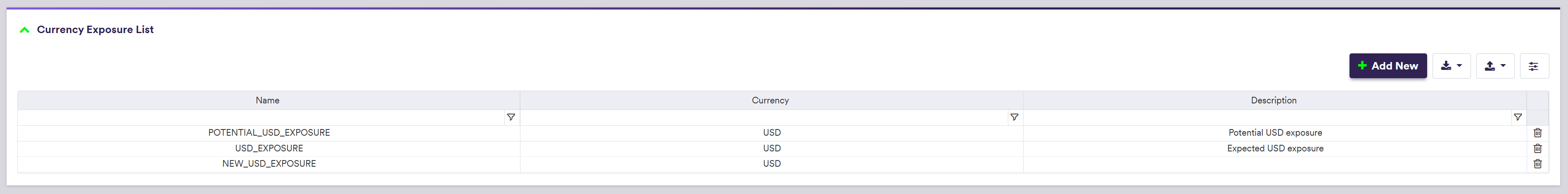

Under

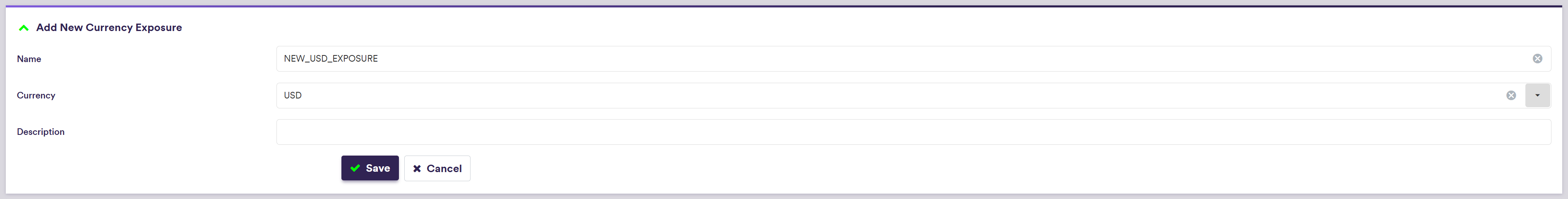

To manually add a currency exposure, click on

To import a currency exposure (or a list of currency exposures), click on (import) and select the relevant currency exposure list definition .CSV import file.

You can download the import file template here ![]() .

.

A description of a currency exposure’s attributes and corresponding permissible values are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Name | The name of the currency exposure | Free text |

| Currency | The currency of the future exposure cashflows |

Any currency in FX Cat A and FX Cat B See FX Rate Rule |

| Description | Comment field (optional) | Free text |

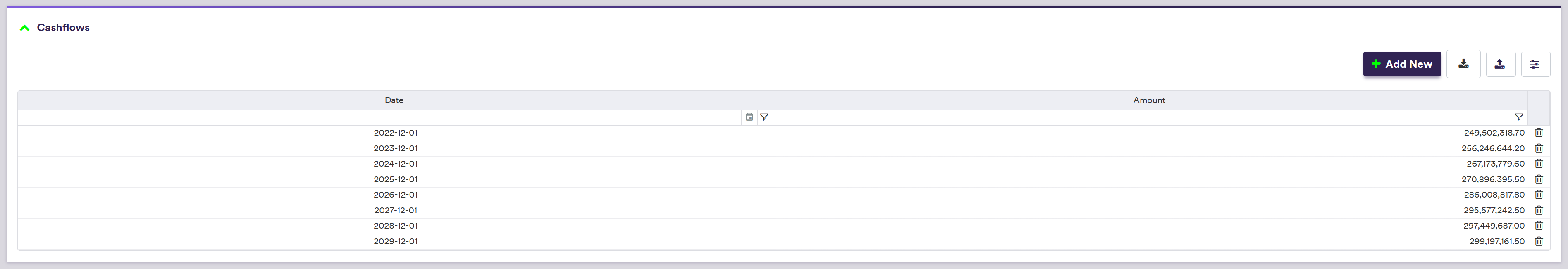

2. Adding Currency Exposure Cashflows

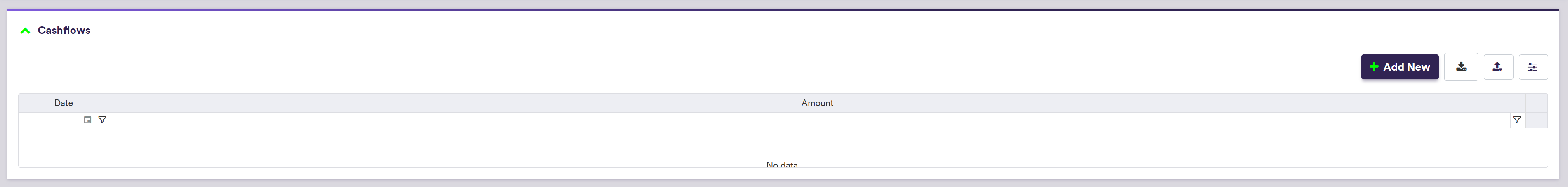

Under

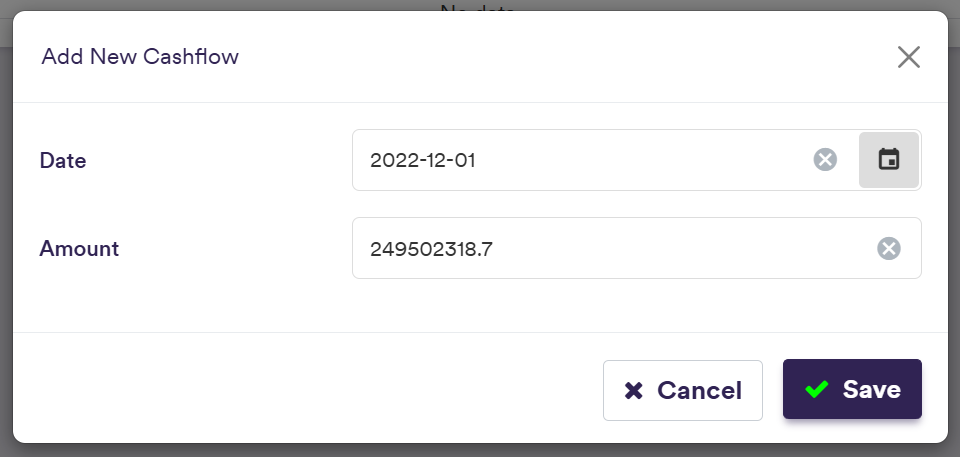

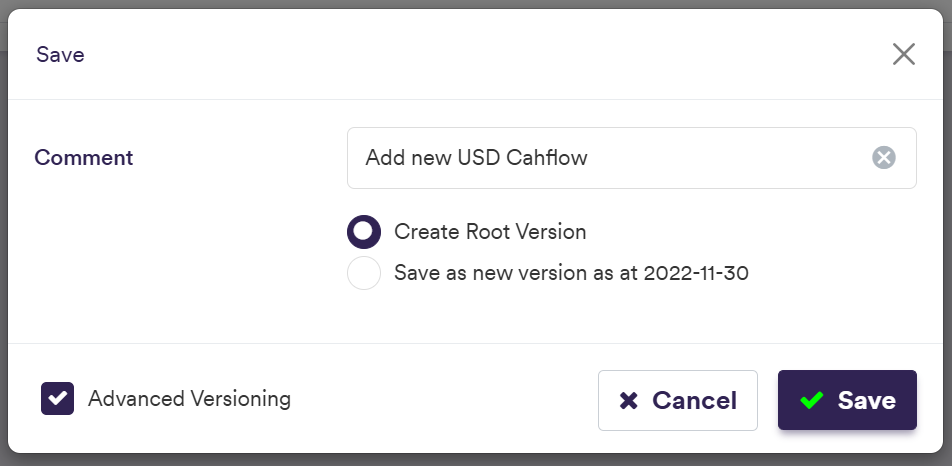

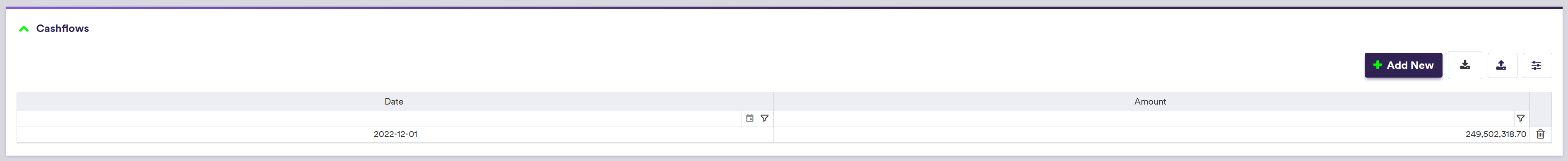

To manually add a cashflow (or a list of cashflows), click on

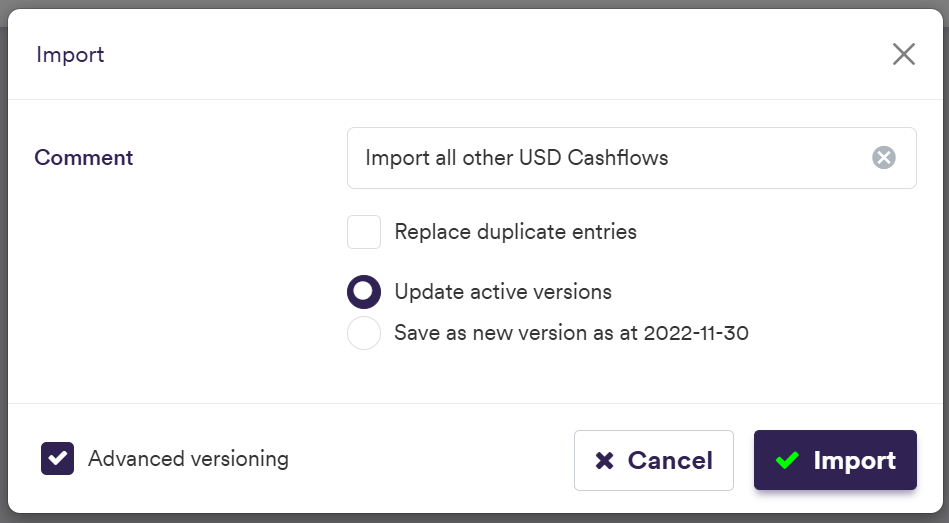

To import a cashflow (or a list of cashflows), click on (import) and select the relevant cashflows list definition .CSV import file.

You can download the import file template here ![]() .

.

A description of a cashflow’s attributes and corresponding permissible values are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Ccy Exposure Name | The currency exposure that will hold the cashflow | Any existing currency exposure |

| Date | The cashflow date | YYYY-MM-DD (ISO 8601) |

| Amount | The cashflow amount | Numeric |