With Xplain’s trade onboarding functionality, you can cross-check trade data in a fully audited and automated manner, according to bespoke validation rules.

On this page, we will discuss:

- trade onboarding settings

- trade onboarding break tests

- trade onboarding workflow

Trade Onboarding Settings

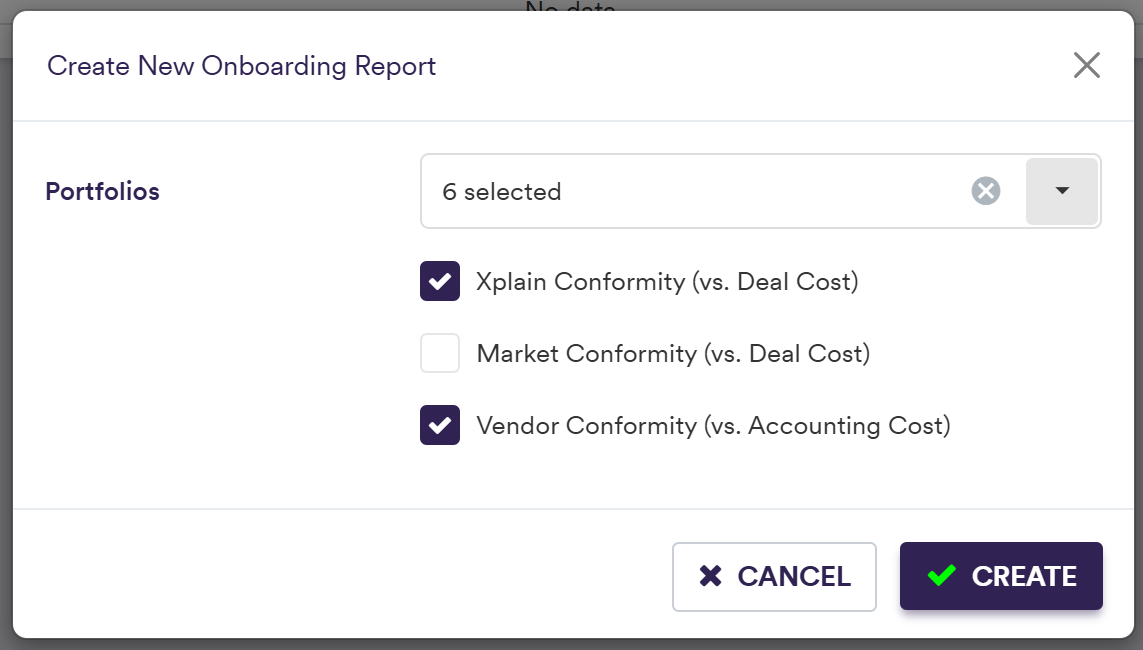

Break tests for trade onboarding can be classified into three categories:

- Xplain Conformity (vs. Deal Cost) tests, to assist in identifying trade misbooking by comparing valuation in Xplain at trade date vs. termsheet deal cost

- Market Conformity (vs. Deal Cost) tests, to assist in identifying trade misbooking by comparing valuation in Xplain at trade date vs. termsheet deal cost

- Vendor Conformity (vs. Accounting Cost) tests, to assist in identifying trade misbooking by comparing third-party valuation at NAV Effective Date vs. accounting cost (*)

(*) NAV Effective Date typically represents the first day on which a third-party valuation was provided and fed the NAV

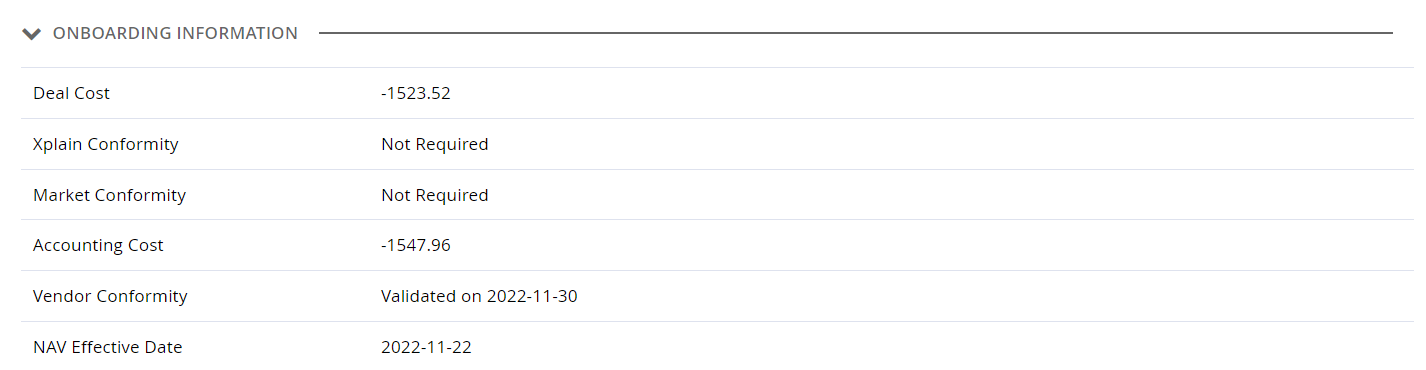

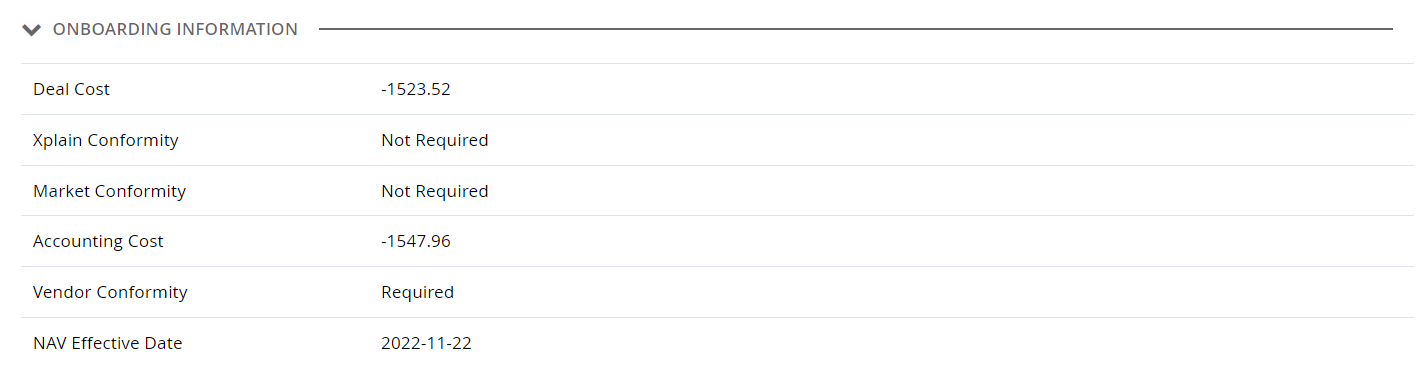

Trade onboarding settings, including onboarding test requirements and benchmark values (i.e. Deal Cost or Accounting Cost) will be flagged / defined at the trade level.

A description of a trade’s attributes related to onboarding and corresponding permissible values are set out in the table below.

| Field Name | Description | Permissible Values | TYPE |

|---|---|---|---|

| Deal Cost | Trade valuation at inception | Numeric | O |

| Xplain Conformity | Whether to compare Deal Cost to the Xplain PV calculated as at the trade date |

Boolean Default = "FALSE" | D |

| Market Conformity | Whether to compare Deal Cost to the Xplain PV calculated as at the trade date |

Boolean Default = "FALSE" | D |

| Accounting Cost | Trade accounting cost | Numeric | O |

| Vendor Conformity | Whether to compare Accounting Cost to the primary valuation data as at the NAV Effective Date |

Boolean Default = "FALSE" | D |

| NAV Effective Date | Date used for the Vendor Conformity onboarding test | YYYY-MM-DD (ISO 8601) | O |

Break Tests for Trade Onboarding

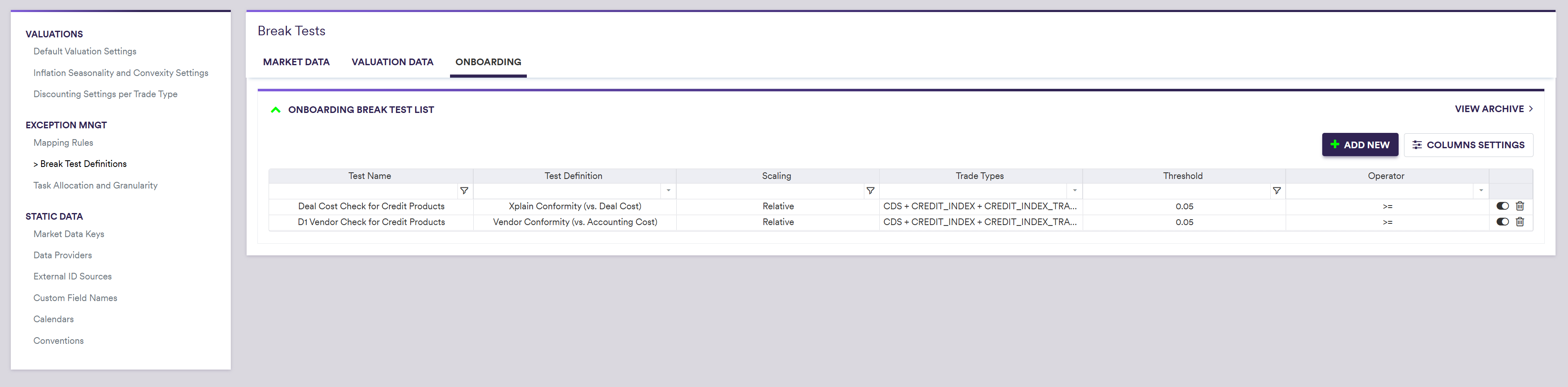

Trade Onboarding Break Test Definitions

Break test definitions for trade onboarding are described in the table below, with the following conventions:

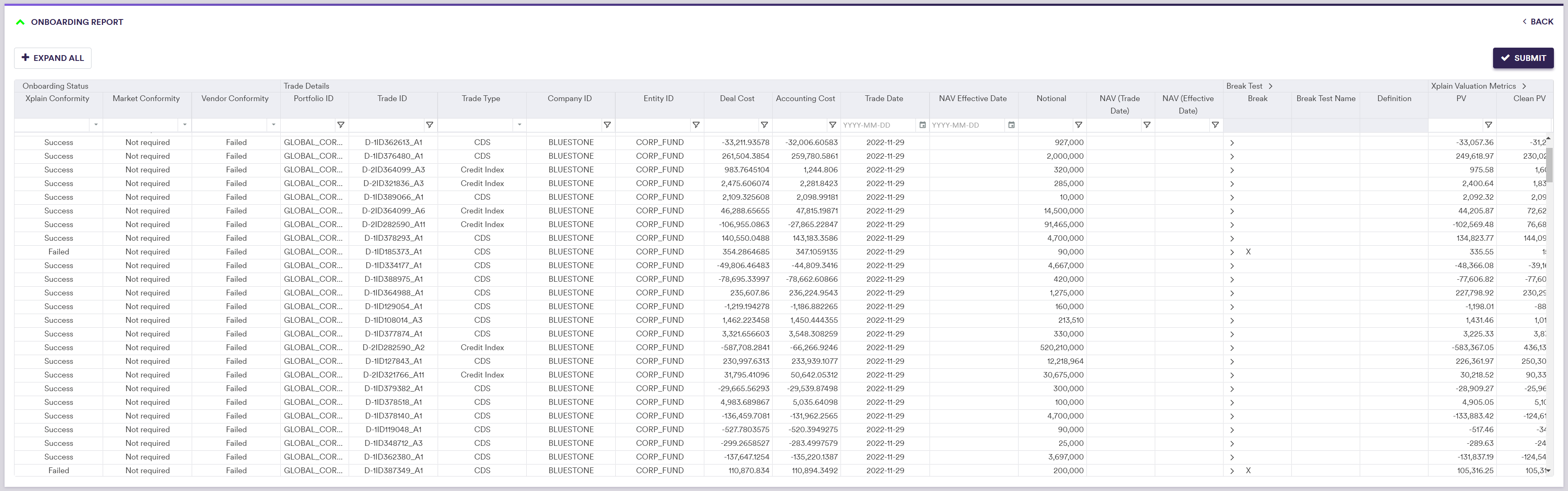

- PV(T0), 01(T0) and Vega(T0) are metrics calculated in Xplain as at the trade date, with 01 being the relevant delta according to the product type (e.g. CS01 for CDS)

- PV(t), 01(t) and Vega(t) are metrics provided by the Primary Valuation Data Provider as at the NAV Effective Date (see above)

| TEST DEFINITION | SCALING | TEST VALUE |

|---|---|---|

| Xplain Conformity (vs. Deal Cost) | Absolute Difference | Abs[Deal Cost - PV(T0)] |

| Xplain Conformity (vs. Deal Cost) | Relative Difference | Abs[(Deal Cost - PV(T0))/Deal Cost] |

| Xplain Conformity (vs. Deal Cost) | Greeks – 01 (*) | Abs[(Deal Cost - PV(T0))/01(T0)] |

| Xplain Conformity (vs. Deal Cost) | Greeks - 01 + Vega (*) | Abs[Deal Cost - PV(T0)]/[Abs(01(T0)) + Abs(Vega(T0)] |

| Xplain Conformity (vs. Deal Cost) | Greeks – Vega | Abs[(Deal Cost - PV(T0))/Vega(T0)] |

| Market Conformity (vs. Deal Cost) | Absolute Difference | Abs[Deal Cost - PV(T0)] |

| Market Conformity (vs. Deal Cost) | Relative Difference | Abs[(Deal Cost - PV(T0))/Deal Cost] |

| Market Conformity (vs. Deal Cost) | Greeks – 01 (*) | Abs[(Deal Cost - PV(T0))/01(T0)] |

| Market Conformity (vs. Deal Cost) | Greeks - 01 + Vega (*) | Abs[Deal Cost - PV(T0)]/[Abs(01(T0)) + Abs(Vega(T0)] |

| Market Conformity (vs. Deal Cost) | Greeks – Vega | Abs[(Deal Cost - PV(T0))/Vega(T0)] |

| Vendor Conformity (vs. Accounting Cost) | Absolute Difference | Abs[Accounting Cost - PV(t)] |

| Vendor Conformity (vs. Accounting Cost) | Relative Difference | Abs[(Accounting Cost - PV(t))/Accounting Cost] |

| Vendor Conformity (vs. Accounting Cost) | Greeks – 01 (*) | Abs[(Accounting Cost - PV(t))/01(t)] |

| Vendor Conformity (vs. Accounting Cost) | Greeks - 01 + Vega (*) | Abs[Accounting Cost - PV(t)]/[Abs(01(t)) + Abs(Vega(t)] |

| Vendor Conformity (vs. Accounting Cost) | Greeks – Vega | Abs[(Accounting Cost - PV(t))/Vega(t)] |

Under

| Field Name | Description | Permissible Values |

|---|---|---|

| Test Definition | The break test definition |

Xplain Conformity (vs. Deal Cost) Market Conformity (vs. Deal Cost) Vendor Conformity (vs. Accounting Cost) |

| Break Test Name | The name of the break test | Free text |

|

Company Entity Portfolio | A list of in-scope companies / entities / portfolios | Any existing Company ID / Entity ID / Portfolio ID |

| Trade Type | Test coverage per asset class / trade type |

RATES | Rates trade type(s) (e.g. "IRS") CREDIT | Credit trade type(s) (e.g. "CDS") FX | FX trade type(s) (e.g. "FX Forward") CUSTOM_RATES | Custom Rates 1 to 5 CUSTOM_FX | Custom FX 1 to 5 CUSTOM_COMMODITY | Custom Commodity 1 to 5 CUSTOM_EQUITY | Custom Equity 1 to 5 CUSTOM_CREDIT | Custom Credit 1 to 5 CUSTOM_OTHER | Custom Other 1 to 5 |

| Rates Currencies (*) | Currency granularity for Trade Type = "RATES" or any sub-category | Any permissible currency |

| Credit Sectors (*) | Sector granularity for Trade Type = "CREDIT" or any sub-category | See permissible credit sectors |

| FX Ccy Pairs (*) | FX pair granularity for Trade Type = "FX" or any sub-category | See fx rate rule |

| Scaling | The applicable scaling | See onboarding break test definitions |

| Threshold/Factor | Threshold value that will be compared to the test value | Numeric (positive) |

| Operator | Operator to apply between the test calculation result and the Threshold | > | >= |

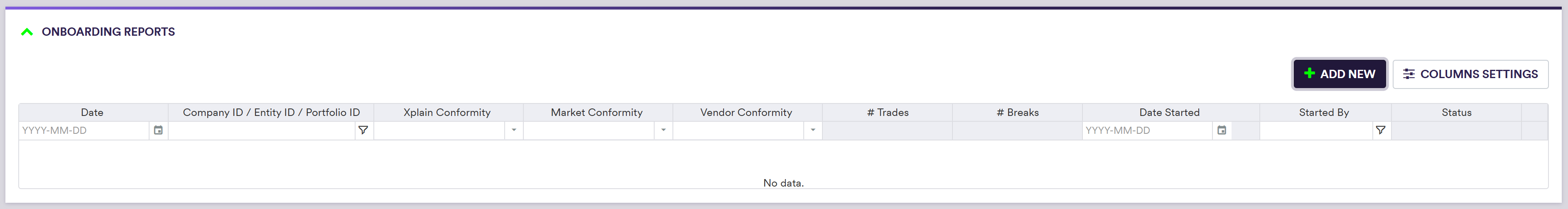

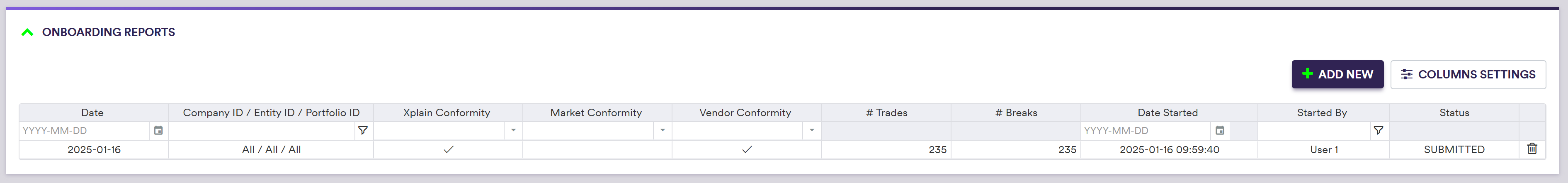

Trade Onboarding Workflow

The prerequisites are as follows:

For valuation data:

- define a pricing environment, if Xplain is the primary valuation data provider or if you want to perform Xplain Conformity or Market Conformity tests

- define valuation data sources and define the trades only otherwise

- upload (and optionally clean) raw market data and valuation data in the relevant data groups, as applicable

Trade onboarding settings:

- define the applicable onboarding break tests

- flag trades that need to be onboarded and define the relevant benchmarks

Trade onboarding break tests will be run on data selected according to the test’s scope granularity settings.

Under

Once a report is submitted, if a trade has passed a requested onboarding test (i.e. Onboarding Status = “SUCCESS”), the relevant trade attribute marking the onboarding requirement (e.g. Xplain Conformity) will be set back to FALSE, as well as a confirmation of onboarding with the date of validation:

(Vendor Conformity: Validated on yyyy-mm-dd)