Under

- run the XVA calculation process (and exposures, if applicable)

- save, slice and dice PV and XVA calculation results

- compare saved PV calculation results for a given portfolio (e.g. day-on-day or using different valuation settings) (see Valuations)

Running XVA Calculations

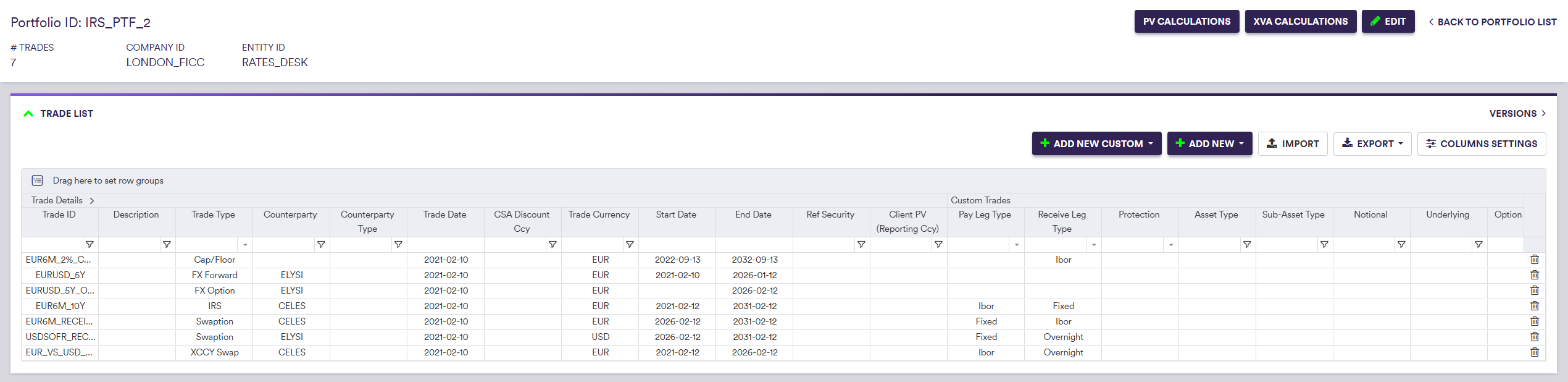

Once you have added relevant funding nodes, defined a curve configuration, a market data environment, a portfolio, the applicable valuation settings and the XVA model parameterisation, the XVA calculation interface can be accessed i) at the portfolio level under

Prior to valuing a portfolio and performing XVA calculations, you will need to:

- set the valuation parameters (see Valuations)

- apply curve shifts, if any (see Valuations)

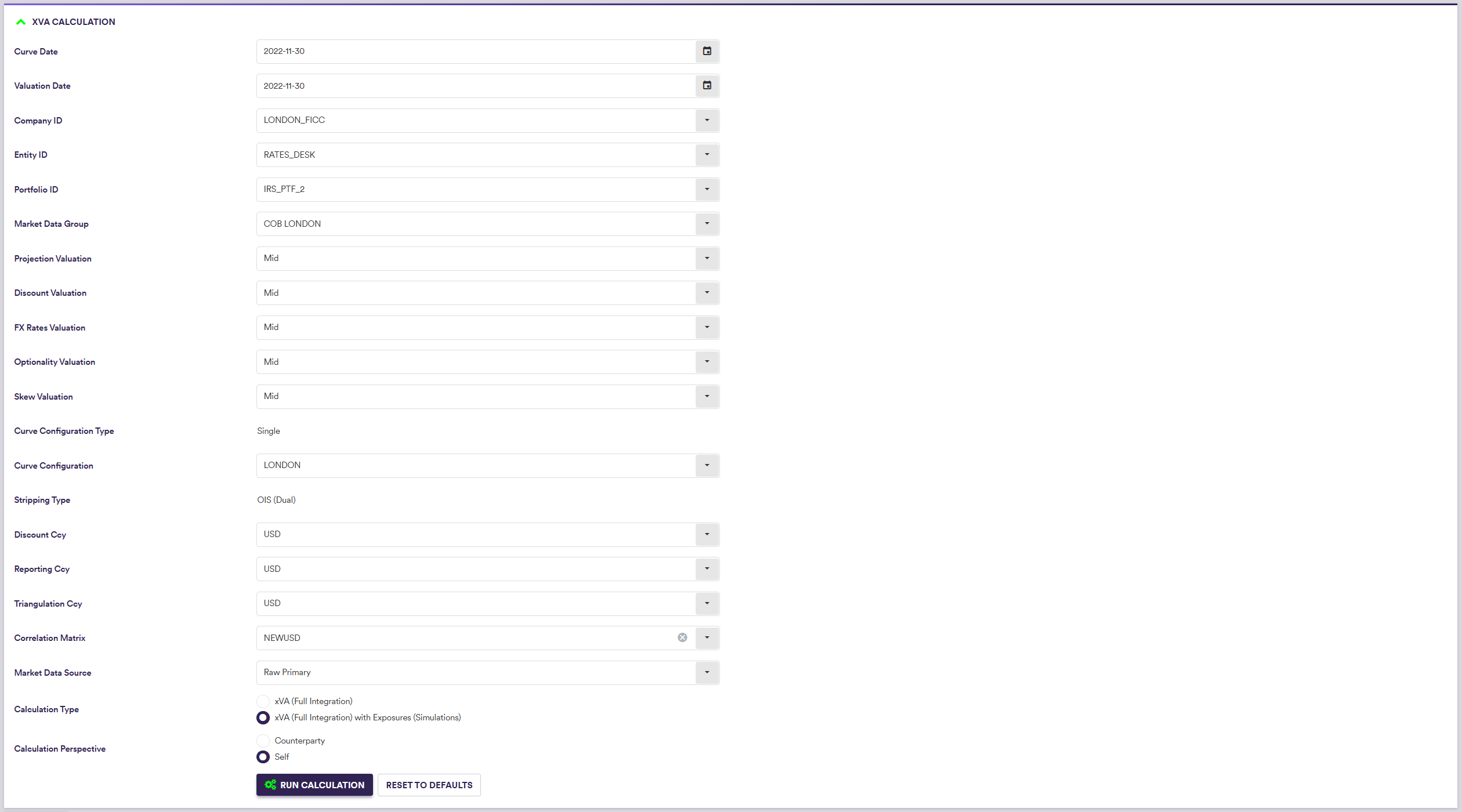

- set the XVA calculation parameters

A description of the settings specific to XVA calculations and corresponding permissible values are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Correlation Matrix | The matrix of correlations between underlying IR rates and FX rates | See correlation matrices |

| Calculation Type | XVA calculations only or with simulated underlying exposure calculations |

xVA (Full Integration) xVA (Full Integration) with Exposures (Simulations) |

| Calculation Perspective | XVA calculations can be performed from the standard or the counterparty's perspective | Counterparty | Self |

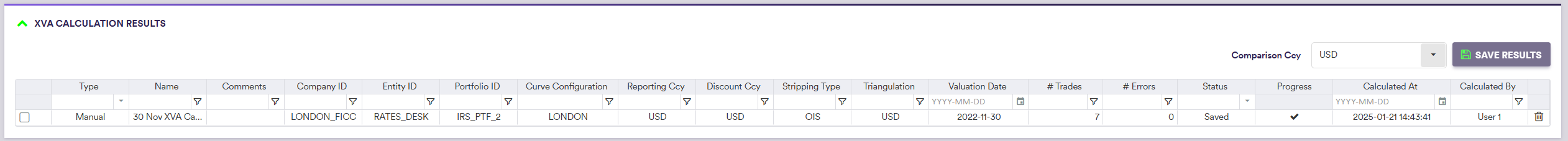

XVA Calculation Results

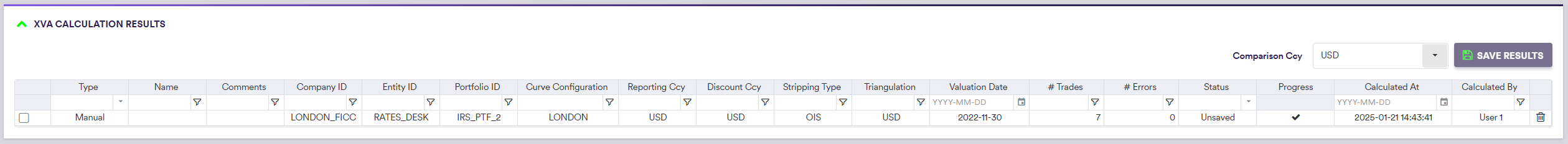

Once a portfolio (and XVA) has been valued (after clicking on

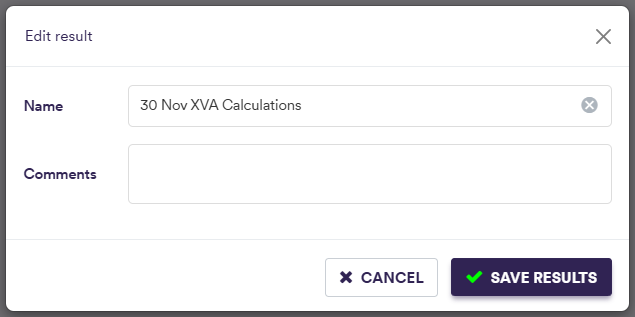

You can save the selected XVA calculation results by clicking on

At the XVA calculation results level (by double-clicking on the line item), the various valuation outputs are:

- trade PV, T0 cashflows and greeks on a trade basis (see Valuations)

- portfolio metrics (cashflows and bucketed greeks) (see Valuations)

- option expiry heatmaps (swaptions and FX options) (see Valuations)

- graphs of calibrated curves used in the valuation process (see Valuations)

- message log of events that were recorded during the valuation process (see Valuations)

In addition, the XVA calculations outputs are:

- XVA calculations and corresponding exposure profiles (if applicable) on a counterparty basis

- underlying exposure simulation results

After saving, XVA valuation results will also be accessible on a trade level in the trade valuation history screen (see Trade Valuation History).

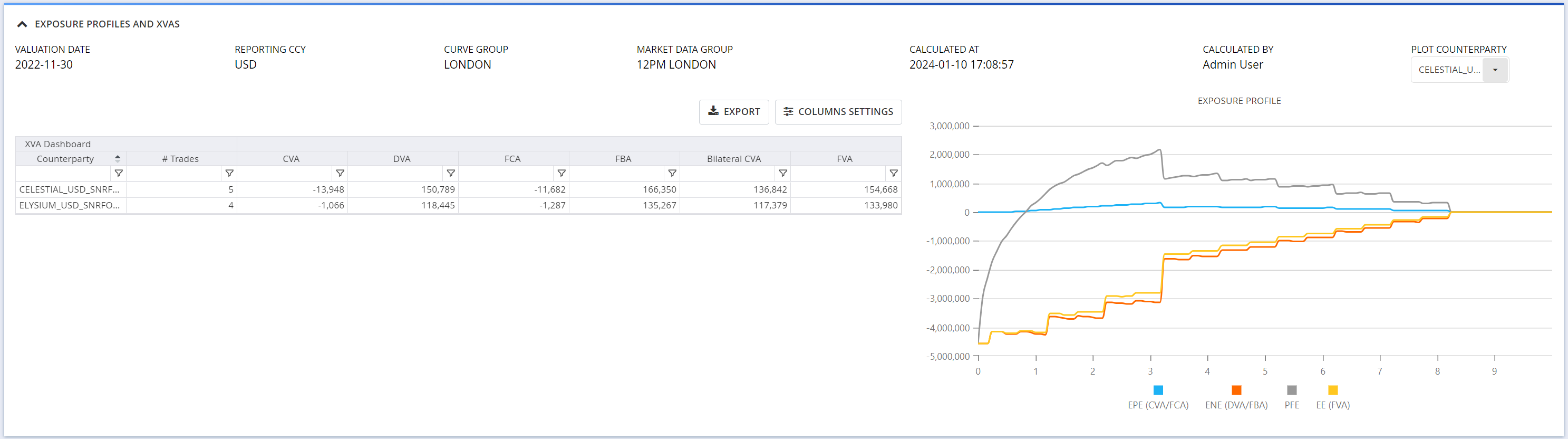

1. XVA Calculation Results on a Counterparty Basis

In the ‘Exposure Profiles And XVAs’ window, you can view, filter and export XVA calculation results on a counterparty basis.

If the XVA calculations have been performed to include exposure simulations, EPE, ENE, PFE and EE per counterparty will be plotted on the right hand side.

A description of the XVA calculation result outputs is set out in the table below.

| Field Name | Description |

|---|---|

| Counterparty | The counterparty credit curve reference |

| # Trades | The number of trades with the Counterparty |

| CVA | Credit value adjustment expressed in the Reporting Ccy |

| DVA | Debit value adjustment expressed in the Reporting Ccy |

| FCA | Funding cost adjustment expressed in the Reporting Ccy |

| FBA | Funding benefit adjustment expressed in the Reporting Ccy |

| Bilateral CVA | CVA + DVA |

| FVA | Funding valuation adjustment expressed in the Reporting Ccy |

2. Exposure Simulation Results

In the ‘Exposures’ window, when applicable, you can see and export exposure simulation results on a counterparty basis.

A description of the simulation result outputs is set out in the table below.

| Field Name | Description |

|---|---|

| Time (Y) | The date as of which the exposure is calculated (expressed in year from the valuation date) |

| Date | The date as of which the exposure is calculated |

| EPE (CVA/FCA) | The expected positive exposure for the selected counterparty, used to calculate CVA and FCA |

| ENE (DVA/FBA) | The expected negative exposure for the selected counterparty, used to calculate DVA and FBA |

| PFE | The potential future exposure for the selected counterparty |

| EE (FVA) | The expected exposure for the selected counterparty, used to calculate FVA |