Once a company and entity have been created, the two steps required to define a non-MTM portfolio of TRS trades are as follows:

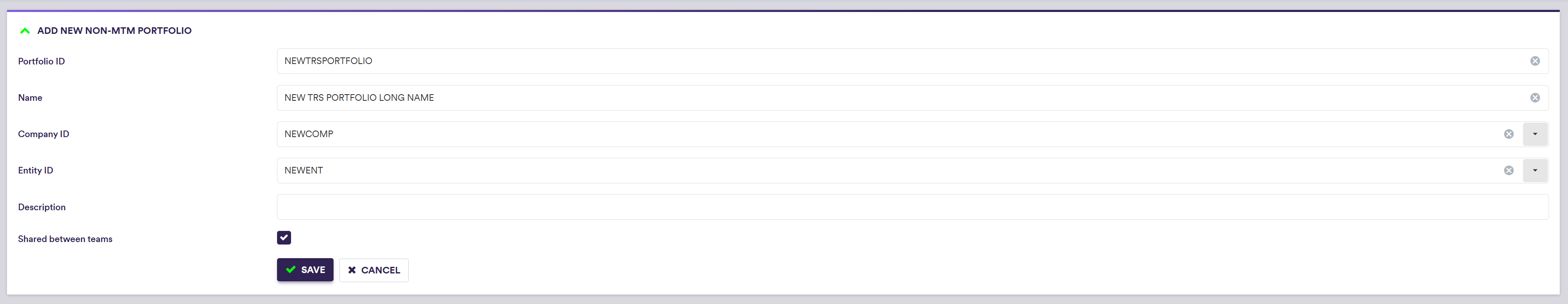

1. Creating a non-MTM Portfolio

Under

A description of a non-MTM portfolio’s attributes and corresponding permissible values are set out in the table below.

| Field Name | Description | Permissible Values |

|---|---|---|

| Portfolio ID | The ID for the portfolio (immutable) | Free text (no spaces) |

| Name | The name of the portfolio | Free text |

| Company ID | The Company ID |

Any existing company See company configuration |

| Entity ID | The Entity ID |

Any existing entity See entity configuration |

| Description | Portfolio description | Free text |

| Shared Between Teams | Whether the portfolio will be accessible across all teams | Boolean |

| Teams |

The team(s) that will have access to the portfolios Applicable only if Shared between Teams = FALSE |

Any existing team(s) See creating a team |

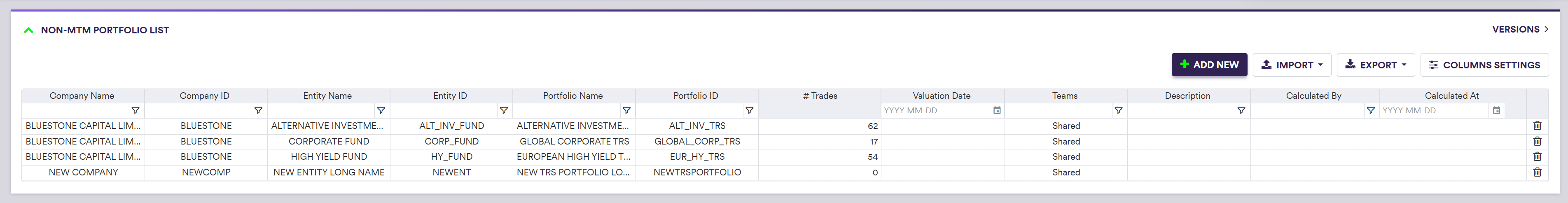

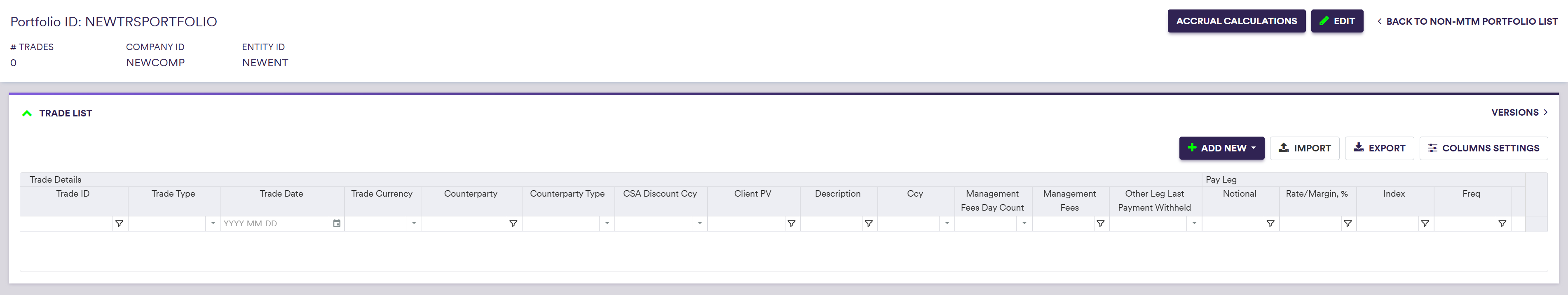

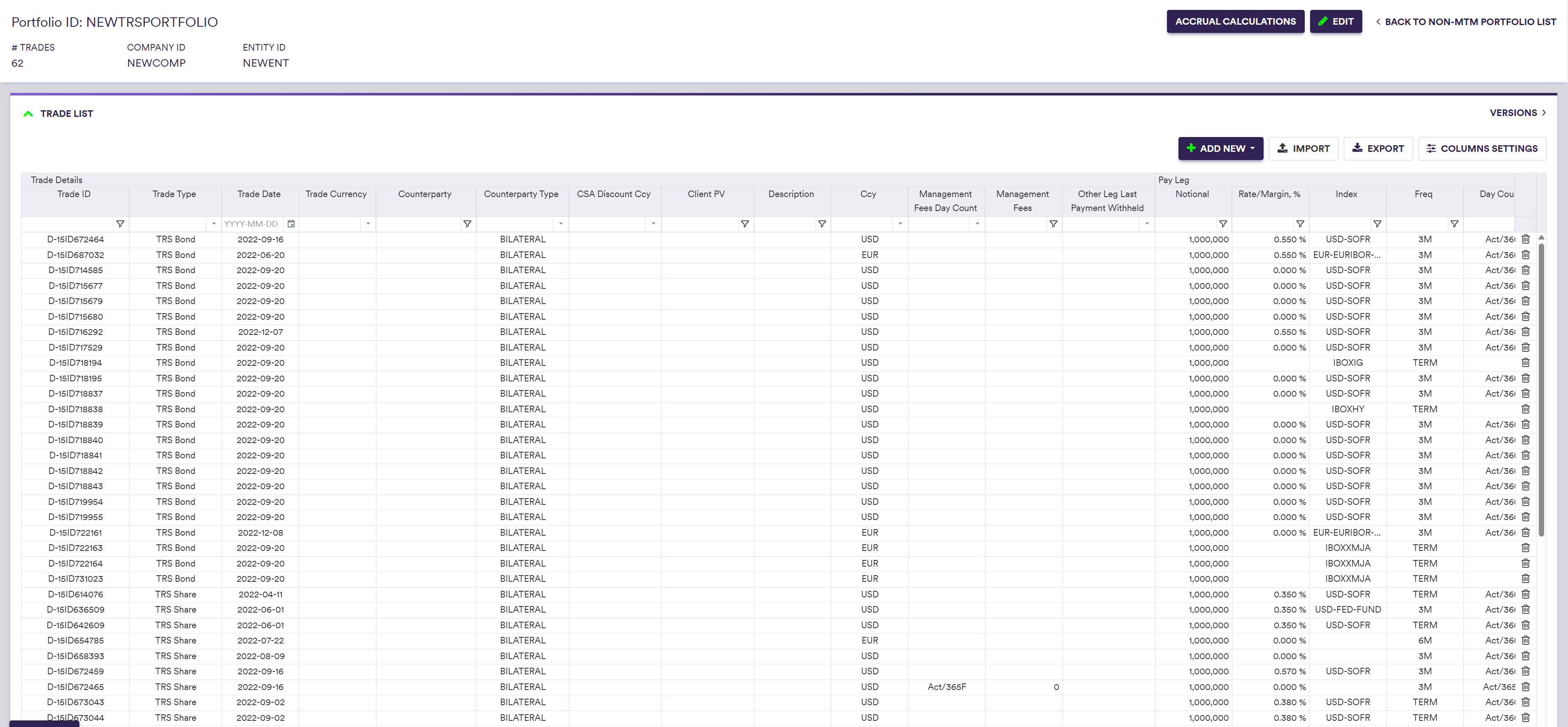

2. Adding TRS trades

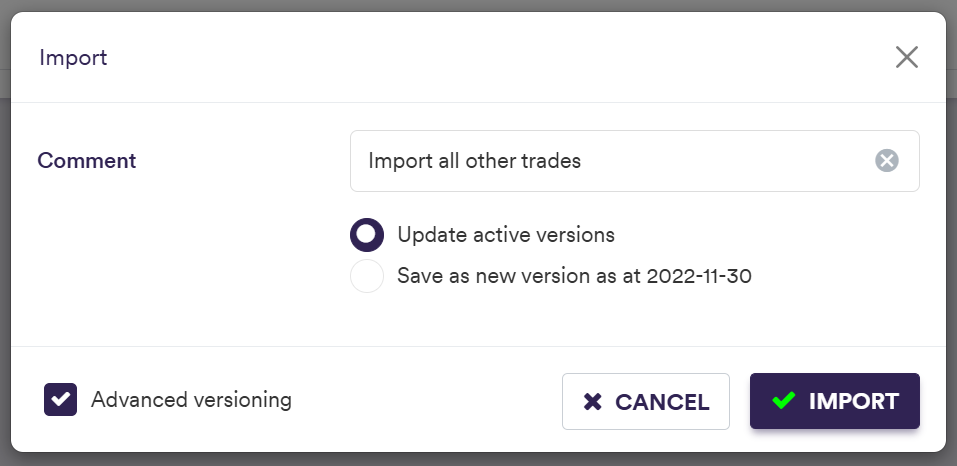

At the non-MTM portfolio level (or also globally at the non-MTM portfolio list level when importing), you can

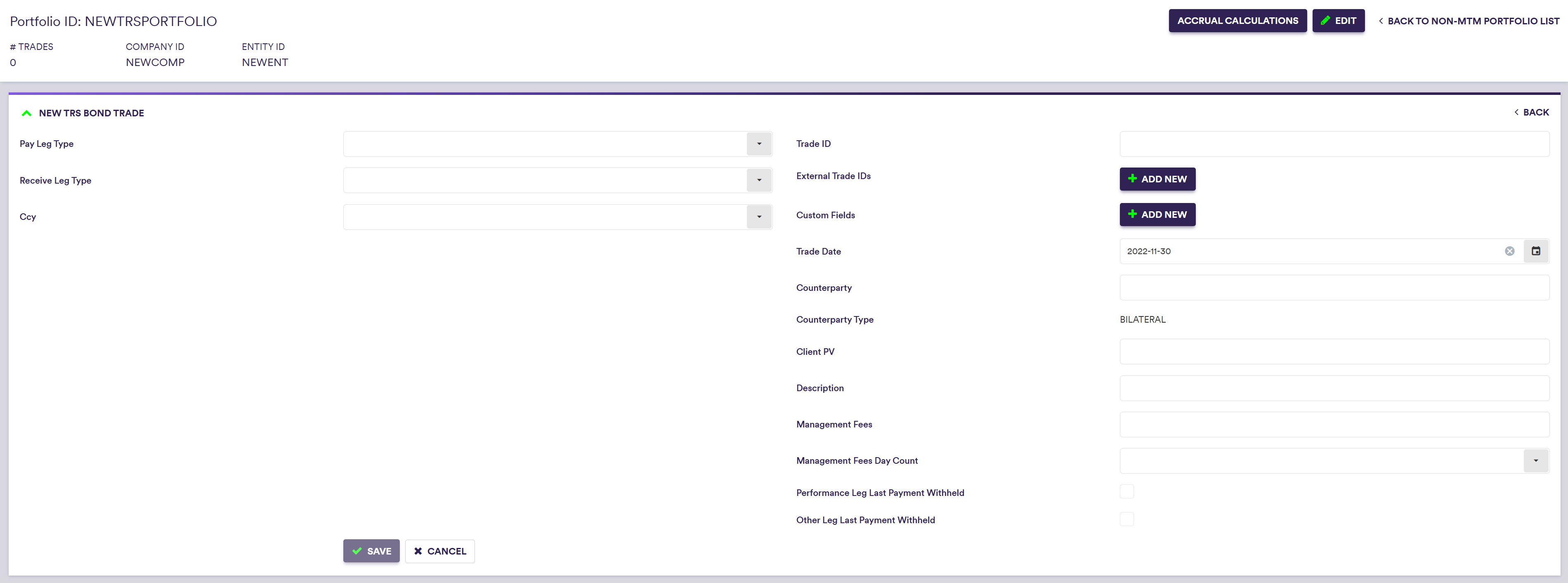

There are two types of TRS trades in Xplain: ‘TRS Bond’ (where the underlying index is a bond) and ‘TRS Share’ (where the underlying index is an equity index or a share).

A trade field will either be mandatory (M), optional (O), conditional (C) (i.e. mandatory upon a certain condition), optional with a default value (D) or harcoded in Xplain (H).

In addition to the generic fields that set out information about the trade, a TRS will have:

- Specific trade fields

- A funding leg (Overnight, Fixed or Ibor)

- A Performance Leg

A description of the funding leg’s attributes and corresponding permissible values are set out in the Portfolios and Trades Permissible Values section.

A description of the TRS specific trade’s attributes, performance leg and corresponding permissible values are set out in the tables below.

TRS

| Field Name | Description | Permissible Values | TYPE |

|---|---|---|---|

| Pay Leg Type | Pay Leg Type | Ibor | Overnight | Fixed | Performance | M |

| Receive Leg Type | Recieve Leg Type | Dependent on trade type and other leg | M |

| Ccy | Trade 3-letter ISO 4217 currency code | See Permissible Currencies | M |

| Management Fees | Management fees (with respect to the performance leg) | Numeric (+ve) | O |

| Management Fees Day Count | Management fees' day count | See Permissible Daycount Conventions | C |

| Performance Leg Last Payment Withheld | Performance leg last payment withheld? |

Boolean Default = FALSE | D |

| Funding Leg Last Payment Withheld | Funding leg last payment withheld? |

Boolean Default = FALSE | D |

Funding Leg

Additional to the fields applicable to trade legs defined in Portfolios and Trades Permissible Values, the following fields apply for the funding legs of TRS trades.

| LEG TYPE | Field Name | Description | Permissible Values | TYPE |

|---|---|---|---|---|

| Ibor | Initial Coupon | The value for the initial fixing rate used in ibor funding leg valuation | Numeric | O |

| Ibor | Accrual Offset Days | Leg accrual date offset (in business days) |

Integer (+ve) Default = 0 | D |

| Ibor | Ibor Fixing Calendar | Fixing business day calendar(s), separated by '+' | Default = Leg Calendar | D |

| Overnight | Accrual Offset Days | Leg accrual date offset (in business days) |

Integer (+ve) Default = 0 | D |

| Fixed | Accrual Offset Days | Leg accrual date offset (in business days) |

Integer (+ve) Default = 0 | D |

| Overnight | Overnight Fixing Offset Days | Index fixing date offset (in business days) |

Integer Default = 0 | D |

Performance Leg

| Field Name | Description | Permissible Values | TYPE |

|---|---|---|---|

| Notional | Leg notional | Numeric | M |

| Accrual Freq | Frequency of leg accrual dates | See Permissible Frequencies | M |

| Payment Freq | Frequency of leg payment dates | See Permissible Frequencies | M |

| Payment Offset Days | Leg payment date offset (in business days) |

Integer Default = 0 | D |

| Compounding Method | Leg compounding method |

See Permissible Compounding Methods Only applicable if AccrualFreq <> PaymentFreq Default = "None" | D |

| Accrual Offset Days | Leg accrual date offset (in business days) |

Integer (+ve) Default = 0 | D |

| TRS Index | TRS index | Any existing TRS index | M |

| TRS Index Type | TRS index type |

Hardcoded based on trade type BOND | SHARE | H |

| TRS Index Fixing Offset Days | Index fixing date offset (in business days) |

Negative Integer Default = 0 | D |

| TRS Index Fixing Calendar | Fixing business day calendar(s), separated by "+" | See Permissible Calendars | D |

| Initial Base Index | The value for the initial index used in performance leg valuation | Numeric | D |

| Dividend Payout | Dividend payable for share index |

Numeric (+ve) For Trade Type = ""TRS_SHARE"" Default = 0 | C |

| Identifier | Leg Identifier | Leg Identifier for individual legs, must be unique | O |