Net currency exposure refers to the total amount of risk you may have in a particular currency. This is calculated by:

- aggregating currency exposure cashflows: Summing up all the cashflows (inflows and outflows) in a specific currency over a certain period.

- against hedge FX trades: Comparing these cashflows to the notional amounts of FX hedge trades that are meant to offset the currency risk.

So, net currency exposure is essentially the difference between the cashflows in a given currency and the hedging trades in that same currency over a specified time horizon.

You will first need to define the currency exposure cashflows that you will want to aggregate subsequently with your hedge FX trades. For more details, please refer to the Net Currency Exposure page.

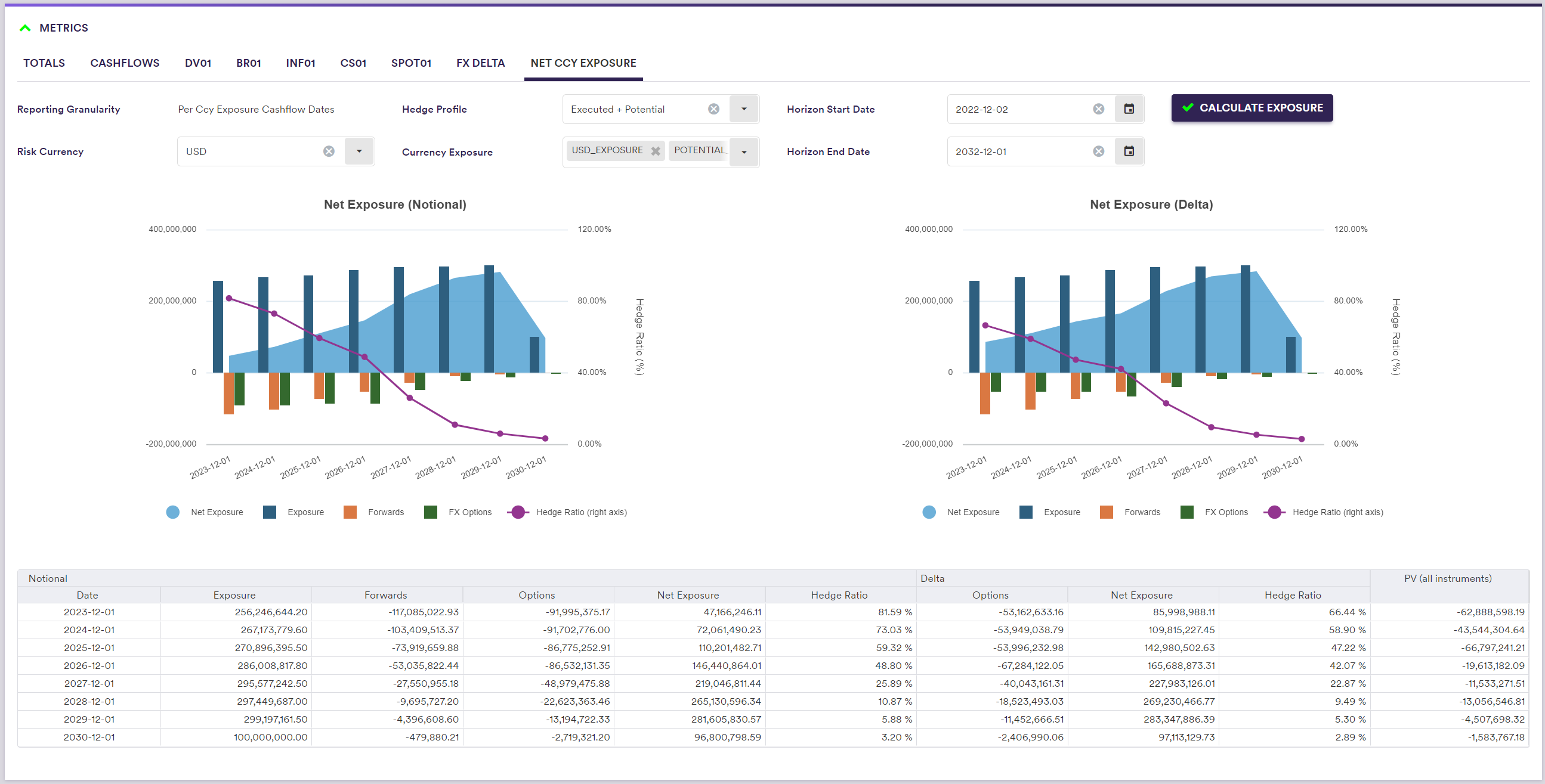

On this page, we will discuss how to calculate and view net currency exposure. Following a portfolio’s PV calculation, you can calculate two types of net currency exposures in Xplain, one based upon unadjusted notionals of FX options (call, put and collars) and one based on delta adjusted option notionals (i.e. weighted by the likelihood of exercise), with the same unadjusted values for FX forwards and FX swaps in both calculations. The hedge trades will be considered on a portfolio basis (or on selected trades).

As pricing environment, you can use the predefined ‘XPLAIN Default’ curve configuration, ‘EUR_HY_PTF’ portfolio and ‘3PM LONDON’ market data group.

Net Currency Exposure Calculation

Under

Once the aggregation parameters are defined, click on

(*) On a trade basis, the trade attribute Custom Field.POTENTIAL_HEDGE will determine the relevance of a trade:

- if FALSE, the trade will be treated as an executed hedge

- if TRUE, the trade will be treated as a potential hedge

- otherwise, if set to any other value, the trade will be ignored

For example, you can use the predefined ‘USD_EXPOSURE’ and ‘POTENTIAL_USD_EXPOSURE’ currency exposure, and consider both existing and potential FX hedges as your Hedge Profile.

| Field Name | Description | Permissible Values |

|---|---|---|

| Risk Currency | The exposure currency |

Any currency in FX Cat A and FX Cat B See FX Rate Rule |

| Reporting Granularity | Aggregation schedule between Horizon Start Date and Horizon End Date | Explicitly determined by the selected currency exposure cashflow dates |

| Currency Exposure | The currency exposure(s) comprising the expected future cashflows | Any currency exposure(s) whose currency is the Risk Currency |

| Hedge Profile |

Hedges to be included in the net currency exposure calculation. If Hedge Profile = "Executed Only", only trades with Custom Field.POTENTIAL_HEDGE set to FALSE will be accounted for. If Hedge Profile = "Executed + Potential", trades with Custom Field.POTENTIAL_HEDGE set to TRUE or FALSE will be accounted for. Trades with Custom Field.POTENTIAL_HEDGE set to any other values will be ignored. | Executed Only | Executed + Potential |

| Horizon Start Date | The cut-off date for the first currency exposure cashflow date | YYYY-MM-DD (ISO 8601) |

| Horizon End Date | The cut-off date for the last currency exposure cashflow date | YYYY-MM-DD (ISO 8601) |

BLUESTONE/HY_FUND/EUR_HY_PTF default valuation settings

A description of the net currency exposure outputs is set out in the table below.

| Category | Field name | Description |

|---|---|---|

| Notional | Date | Cashflows between the previous Date (or Horizon Start Date) to this Date (included) will be taken into account |

| Notional | Exposure | Aggregated expected future cashflows in the relevant period |

| Notional | Forwards | Aggregated FX forward notionals in the Risk Currency in the relevant period (+ve if received, -<e if paid) |

| Notional | Options | Aggregated FX options notionals in the Risk Currency in the relevant period (+ve if received, -<e if paid) |

| Notional | Net Exposure | Net Exposure, Forwards and Options amounts in the relevant period |

| Notional | Hedge Ratio | Sum of Forwards and Options amounts divided by Net Exposure in the relevant period |

| Delta | Date | See above |

| Delta | Exposure | See above |

| Delta | Forwards | See above |

| Delta | Options | See above, with delta adjusted FX option notional amounts |

| Delta | Net Exposure | See above, with delta adjusted FX option notional amounts |

| Delta | Hedge Ratio | See above, with delta adjusted FX option notional amounts |