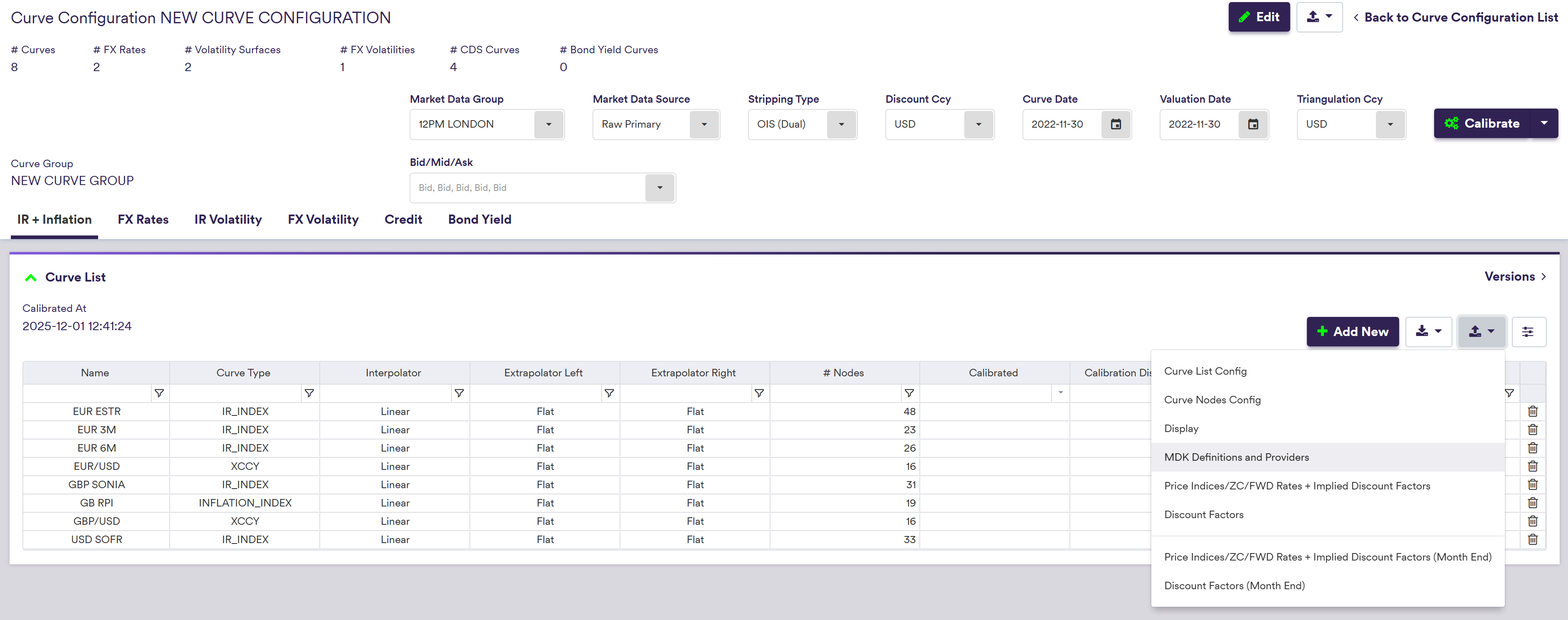

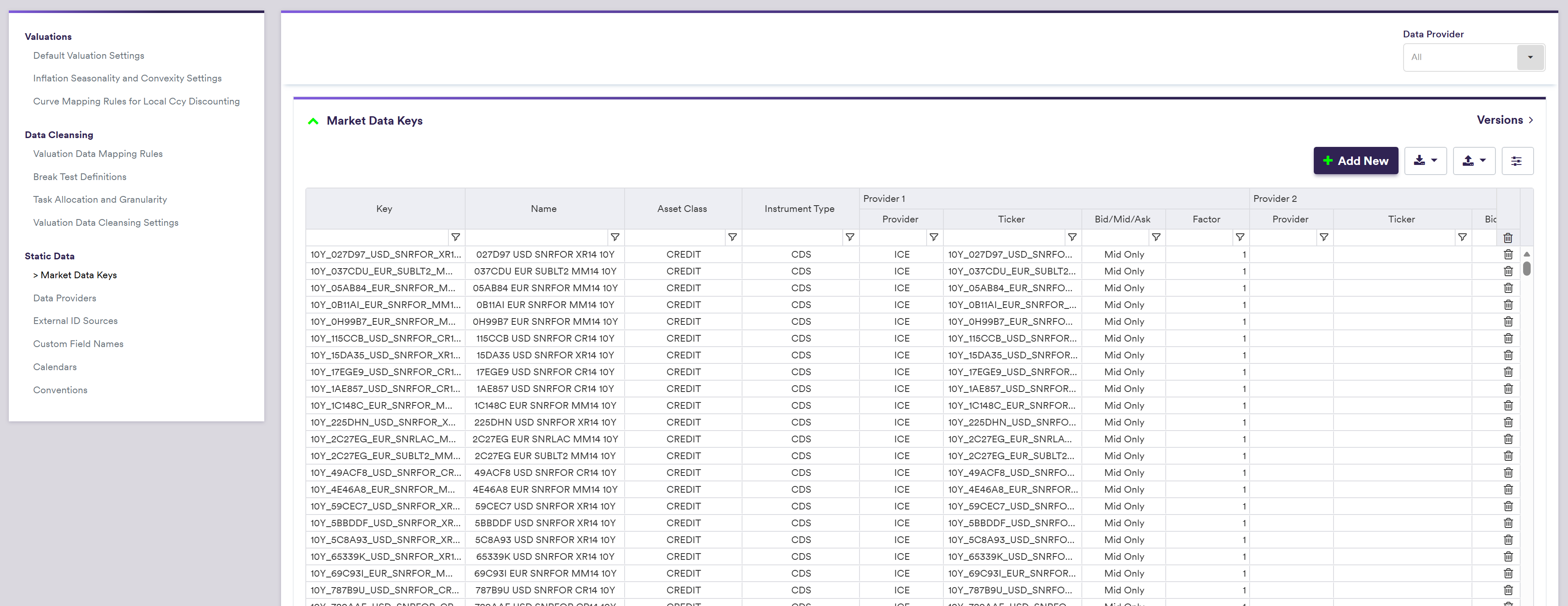

For each curve node and volatility point, Xplain automatically generates a unique identifier, referred to as a market data key (MDK), which is derived from the instrument’s characteristics (e.g. tenor) and the underlying index convention. MDKs can be viewed or exported at the curve group level or, when in edit mode, at the curve configuration level. For more detail, you can refer to the MDK Naming Convention section below.

Market data keys will be used to map historical market data to the relevant instrument.

The two steps required to define an MDK are as follows:

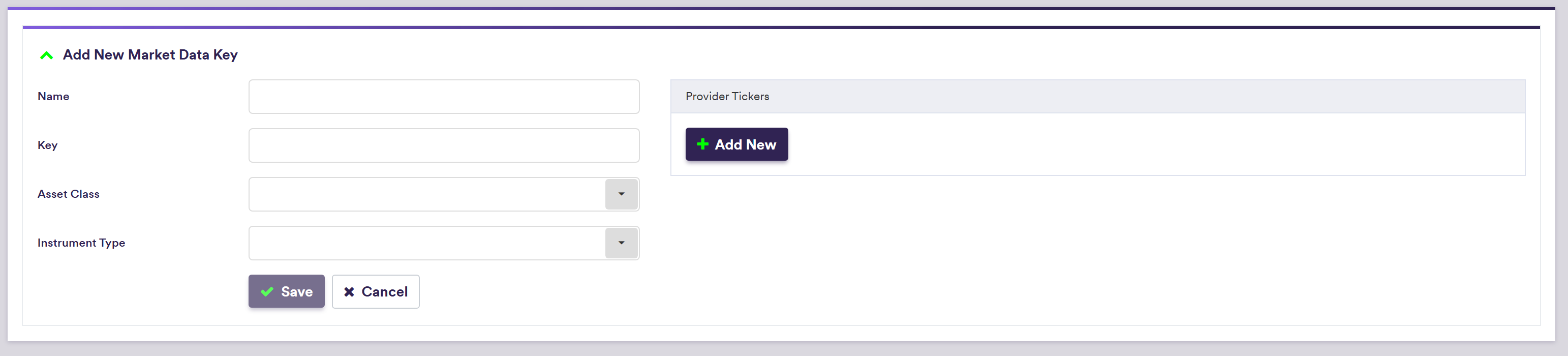

1. Creating an MDK

Under

A description of an MDK’s attributes and corresponding permissible values are set out in the table below:

| Field Name | Description | Permissible Values |

|---|---|---|

| Key | The MDK | See MDK overview |

| Name | The MDK’s long name or description | Free text |

| Asset Class | The MDK’s broad classification | RATES | FX | CREDIT |

| Instrument Type | The MDK’s instrument type | See MDK Overview below |

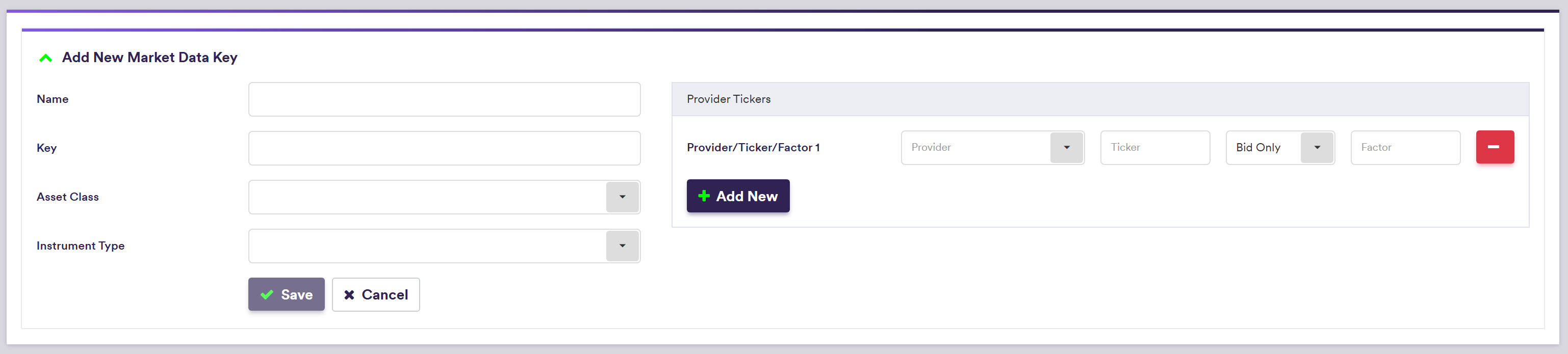

2. Mapping an MDK to a Provider/Ticker

Under

A description of an MDK’s attributes and corresponding permissible values are set out in the table below:

| Field Name | Description | Permissible Values |

|---|---|---|

| Key | The MDK | See MDK overview |

| Provider | The raw market data's provider for that MDK | Any existing market data provider |

| Ticker | The provider's ticker for that MDK | Any (e.g. EUSW10Y) |

| Bid/Mid/Ask | Whether the relevant provider provides bid, mid or ask data only, or both bid/ask data | Bid only | Mid Only | Ask only | Bid/Ask |

| Factor | The MDK's normalisation factor | Numeric (e.g. 100 if expressed as percentage) |

MDK Naming Convention

MDK are automatically generated by Xplain for each curve node and volatility point. MDK are derived from the instrument’s characteristics and the underlying index convention, as set out in the tables below:

For an IR and inflation curve node: MDK = Instrument & “” & _Convention, where Instrument is defined on a curve type basis as set out in the table below.

| Curve Type | Instrument Type (*) | Instrument | MDK Example | |

|---|---|---|---|---|

| IR_INDEX | FixedIborSwap | Tenor | e.g. 5Y_USD-FIXED-6M-LIBOR-3M | |

| IR_INDEX | FixedOvernightSwap | Tenor | e.g. 5Y_USD-FIXED-1Y-FED-FUND-OIS | |

| IR_INDEX | ForwardRateAgreement | FRA Settlement & "x" & Tenor + FRA Settlement | e.g. 1Mx7M_GBP-LIBOR-6M | |

| IR_INDEX | IborFuture | Serial Future | e.g. 2D+1_USD-LIBOR-3M-IMM-CME | |

| IR_INDEX/INDEX_BASIS | IborFixingDeposit | Tenor | e.g. 3M_USD-LIBOR-3M | |

| IR_INDEX/INDEX_BASIS | TermDeposit | Tenor | e.g. 3M_AUD-DEPOSIT-T0 | |

| INDEX_BASIS | IborIborSwap | Tenor | e.g. 5Y_USD-LIBOR-1M-LIBOR-3M | |

| INDEX_BASIS | OvernightIborBasisSwap | Tenor | e.g. 5Y_CAD-CORRA-OIS-6M-CDOR-3M | |

| INFLATION_INDEX | FixedInflationSwap | Tenor | e.g. 5Y_GBP-FIXED-ZC-GB-RPI | |

| XCCY_BASIS | XCcyIborIborSwap | Tenor | e.g. 5Y_GBP-LIBOR-3M-USD-LIBOR-3M | |

| XCCY_BASIS | XCCYOvernightOvernightSwap | Tenor | e.g. 5Y_EUR-ESTR-USD-SOFR | |

| XCCY_BASIS | XCCYIborOvernightSwap | Tenor | e.g. 5Y_EUR-EURIBOR-3M-USD-SOFR-OIS | |

| FX_SWAP | FxSwap | Tenor | e.g. 2Y_GBP/USD |

| IR Volatility Point Type | MDK Definition | MDK Example |

|---|---|---|

| Swaption ATM | Expiry & “v” & Tenor & “_” & “ATM” & “_” & Index | 3Yv10Y_ATM_EUR-EURIBOR-6M |

| Swaption Skew - Moneyness | Expiry & “v” & Tenor &“_”& Moneyness & “_” & Index | 3Yv10Y_+100_EUR-EURIBOR-6M |

| Swaption Skew - Absolute Strike | Expiry & “v” & Tenor & “_” & Strike & “_” & Index | 3Yv10Y_2%_EUR-EURIBOR-6M |

| Cap/Floor Strike | Maturity & “_” & Strike & “CF” & Index | 3Y_-0.50%_CF_EUR-EURIBOR-6M |

| FX Volatility Point Type | MDK Definition | MDK Example |

|---|---|---|

| ATM | CcyPair & “V” & Tenor | 3M_GBP/USDV |

| Skew Risk Reversal 1 | CcyPair & Delta 1 & “R” & Expiry | 1M_GBP/USD10R |

| Skew Butterfly 1 | CcyPair & Delta 1 & “B” & Expiry | 1M_GBP/USD10B |

| Skew Risk Reversal 2 | CcyPair & Delta 2 & “R” & Expiry | 1M_GBP/USD25R |

| Skew Butterfly 2 | CcyPair & Delta 2 & “B” & Expiry | 1M_GBP/USD25B |

| Credit Node Type | MDK Definition(*) | MDK Example |

|---|---|---|

| QUOTED_SPREAD or PAR_SPREAD | Tenor & "_" & CurveID & "_SPREAD" | 5Y_GS_USD_SNRFOR_CR_SPREAD |

| POINTS_UPFRONT | Tenor & "_" & CurveID & "_UF" | 5Y_CDXNA_USD_UF |

| FUNDING | Tenor & "_" & CurveID & "_FUNDING" | 5Y_GS_USD_FUNDING |

| Instrument Type | MDK Definition | MDK Example |

|---|---|---|

| BondYield | MaturityDate ("DDMMMYYYY") & "_" & Cusip | 06MAR2023_BY690737 |

| Node Type | MDK Definition | MDK Example |

|---|---|---|

| FX Rate | Base Ccy & “/” & Counter Ccy | GBP/USD |

Note that under the