In preferences, under the

- Xplain Default valuation settings

- inflation seasonality and convexity settings, including inflation seasonality factors and interest rate future convexity adjustments

- local currency discounting settings;

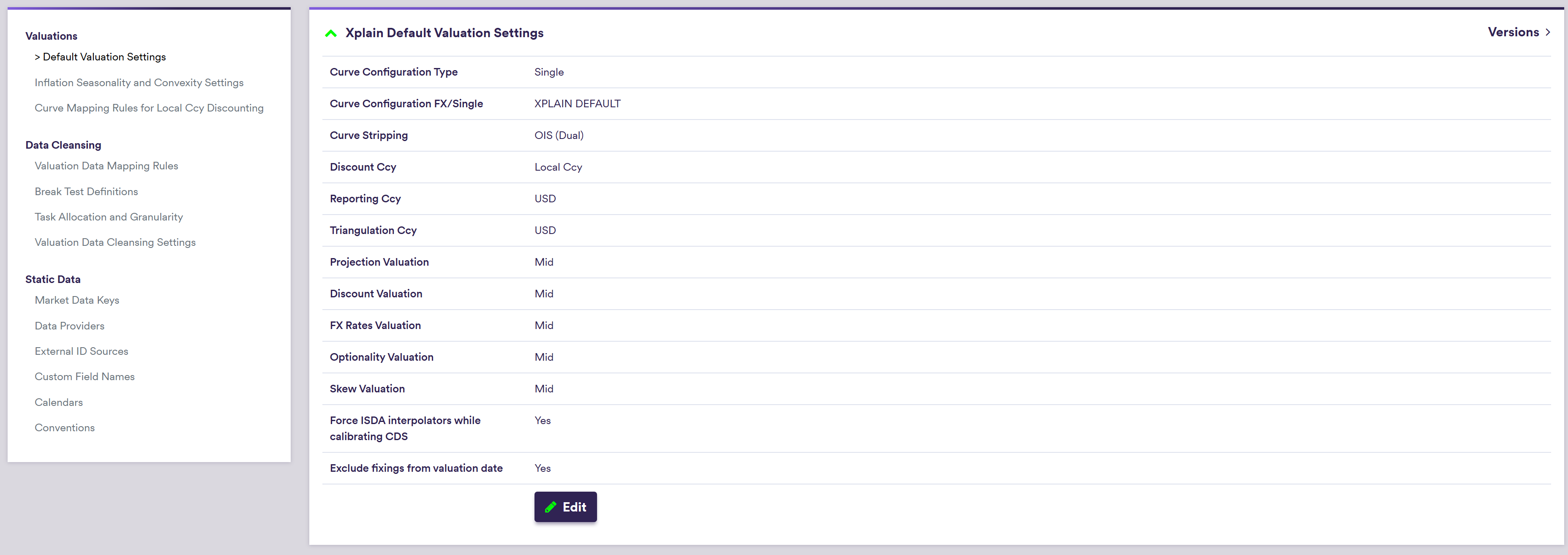

Xplain Default Valuation Settings

You can parameterise Xplain’s default valuation methodology by clicking on

Inflation Seasonality and Convexity Settings

Under

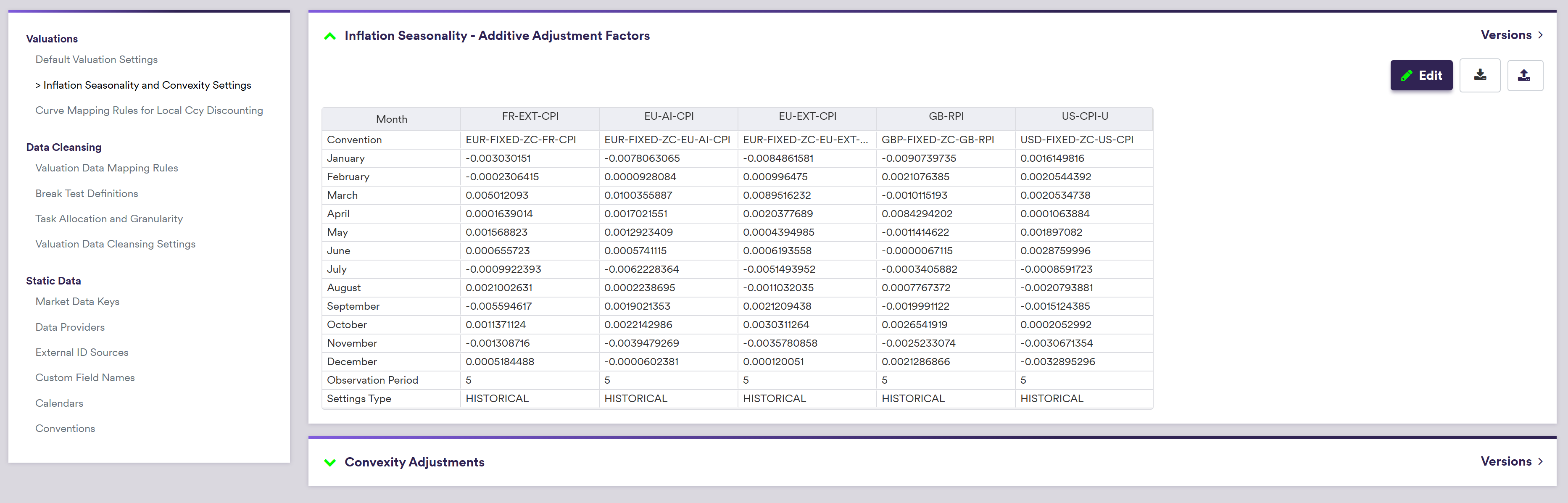

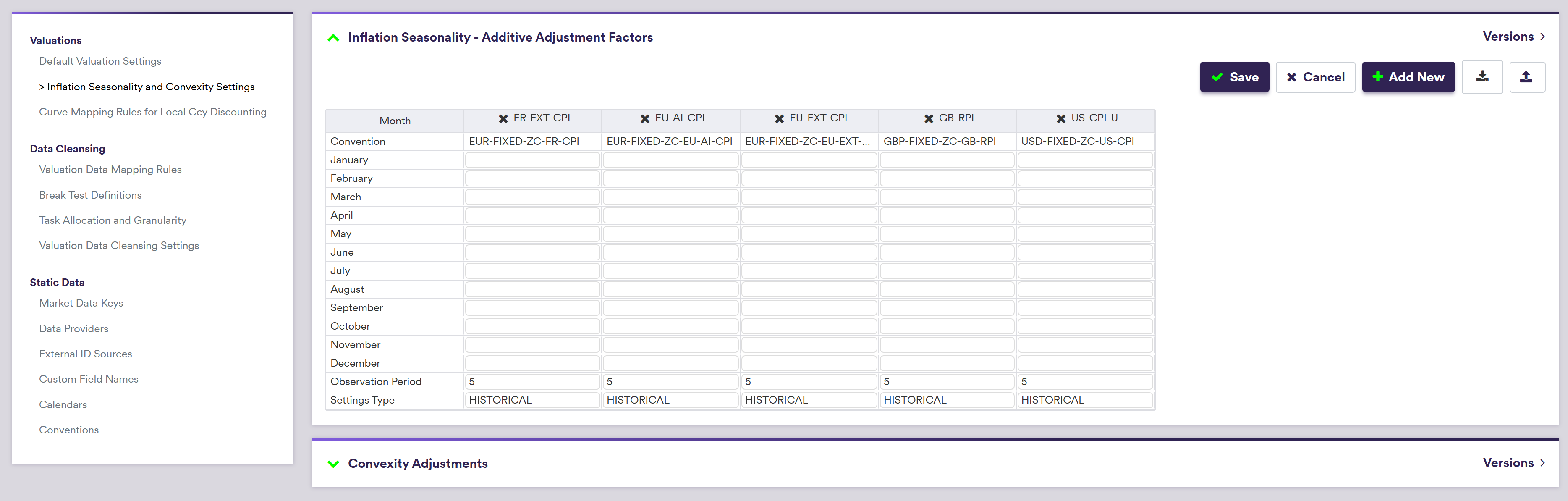

1. Inflation Seasonality Factors

You can

A description of the inflation seasonality factors’ attributes and corresponding permissible values are set out in the table below.

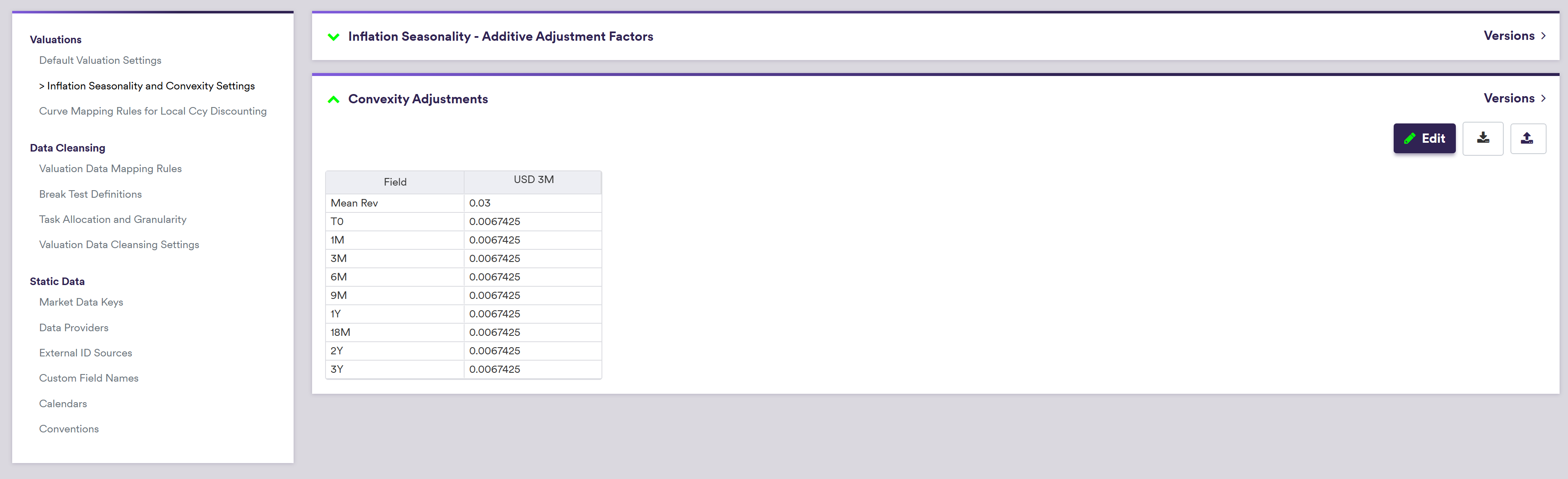

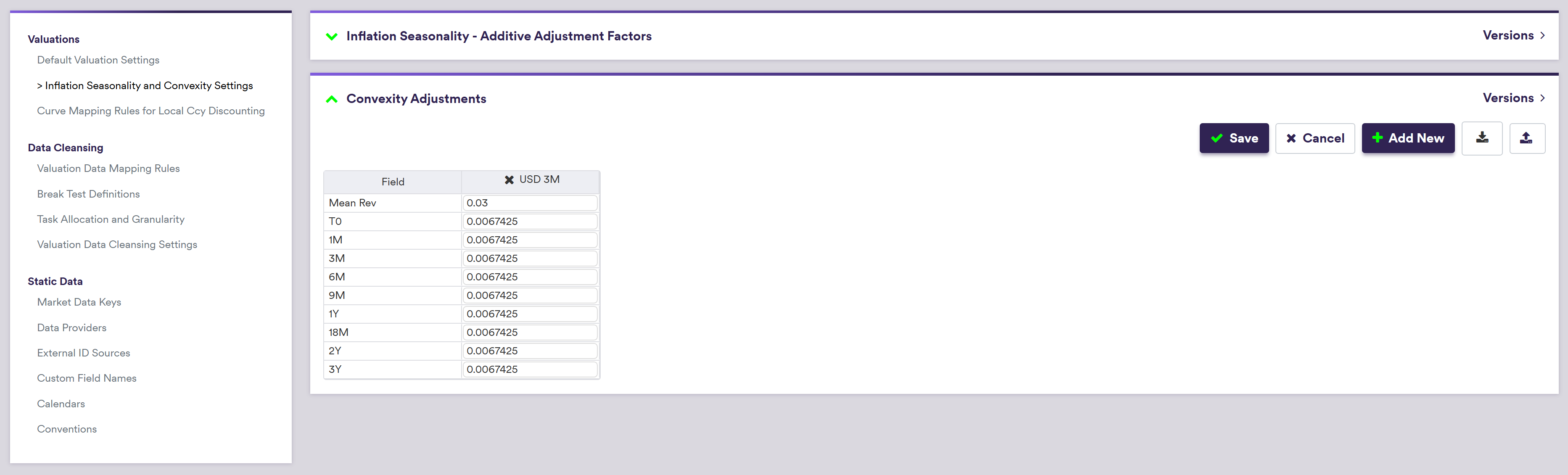

2. Future Convexity Adjustment

You can

A description of the future convexity adjustment factors’ attributes and corresponding permissible values are set out in the table below.

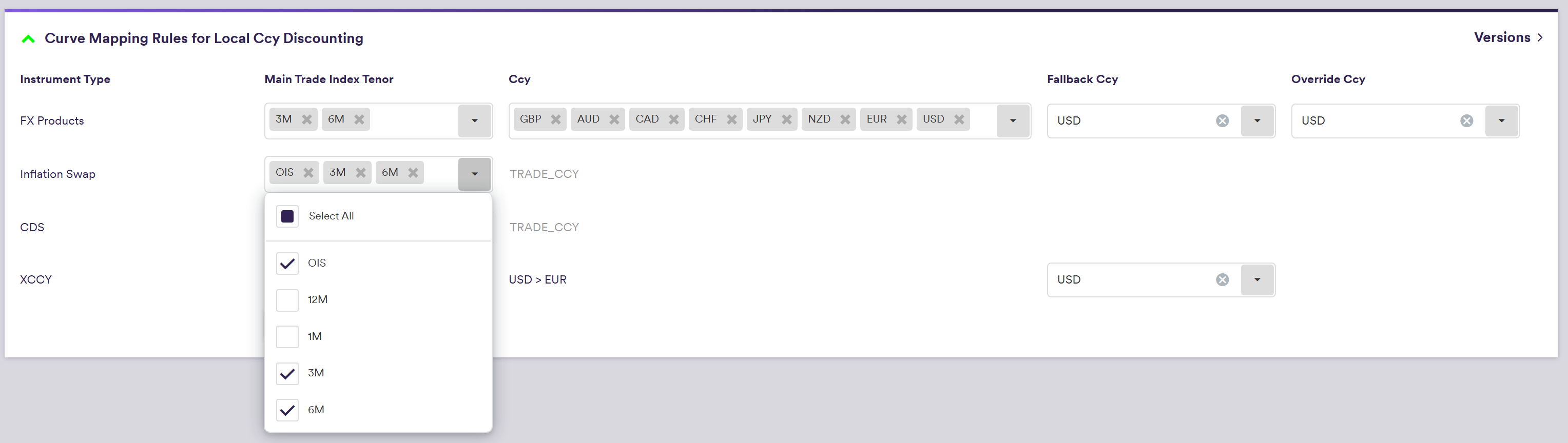

Discounting Settings per Trade Type

1. Trade Discount Currency per Instrument Type

When “Local Ccy” discounting is applied, the portfolio will be split into sub-portfolios of trades mapped to the same Discount Ccy.

For FX instruments, Xplain will use a user-defined pecking order to determine the discount currency, where applicable.

For XCCY, the trade and discount currency will be i) USD for a EUR vs. USD XCCY swap, if not ii) USD (or EUR) if one of the legs’ currency is USD (or EUR).

In all other cases, the Fallback Ccy will apply.

For FX products, if defined, the Override Ccy will prevail in all cases.

Unless Stripping Type is set to “SINGLE” (i.e. same projection and discounting curve), the default discount curve will be the OIS curve of such local currency.

2. Underlying index per Instrument Type

When there is no OIS curve for a given currency, the portfolio will be further split according to the trade’s underlying index, and such index curve will then be used for discounting.

However, when the instrument type is not linked to an index, you will need to artifically associate such intrument type to an underlying index, and define the desired priority for index mapping.

Under

Select tenors in desired priority order for index mapping

A description of the instrument type parameters and corresponding permissible values are set out in the table below.