Once you have performed two valuations on the same portfolio, you can compare the two PV calculation results. With a single portfolio valuation, if you have defined a Client PV (one of the generic trade attributes) at the trade level, you can compare the PV calculations vs. the Client PV.

PV comparisons will only be performed if there has been no change in the trade definition (i.e. all trade attributes are the same).

Other pricing functionalities are listed here.

On this page, we will discuss how to:

By way of example, you can use the valuation(s) of the predefined ‘RATES_DESK’ portfolio. Alternatively, you can use the ‘NEWPORTFOLIO’ example that you may have defined.

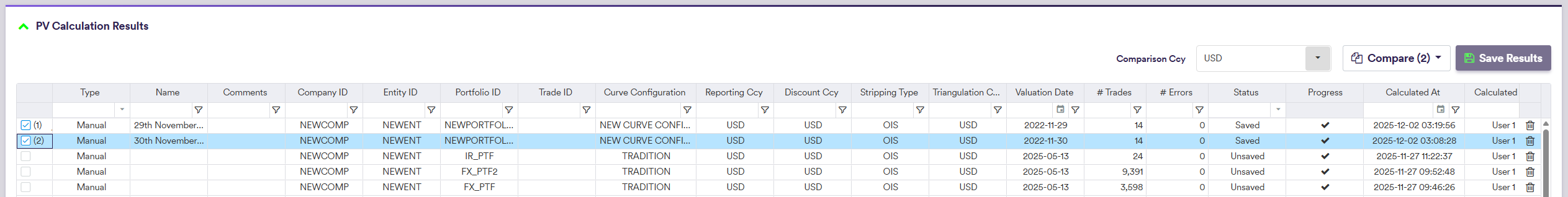

This page will guide you through the process using an example: comparing the valuation of the ‘NEWPORTFOLIO’ as at 29 and 30 November 2022.

Running the Valuation Comparison Process

Under

You can also select and compare PV calculation results versus Client PV, by clicking on

The comparison results will be displayed in the selected Comparison Ccy

The list of calculation results will always comprise the latest valuation performed on a given portfolio (or trade), which will override any unsaved valuation. As such, for the purpose of this example, you will have performed and saved a valuation as at 30 November 2022 and performed a second valuation as at 29 November 2022 (or vice versa).

Once the valuation comparison process has been completed, you will automatically be redirected to the “COMPARISON Results” page.

Viewing the Comparison Results

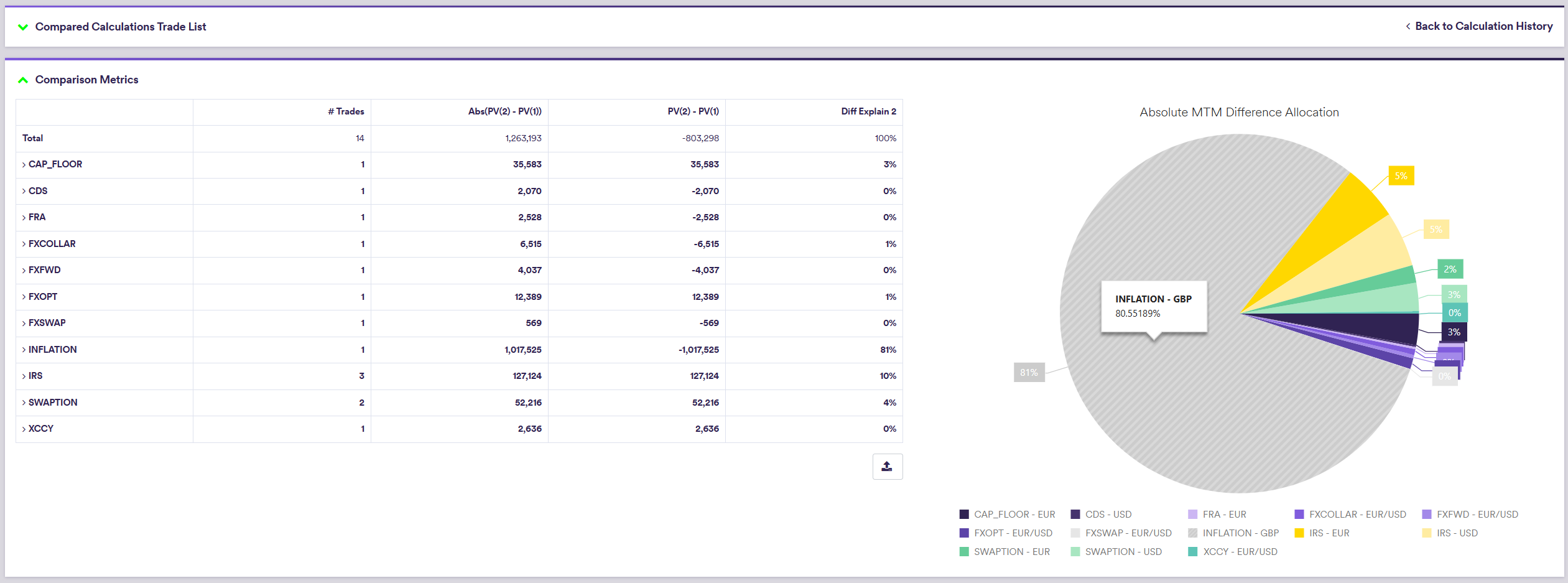

Once the valuation comparison process has been completed, the results are as follows:

- compared trade calculations (PV, Greeks-01, absolute and relative difference, as well as PV difference expressed in number of Greeks-01) on a trade basis;

- portfolio metrics (PV difference allocation per instrument type and underlying); and

- graph comparison of calibrated curves used in the valuation process; and

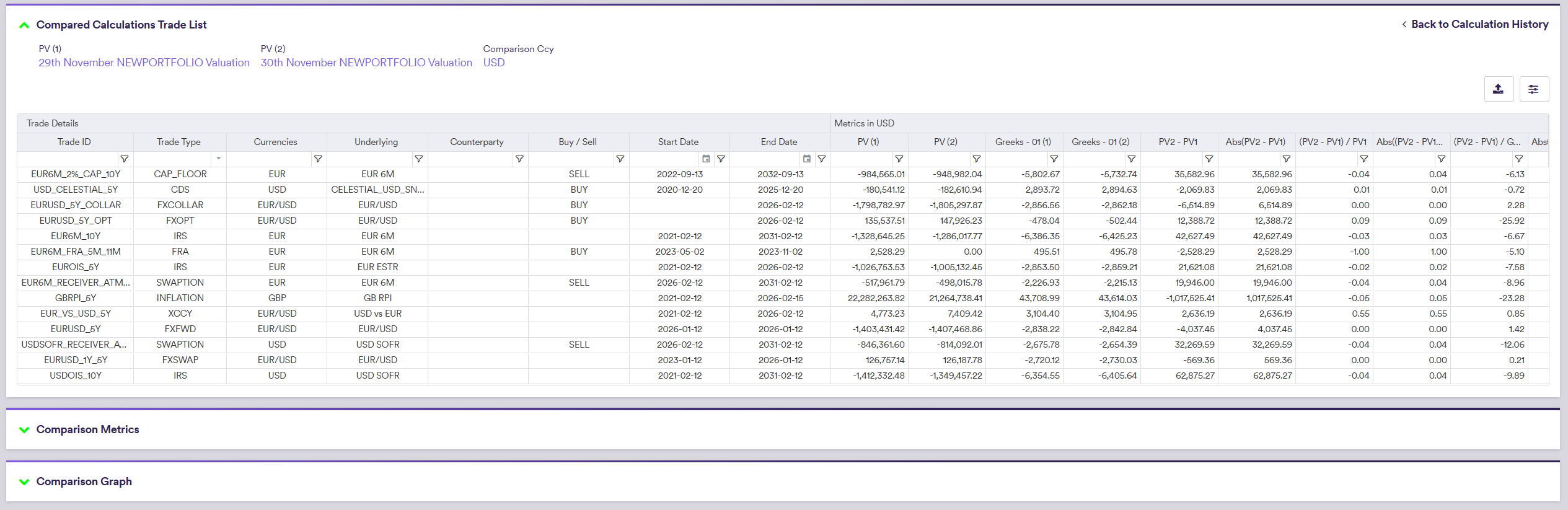

1. Comparison on a Trade Basis

You can view, filter and export comparison results on a trade basis. By double-clicking on the line item, you can view the full trade details.

2. Comparison on a Portfolio Basis

You can view and export PV comparison results on a portfolio basis, or based on the selected trades. The PV comparison results will be split by product type and underlyings and will show the contribution to the portfolio valuation difference.

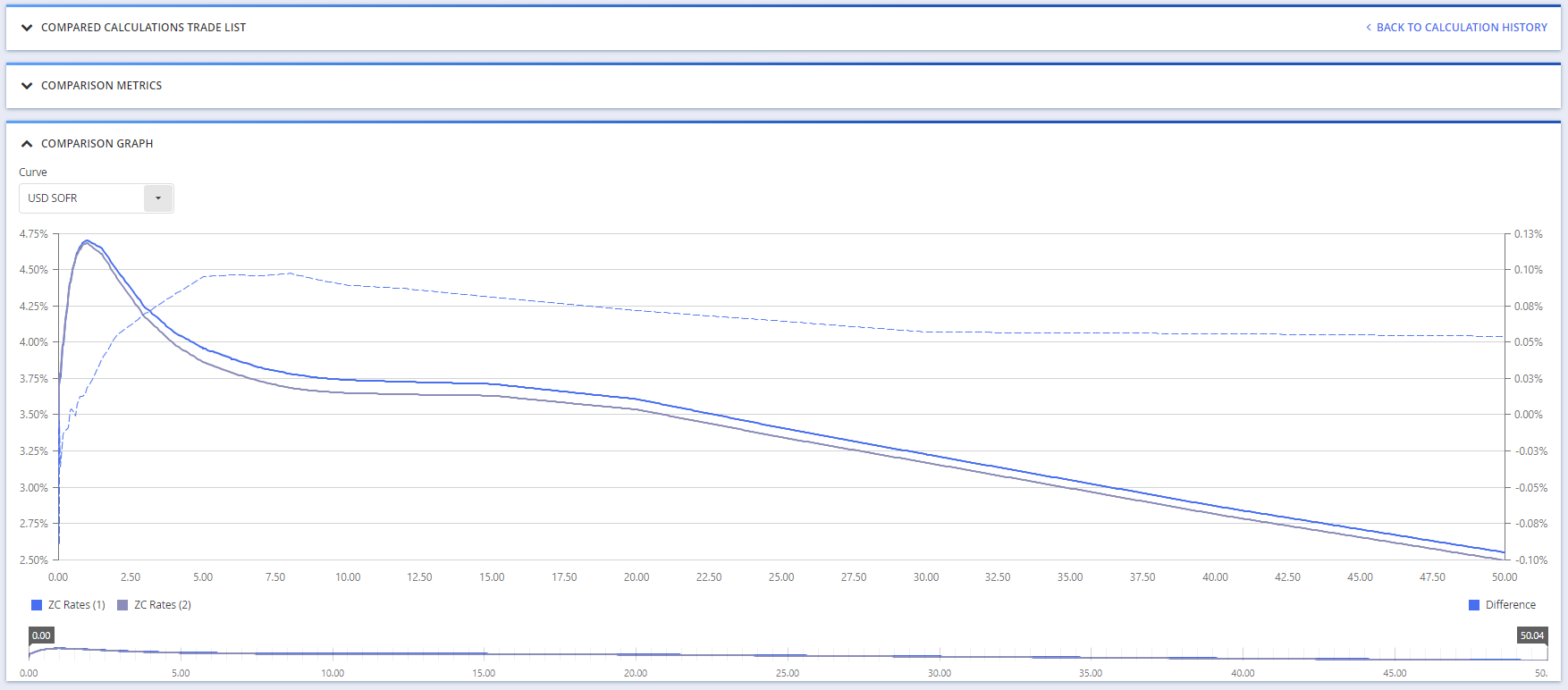

3. ZC Curve Comparison

You can compare the relevant ZC curve used in each calculation by selecting a curve in the dropdown.